[ad_1]

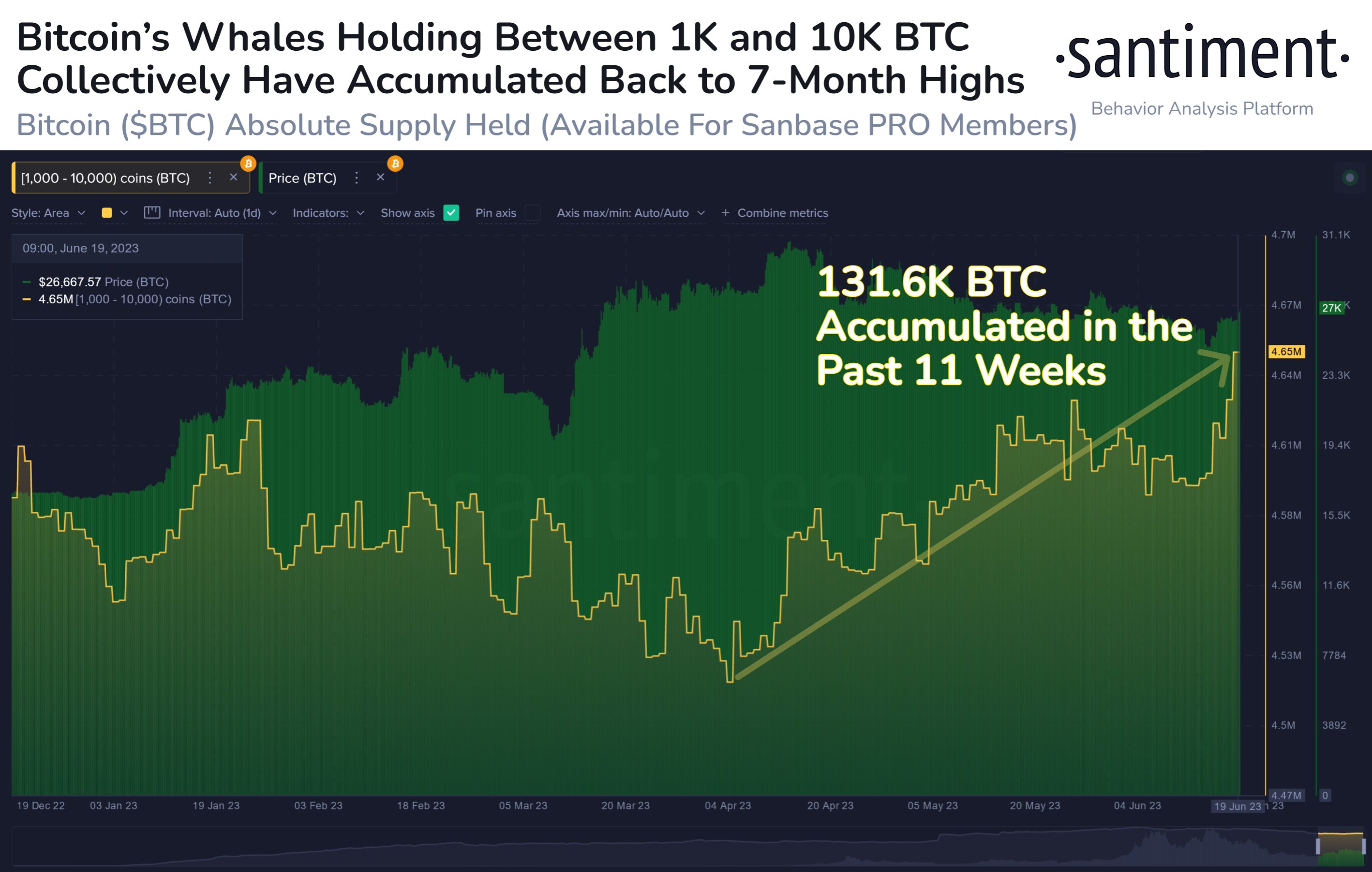

Bitcoin’s market has been witnessing the exercise of huge holders who’ve been actively accumulating extra Bitcoin over the previous two months. While the BTC’s price appeared to dwindle in latest occasions, wallets holding substantial quantities of Bitcoin, identified a Bitcoin whales, have amassed a mixed whole of $3.5 billion since early April.

Bitcoin Whale Accumulation Amidst Price Volatility

According to Santiment, a market intelligence platform, Bitcoin whales have been actively accumulating extra Bitcoin amidst the value decline witnessed in latest months. Wallets holding between 1,000 and 10,000 BTC have collectively acquired a staggering $3.5 billion price of the cryptocurrency for the reason that first week of April.

Whale accumulation sometimes signifies a optimistic outlook, as these traders are inclined to have a long-term perspective and will anticipate future worth appreciation.

Santiment also shared its latest insight highlighting the rise in BTC whale transactions and the contrasting responses to Blackrock and SEC lawsuits.

Bitcoin Price Action

American multinational funding big BlackRock filing for a spot Bitcoin Exchange Traded Fund (ETF) utility with the United States Securities and Exchange Commission (SEC) raised the bullish momentum for Bitcoin.

As of at this time, Bitcoin is buying and selling at $26,869.12, showcasing comparatively steady consolidation above the $27,000 degree. The cryptocurrency’s 24-hour low of $26,338.54 and excessive of $27,147.47 spotlight a slender buying and selling vary.

CoinGape lined how Bitcoin price has recovered mid-June after crashing down following lawsuits and regulatory uncertainity. Looking again over the previous few months, the cryptocurrency reached a latest excessive of $30,404 on April 14, 2023, but in addition skilled a major dip to $20,187 on March 11.

The introduced content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link