[ad_1]

Binance CEO Changpeng “CZ” Zhao on Thursday shared his bullishness on Ethereum worth as ETH locked on the Beacon Chain reached an all-time excessive. Typically, token unlocks trigger crypto costs to fall, whereas locking or staking will increase crypto costs.

However, ETH worth is at present buying and selling beneath $1,850 whereas implied volatility additionally dropped to a brand new all-time low. Ethereum dangers falling to $1500 if it breaks the essential help degree.

Binance CEO “CZ” Shares Bullish Outlook on Ethereum

Binance CEO took to Twitter to share that locked ETH hit an ATH, mentioning “locked” ETH as an alternative of “staked” ETH to offer extra deal with the worth. It means he’s bullish on Ethereum worth as locked ETH and ETH staking proceed to rise.

Typically, a rise within the quantity of ETH locked up might result in a lower within the general provide of Ethereum tokens out there out there. The lower in ETH will trigger costs to rally larger.

ETH locked means all ETH that’s out of circulation, it consists of ETH staked on the Beacon chain, ETH deposited to the Beacon contract however not validating but, and rewards on the Beacon chain.

Locked ETH at ATH. You know what follows? https://t.co/3xS8OoCfT9

— CZ 🔶 Binance (@cz_binance) May 11, 2023

According to Etherscan data, 21.10 million ETH price over $38 billion have been deposited into Ethereum’s Beacon Deposit Contract. The Ethereum Staking deposits outpaced withdrawals amid the memecoin frenzy, particularly PEPE, that brought on fuel charges on Ethereum to rise to a 12-month excessive.

Data from Nansen signifies the variety of distinctive staking depositors stands at roughly 112,000, which has elevated considerably after the Shanghai improve. Moreover, data sourced from BeaconScan reveals that the variety of lively validators have elevated to 566k, with practically 40k pending validators.

Also Read: Terra Classic Project DFLunc Burns Billions Of LUNC, More Than Binance

Will ETH Price Rally?

Binance introduced a discount within the processing time for ETH staking withdrawal requests to simply 5 days from 15 days, ranging from May 18, which is sort of 3x instances sooner than earlier. This will put promoting stress on the ETH worth.

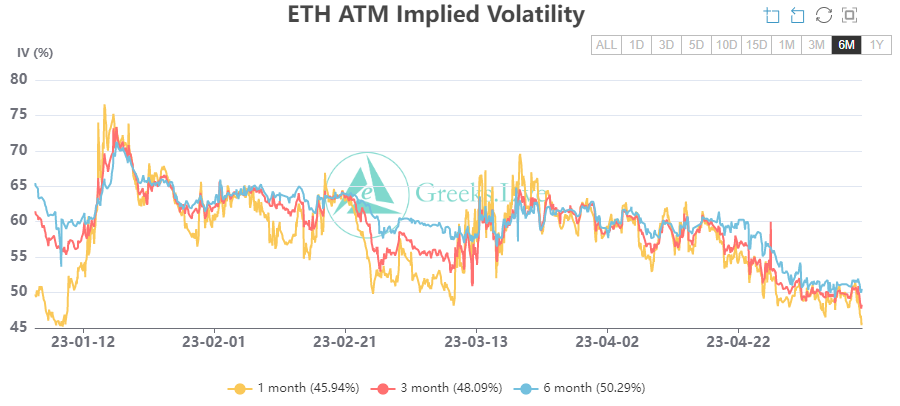

Meanwhile, the implied volatility (IV) for ETH has hit decrease at the moment, particularly ETH short-term IV falling all-time low throughout all phrases. Generally, IV dips in a bullish market as volatility falls, however the general volatility market stays decrease as macro knowledge failed to maneuver ETH worth considerably.

ETH price is at present buying and selling at $1,816, down 3% within the final 24 hours. The market continues to witness liquidation amid uncertainty. CoinGape Media reported that ETH worth breakdown beneath essential help may trigger a 17% fall to $1,500.

Also Read: Binance Opens Conflux Network (CFX) Mainnet Deposits and Withdrawals

The introduced content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link