[ad_1]

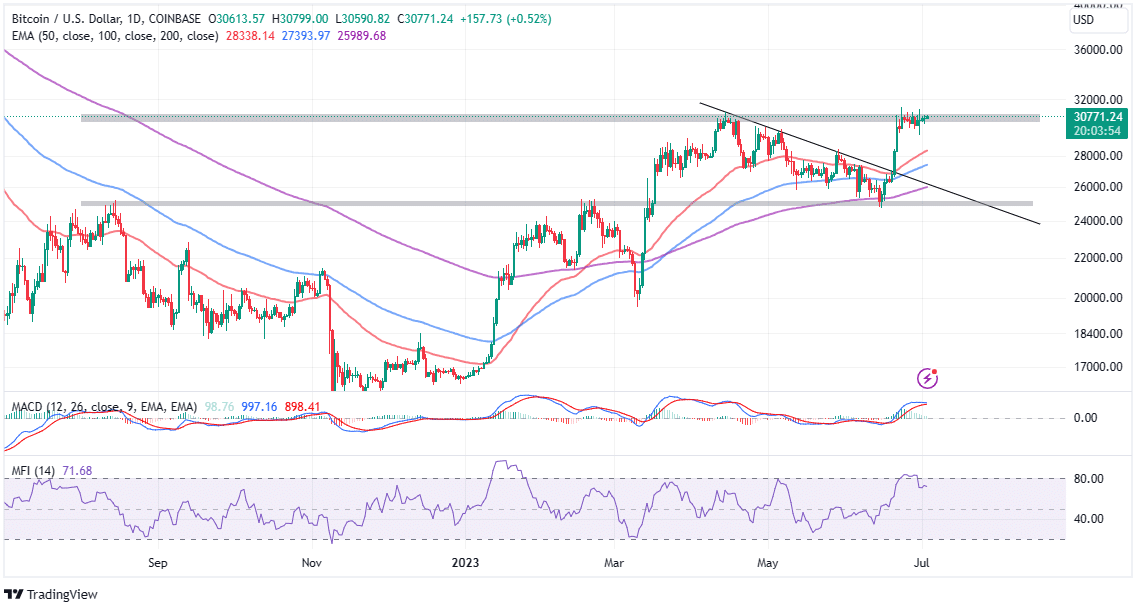

Bitcoin worth has stabilized its technical facet above $30,000, giving bulls ample time to plan the subsequent focused assault on the resistance between $31,000 and $32,000. With BTC making quite a few makes an attempt to interrupt this resistance, such a transfer will possible open the door to good points eyeing $35,000 and $38,000.

Is Bitcoin Price Close To A Breakout?

The largest cryptocurrency is buying and selling at $30,760 towards the tip of the Asian session on Monday. Since the restoration began within the wake of June’s drop beneath $25,000, Bitcoin worth has usually sustained its place above $30,000.

However, it has turn out to be more and more troublesome to push regular worth actions above $31,000, not to mention the higher resistance vary round $32,000.

Despite the snarl-up throughout the board, analysts imagine Bitcoin price is ready which will enable it to rally, closing the gap to $38,000 versus sliding to $25,000.

A purchase sign from the Moving Average Convergence Divergence (MACD) indicator reinforces the bullish grip on BTC.

Moreover, Bitcoin’s place above all of the utilized transferring averages, together with the 50-day EMA, the 100-day EMA, and the 200-day EMA, reveals {that a} bullish breakout is the most definitely consequence.

As traders put together for the anticipated transfer to $35,000 and $38,000, they have to keenly watch BTC’s response to the speedy resistance at $31,000. It can be prudent to carry onto the purchase orders and solely think about activating with the worth flipping above the short-term hurdle.

Some conservative merchants might need to wait till Bitcoin price steps above the subsequent hurdle at $32,000, which might be adopted by a spike in buying and selling quantity and elevated investor curiosity.

On the opposite hand, the Money Flow Index (MFI), which not too long ago pulled again from the oversold area, reveals that Bitcoin worth might first drop to $30,000, and if push involves shove, $28,000, the place it will sweep by means of contemporary liquidity to help an prolonged breakout to $38,000.

What Will it Take for Bitcoin Price To Rise To $310k?

Popular on-chain analyst Willy Woo has affirmed his bullish stance on Bitcoin, however this time with a large forecast of $310,000 per BTC. However, Woo informed his thousands and thousands of followers on Twitter that there’s a caveat.

In his opinion, eight establishments should be comfy with dedicating as much as 5% of their property beneath administration (AUM) to the biggest crypto.

Some of those companies embody Blackrock with $9,090 billion AUM, Fidelity with $4,240 billion AUM, JP Morgan with $3,300 AUM, Morgan Stanley with $3,131 billion AUM, and Goldman Sachs with $2,672 AUM amongst others.

According to Woo, if all these eight companies channel 5% of their AUM into Bitcoin, the worth of the coin may leap to vary between $128,000 and $398,000. However, he warned that “it would really depend on whether they deploy in a bearish or bullish phase of the market.”

It would actually rely on whether or not they deploy in a bearish or bullish part of the market however the vary can be between $128k – $398k. Right now it is $310k.

Methodology is by way of measuring market cap enhance vs realised cap enhance. pic.twitter.com/pPO0U6xAE8

— Willy Woo (@woonomic) June 28, 2023

Woo’s remarks come within the wake of filings by funding giants BlackRock and Fidelity for a Bitcoin-spot exchange-traded fund (ETF). These functions, nevertheless, have been allegedly deemed inadequate by the U.S. Securities and Exchange Commission (SEC).

Market members imagine Blackrock has not less than a 50% probability of getting the approval, which is anticipated to extend investor confidence in a market characterised by excessive volatility.

Related articles

The offered content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link