[ad_1]

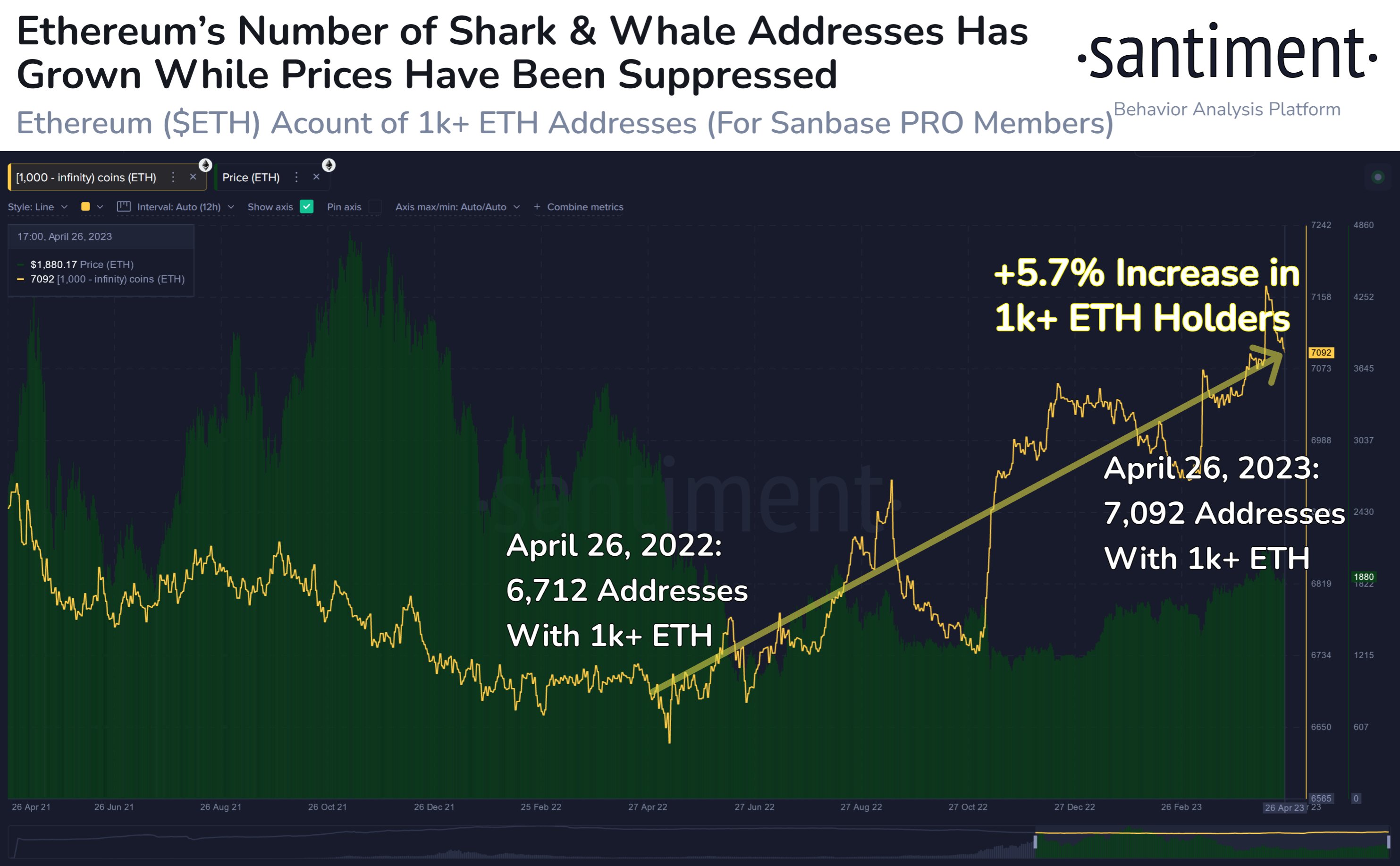

On-chain information from Santiment reveals the Ethereum shark and whale addresses have registered a progress of 5.7% over the previous 12 months.

Ethereum Sharks & Whales Numbers Have Gone Up During The Past Year

According to information from the on-chain analytics agency Santiment, there are actually round 380 extra sharks and whales out there in comparison with 12 months in the past.

The related indicator right here is the “ETH Supply Distribution,” which tells us in regards to the complete quantity of Ethereum that every pockets group within the sector is at the moment holding. Addresses are divided into these “wallet groups” primarily based on the variety of cash that they’re carrying of their balances proper now.

The 10-100 cash cohort, as an illustration, consists of all wallets which are holding between 10 and 100 ETH in the meanwhile. The Supply Distribution metric for this particular group would measure the sum of the person balances of all addresses on the community which are satisfying this situation.

Related Reading: Bitcoin Accumulation: HODLers Are Buying 15,000 BTC Per Month

In the context of the present dialogue, the traders of curiosity are these holding no less than 1,000 ETH, that means that the related vary right here could be 1,000 to infinite cash.

Here is a chart that reveals the pattern within the Ethereum Supply Distribution for such traders over the past couple of years:

The worth of the metric appears to have been going up in current days | Source: Santiment on Twitter

This pockets vary of no less than 1,000 ETH (value about $1.9 million on the present change fee) consists of two crucial cohorts for Ethereum: the sharks and whales.

These traders could be fairly influential out there as they maintain such giant quantities of their wallets (with the whales naturally being extra highly effective than the sharks since they’re the bigger of the 2. Because of this motive, their conduct might present hints about the place the market could also be headed in the long run.

As displayed within the above graph, the Supply Distribution for the 1,000+ ETH vary had a worth of 6,712 a 12 months in the past. Since then, the indicator has loved an general uptrend and its worth has risen to 7,092 as we speak.

This implies that 380 new addresses belonging to sharks and whales have come up on the community over the last 12 months, representing a rise of about 5.7%.

Ethereum noticed a decline throughout a lot of the previous 12 months because the bear market tightly gripped the cryptocurrency. Overall, the asset remains to be down 35% on this interval, that means that these humongous holders have been shopping for whereas the worth of the asset has been comparatively low.

From the chart, it’s seen that probably the most vital shopping for spree on this interval got here simply following the collapse of the cryptocurrency change FTX. This means that the sharks and whales noticed the lows following this crash as a worthwhile shopping for alternative.

And certainly, their accumulation there seems to be to have paid off thus far, as these lows now seem like the bottom level for this bear market. These holders have additionally continued to purchase a web quantity within the current rally thus far, that means that they’re supportive of the value surge. Naturally, this generally is a constructive signal for bullish momentum in the long run.

ETH Price

At the time of writing, Ethereum is buying and selling round $1,900, down 1% within the final week.

Looks just like the asset's worth has seen some volatility not too long ago | Source: ETHUSD on TradingView

Featured picture from Bastian Riccardi on Unsplash.com, charts from TradingView.com, Santiment.web

[ad_2]

Source link