[ad_1]

Key Takeaways

- Ethereum accomplished its long-awaited Merge improve in September 2022

- Stakers are at the moment incomes roughly 4% APY from their Ether tokens

- 19% of the overall Ether provide is staked, the bottom ratio of any of the main cash

- Staking rewards are divided amongst stakers, which means the APY earned decreases as extra customers stake

- Demand on the community will increase gasoline charges and in the end contributes to extra APY, which means there are a number of elements at play when attempting to assess the place the yield might land

- All in all, it stays up for debate as to the place the yield is headed, regardless of many analysts predicting basement-level yields of 1%-2% are inevitable

The fundamentals of Ethereum have been fully reworked in September 2022 when the Merge went stay, the blockchain formally turning into a proof-of-stake consensus. The implications for this are many, nonetheless one of many extra fascinating elements is that traders can now earn a yield from staking their Ether tokens.

Let’s dive into how well-liked staking has been, the place it’s trending going ahead, and speculate about the place the all-important APY might land.

Ethereum stakers are growing

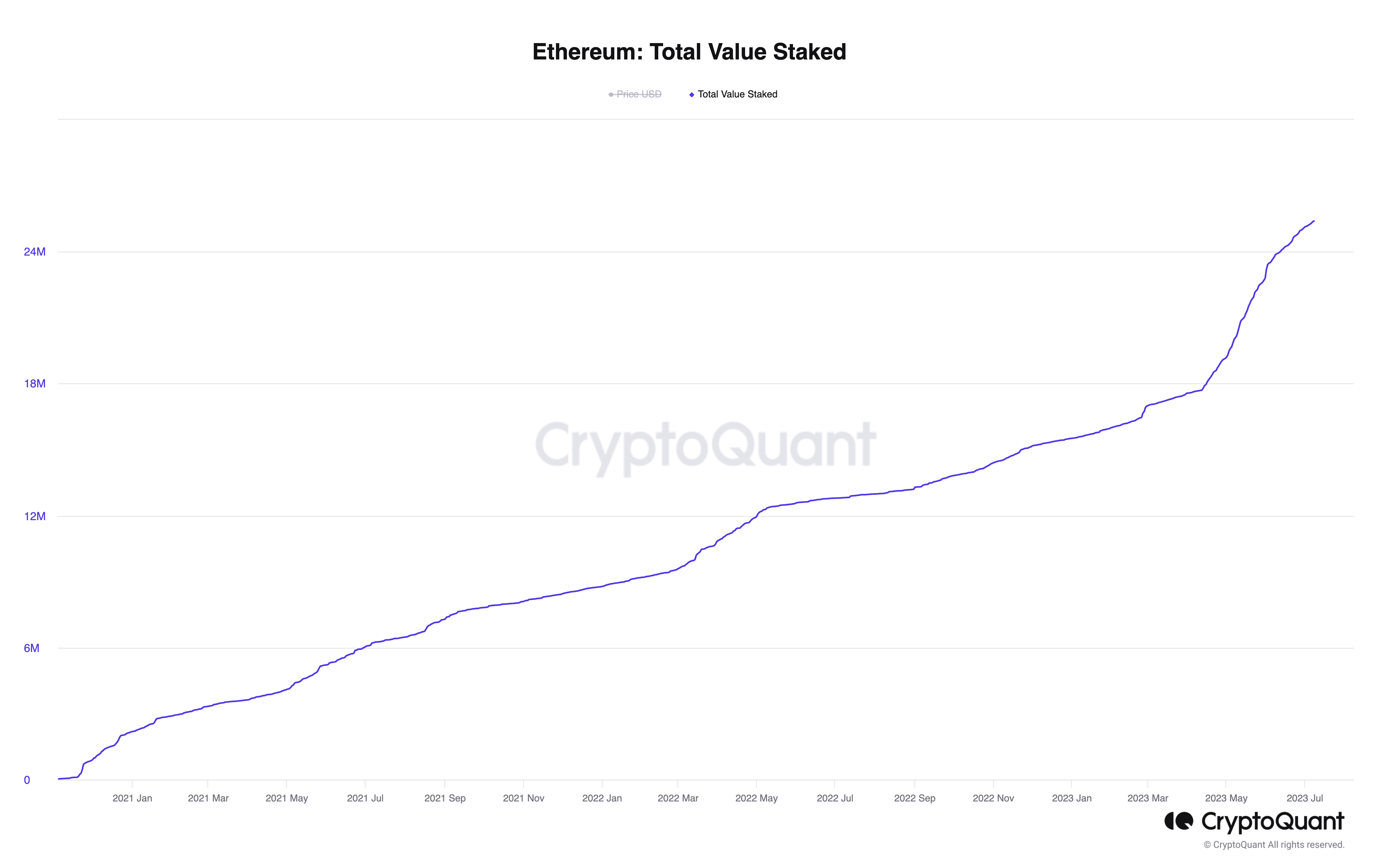

Ethereum staking has proved wildly well-liked. There is at the moment nearly 18.75% of the overall provide staked. The beneath chart from CryptoQuant exhibits that not solely has the rise been constant, however the fee of enhance has steepened noticeably because the Shapella improve in April.

Shapella lastly allowed staked Ether to be withdrawn, with some early stakers having had tokens locked up since This autumn of 2020. There was therefore some concern that Ether could be withdrawn en masse as soon as the Shapella improve went stay, the next promote stress certain to dent the worth. Not solely has this occurred, however staking has solely develop into extra well-liked because the improve.

Despite the recognition of Ethereum staking, and the dearth of withdrawals sparked by Shapella, the community’s staked tokens as a p.c of the overall provide nonetheless pale compared to different proof-of-stake blockchains.

Despite the recognition of Ethereum staking, and the dearth of withdrawals sparked by Shapella, the community’s staked tokens as a p.c of the overall provide nonetheless pale compared to different proof-of-stake blockchains.

The chart beneath highlights Ethereum in yellow, its 19% ratio far beneath the opposite main proof-of-stake cash. Assessing the remainder of the highest 10 by staked market cap, these cash common a 53% stake ratio, with solely BNB Chain remotely shut to Ethereum, sitting at 15%.

