[ad_1]

On-chain knowledge exhibits the stablecoin trade influx imply has reached a brand new all-time excessive, right here’s why this would possibly show to be bullish for Bitcoin.

Stablecoin Exchange Inflow Mean Has Surged Up To A New ATH Recently

As identified by an analyst in a CryptoQuant post, these inflows will be optimistic for Bitcoin in the long run, however could be bearish within the brief time period.

The “stablecoin exchange inflow mean” is an indicator that measures the common quantity of stablecoins per transaction going into the wallets of centralized exchanges.

As stablecoins are comparatively secure in worth (as their identify already implies) on account of them being tied to fiat currencies, traders within the crypto area use them for escaping the volatility related to most different cash.

Once these holders really feel that costs are proper to enter again into unstable markets like Bitcoin, they convert their stables into them utilizing exchanges.

Because of this, a lot of these cash shifting into exchanges can present shopping for stress for the unstable cryptos, and therefore surge up their costs.

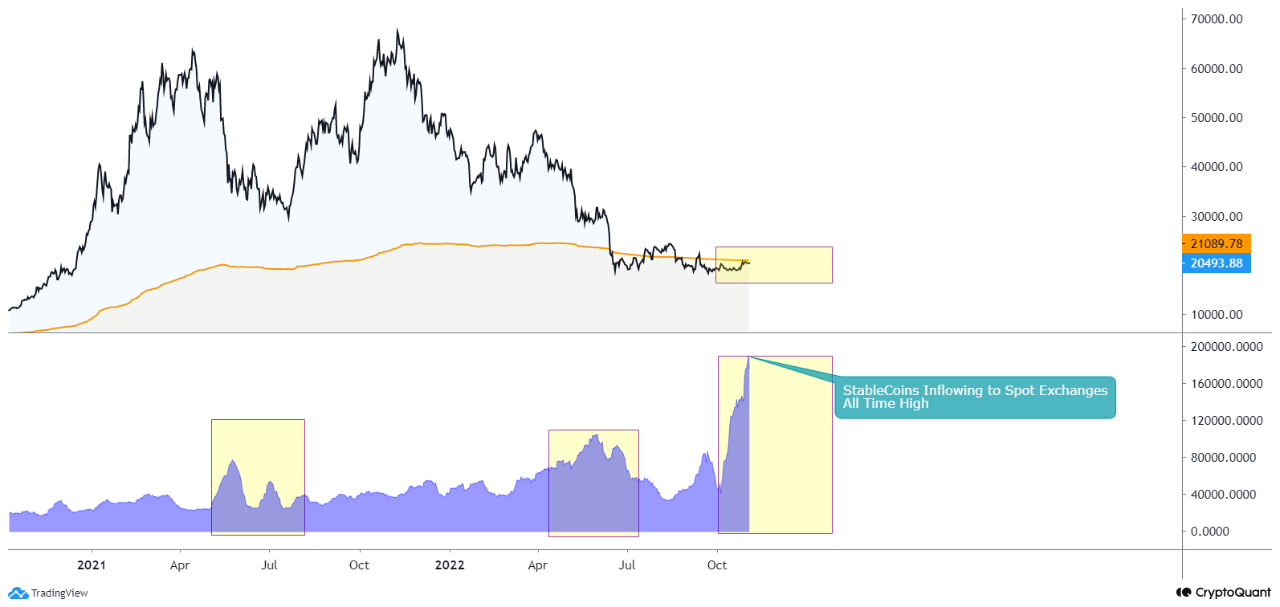

Now, here’s a chart that exhibits the pattern within the stablecoin trade influx imply, in addition to the corresponding Bitcoin costs, during the last couple of years:

The worth of the metric appears to have been fairly excessive in current days | Source: CryptoQuant

As you possibly can see within the above graph, the stablecoin trade influx imply has noticed some sharp uptrend in current weeks, and has now set a brand new all-time excessive.

This means that the common transaction going into trade wallets is at the moment carrying bigger quantities than ever.

In the chart, the quant has additionally marked the durations the place an analogous pattern was seen over the last couple of years.

It seems to be like in each the earlier situations, excessive values of the indicator result in the worth of Bitcoin forming a backside, after which subsequently observing some uplift.

However, the bullish impact has normally been delayed, suggesting that the present excessive values would solely be constructive for BTC in the long run.

The analyst notes that within the brief time period, this pattern within the stablecoin influx imply may trigger volatility for Bitcoin, thus presumably offering a detrimental impact to it.

Bitcoin Price

At the time of writing, Bitcoin’s price floats round $20.3k, down 2% within the final week. Over the previous month, the crypto has gained 6% in worth.

Looks like the worth of the crypto has barely declined in the previous few days | Source: BTCUSD on TradingView

Featured picture from Traxer on Unsplash.com, charts from TradingView.com, CryptoQaunt.com

[ad_2]

Source link