[ad_1]

After rising over $29k on Thursday, Bitcoin worth fell to $27.5k immediately. The BTC worth trades at $27,863 after a 3% pullback within the final 24 hours. Altcoins comparatively stays stronger amid weak point in Bitcoin, with Ethereum worth buying and selling sideways close to the $1800 stage within the final 24hrs.

Among the highest altcoins, Cardano (ADA) and XRP trades held strongly amid promoting strain within the broader crypto market. ADA worth is up over 2% to $0.384 amid rebound from the help stage, whereas XRP worth trades at $0.5318 after a 25% rally this week as buyers anticipate Ripple’s win the long-running lawsuit in opposition to the US SEC.

Reasons Why Bitcoin Price Is Dragging

Friday Expiry: The main motive behind the pullback in Bitcoin worth is the month-to-month and quarterly expiry on March 31. As per data by Deribit alternate, 141k BTC choices are set to run out with a put-call ratio of 0.74 and a max ache level of $24,000. Bitcoin worth will stay risky as choices with a notional worth of $4.1 billion expire on Friday.

Moreover, 1.746 million ETH choices of notional worth $3.1 billion are about to run out, with a put-call ratio of 0.33 and a max ache level of $1,600.

Deribit market information Deribit CVD & Delta point out the Bitcoin worth impression of choices expiry. Binance Market BUSD leads the promoting with futures promoting. The BTC worth dangers draw back volatility if it breaks beneath $27.7k.

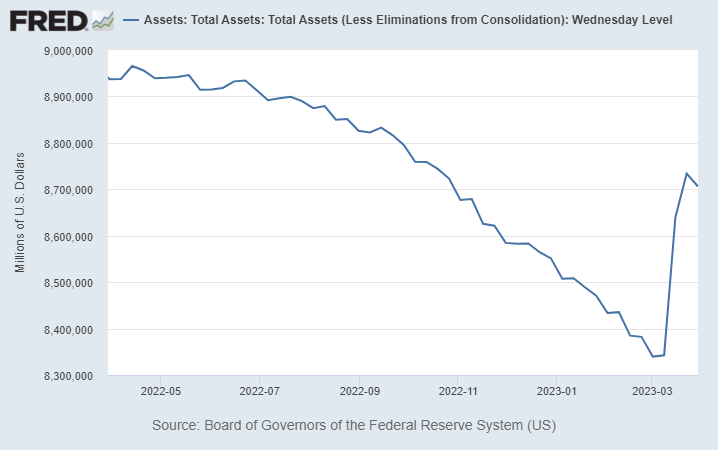

US Federal Reserve Balance Sheet: U.S. Fed released its steadiness sheet displaying components impacting balances. The Fed steadiness sheet drops by $28 billion this week, after rising almost $100 billion last week to a complete of $400 billion amid banking woes.

Fed loans to banks fall to $152.6 billion from $163.9 billion and discount-window loans fall to $88.2 billion from $110.2 billion final week. Moreover, borrowings from BTFP rose to $64.4 billion from $53.7 billion. This impacts merchants sentiment and pulled down Bitcoin worth.

US Personal Consumption Expenditures (PCE) Data: The U.S. Bureau of Economic Analysis will launch the PCE and Core PCE inflation information immediately. The PCE inflation increased to 5.4% YoY in January from 5.3% in December and Core PCE information additionally elevated final month.

The Core PCE is predicted to chill to 4.4% YoY down from the earlier 4.7%. Bitcoin worth trades decrease as merchants await the important thing inflation information impacting Fed determination on additional charge hikes.

Also Read: Top Whale Buys Billions Of Shiba Inu (SHIB) Tokens, Burn Rate Jumps Over 700%

The introduced content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link