If we then shift the chart to assess the overall market cap of the staked portion of cash, Ethereum’s dominance is obvious. Its 19% staked tokens carry a worth of $43 billion – greater than the opposite 9 cryptos’ staked market caps mixed.

Ethereum’s low staked ratio implies that it ought to have extra, no less than if different cash can be utilized as a benchmark. This is particularly true when contemplating current bullish developments on the Ethereum community which recommend it might be solidifying its place because the market-leading sensible contract platform. Most notable of those could possibly be dialogue round potential Ether futures ETFs, in addition to the announcement that PayPal is launching a stablecoin on the community this week.

So, what occurs to the staking yield if the quantity of staked Ether does certainly proceed to enhance? Remember, the overall annual yield paid out to stakers is calculated as follows:

[(gross annual ETH issuance + annual fees*(1-% of fees burned)]

These complete staking rewards are then divided by the common ETH staked over the 12 months to commute the APY.

In different phrases: The quantity of ether staked is within the denominator of the fraction. So as the quantity staked will get greater, the APY shrinks. This impact can already be seen in what has occurred to date. Analysts had predicted a yield of 10%-12% forward of the Merge, nonetheless right this moment it’s nearer to 4%. And that’s 4% with its staking ratio utterly out of whack in contrast to different proof-of-stake cash, as talked about above.

What occurs subsequent?

With the quantity of Ether staked growing incessantly, is the yield due to this fact primed to collapse?

Some analysts consider it’s headed in direction of 1%-2%; some even assume much less. The actuality is that no one actually is aware of as a result of, as all the time, demand depends on quite a lot of elements.

We want to keep in mind, as we frequently say in these columns, that speculating on the way forward for crypto is so troublesome as a result of we now have such little information to work with. This is true for Ethereum as a complete, which solely launched in 2015, however particularly so relating to the yield, because the Merge has solely been stay since September (or since April in the event you rely the “true” completion date as post-Shapella).

Hence, it’s a problem to forecast the staking yield going ahead. We have targeted on the spectacular development of staking to this point, and whereas this will drive the yield down, demand on the community will enhance the numerator of the aforementioned formulation and kick the yield up.

