[ad_1]

Bitcoin value briefly renewed the bullish outlook above $29,000 and teased a breakout above $30,000 following the Federal Open Market Committee (FOMC) interest rate hike decision.

According to a CNBC report, the 25-basis level enhance to a goal vary of 5.25 – 5.5% propelled the price of borrowing within the US to the best degree in additional than 22 years.

Remarks by the Fed Chair, Jerome Powell indicated that inflation had eased since mid-last 12 months however insisted on the necessity to obtain its 2% objective, implying that the nation “has a long way to go.”

In different phrases, there’s a chance of one other data-driven decision that would lead to a hike, particularly in September “if the data warranted.”

Investors in danger property like Bitcoin have faulted the Fed for its hawkish strategy to coverage making with Powell saying the financial institution might “choose to hold steady and we’re going to be making careful assessments…, meeting by meeting.”

Bitcoin Price Holds Under $30k – Where To Next?

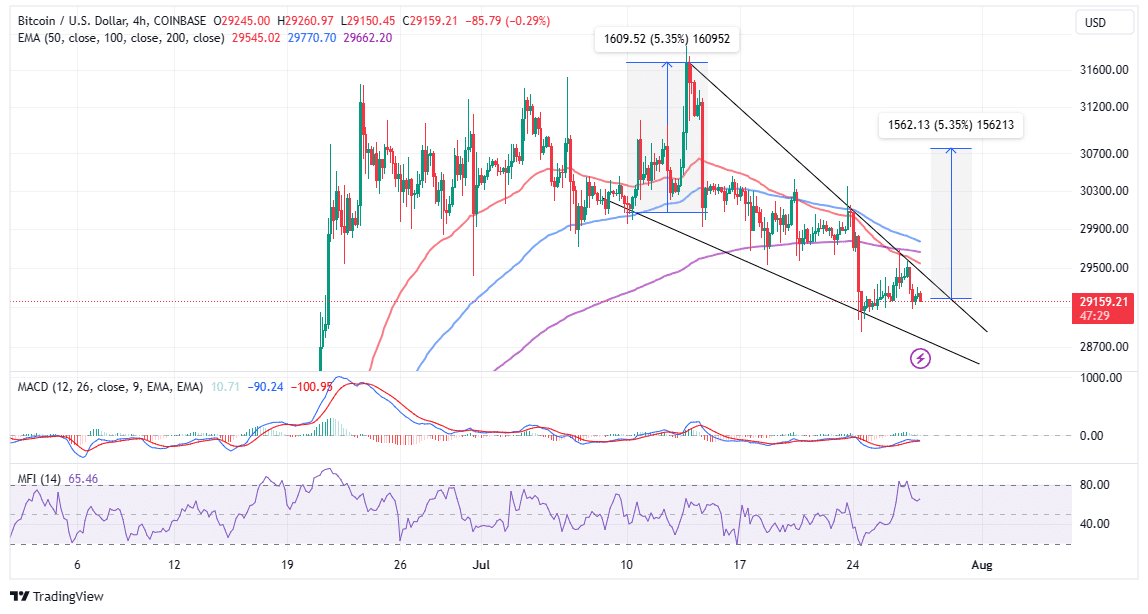

Market watchers anticipated Bitcoin price to resume its uptrend above $30,000, however each positive factors and losses had been contained in a decent vary, with assist at $29,000 holding regular.

The Money Flow Index (MFI), nonetheless, rolled again from the overbought area into the impartial zone, suggesting that some buyers offered in favor of much less risky property. Based on the day by day chart, their impression stays restricted, because the MFI reveals fund inflows beginning to enhance once more.

The similar chart reveals the formation of a falling wedge sample, teasing a 5.35% breakout to $30,753 if validated.

This is a bullish chart formation that indicators a possible reversal or continuation of a downtrend. It is shaped when the worth makes decrease highs and decrease lows inside a narrowing vary, making a wedge-like form.

The sample confirmed when the worth breaks above the higher trendline of the wedge, signifies that sellers within the Bitcoin market are shedding power and that consumers are taking up.

Traders can use the falling wedge sample to enter an extended place on the breakout level or wait for a retest of the higher trendline as assist, relying on their danger tolerance.

The value goal for the commerce may be estimated by measuring the peak of the wedge at its widest level (5.35%) and projecting it from the breakout level ($29,191) – therefore the forecasted transfer to $30,753.

What’s Holding Bitcoin Price Breakout

The horizontal motion within the Moving Average Convergence Divergence (MACD) beneath the imply line reveals that Bitcoin lacks the momentum to trigger a breakout or maintain one.

Moreover, the 50-day Exponential Moving Average (EMA) (pink) has not too long ago validated a dying cross sample by crossing beneath the 200-day EMA (purple).

If this technical image holds, a restoration would stay a pipe dream till Bitcoin price sweeps liquidity at decrease ranges, for instance, $28,000 or $25,000, thus tapping recent momentum for a rally above $30,000.

Related Articles

The offered content material might embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability for your private monetary loss.

[ad_2]

Source link