[ad_1]

Data from Glassnode reveals Bitcoin holders realized 14 occasions extra losses than earnings in latest weeks.

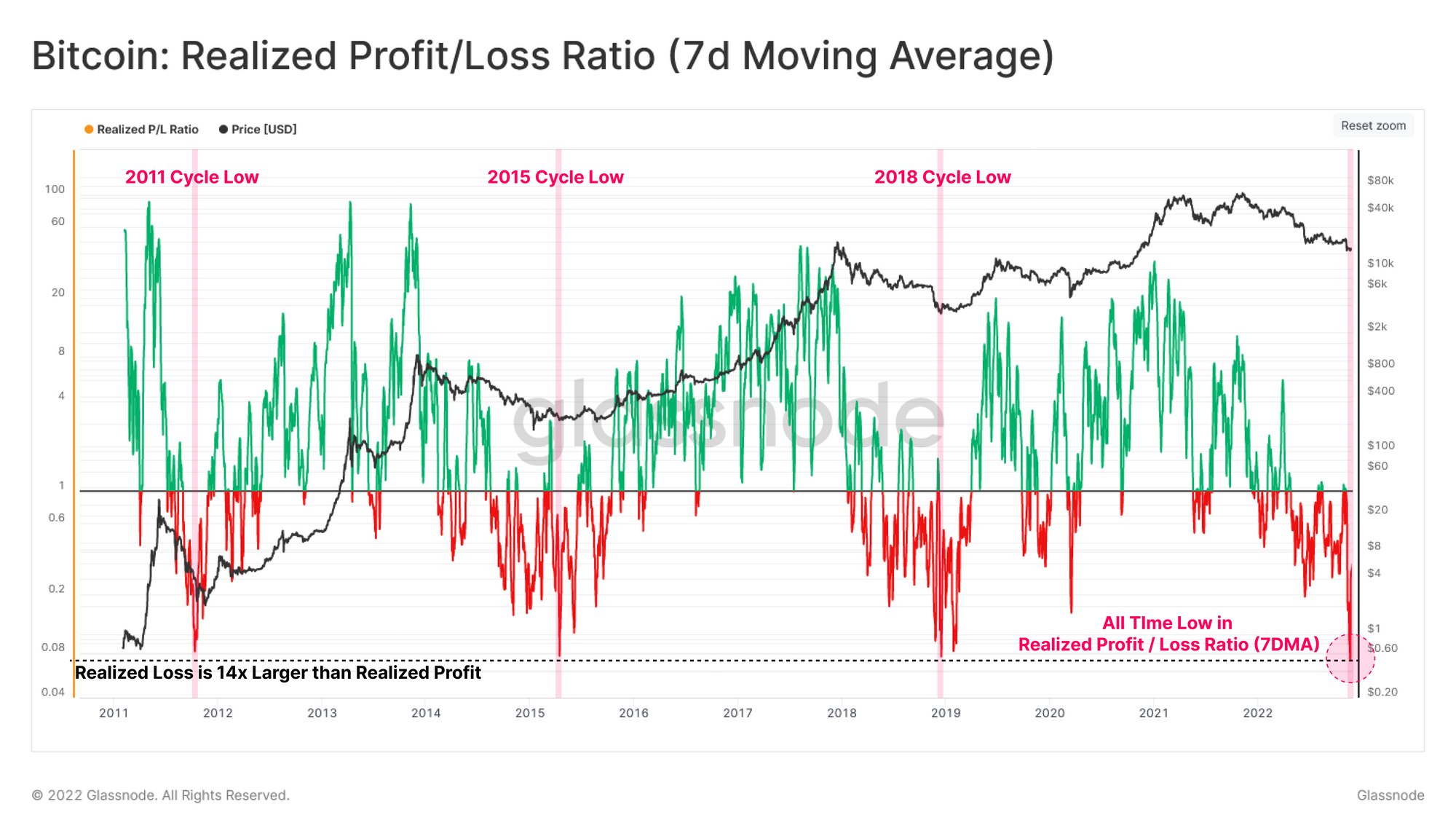

Bitcoin 7-Day MA Realized Profit/Loss Ratio Sets New All-Time Low

As per the newest weekly report from Glassnode, the realized revenue/loss ratio has assumed its lowest worth ever lately.

Whenever a coin sits idle on the chain and the value of Bitcoin modifications, it accumulates some quantity of revenue or loss, relying upon the course of the value fluctuation.

This revenue or loss is named “unrealized” so so long as the coin holds nonetheless in the identical pockets, however as quickly because the holder strikes/sells this coin, the full quantity of revenue/loss it was carrying is then stated to be “realized.”

The realized revenue and the realized loss metrics preserve monitor of such quantities of revenue and loss being harvested by traders throughout the BTC market.

Now, the “realized profit/loss ratio” is an indicator that measures the ratio between the present values of those two metrics.

Here is a chart that reveals the development within the 7-day shifting common of this Bitcoin ratio over the historical past of the crypto:

The 7-day MA worth of the metric appears to have been fairly low in latest days | Source: Glassnode's The Week Onchain - Week 49, 2022

As you possibly can see within the above graph, the Bitcoin realized revenue/loss ratio has plunged deep under a price of 1 following the FTX crash.

When the indicator has values on this zone (that’s, when it’s lower than 1), it means BTC traders are realizing the next quantity of loss than revenue proper now.

In the newest plunge, the metric not solely dropped to fairly low values, it in truth recorded a brand new all-time low. This backside degree corresponded to the loss realization being 14 occasions greater than revenue realization.

From the chart, it’s obvious that deep lows like now have traditionally been noticed at or close to bottoms in earlier bear markets, which suggests they’ve all the time been on the middle of macro market regime shifts.

If the identical development follows this time as properly, then the present Bitcoin market might also be in the midst of such a shift.

BTC Price

At the time of writing, Bitcoin’s price floats round $16.9k, up 3% within the final week. Over the previous month, the crypto has misplaced 20% in worth.

The under chart reveals the development within the worth of the coin during the last 5 days.

Looks like the worth of the crypto has been buying and selling sideways round $17k | Source: BTCUSD on TradingView

Featured picture from 愚木混株 cdd20 on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link