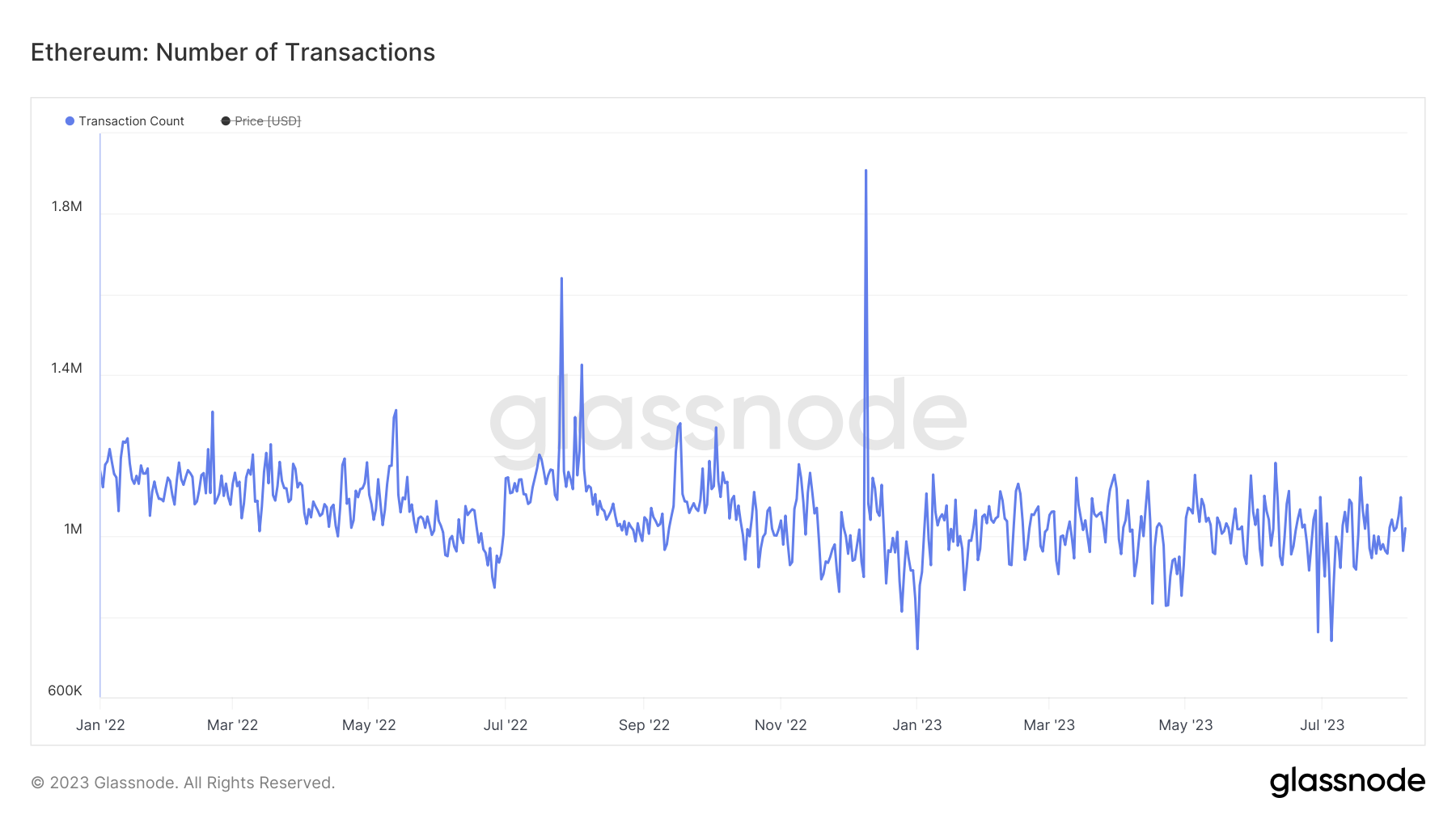

Indeed, complete transactions, the speed has been fairly resilient all through the final eighteen months, regardless of the massacre within the sector final 12 months.

Then once more, crypto is altering rapidly. It stays troublesome to foresee how regulation, infrastructural improvement (restaking and Eigeanlayer spring to thoughts for instance) and the macro panorama, simply to title just a few elements, will have an effect on the local weather going ahead.

Speaking of macro, there may be additionally the matter of trad-fi yields. Currently, the Fed funds fee is 5.25%-5.5%, having been near-zero prior to March 2022. Backing out possibilities from Fed futures implies the market is anticipating the tip of the cycle is close to. Not to point out, with the mammoth quantity of debt within the present system, charges can not keep excessive without end.

Could falling trad-fi yields have an effect on demand for staking yield? Perhaps – whereas it’s exhausting to separate the general liquidity drain and suppressing of danger belongings that happens out of hiked charges, the superior (and risk-free) return is unquestionably a key motive why capital has flooded out of DeFi within the final 12 months. While previously-dizzying DeFi yields have collapsed, trad-fi yields have rocketed because the Federal Reserve has scrambled to rein in rampant inflation.

Furthermore, if yield does fall down in direction of 1%-2%, stakers might start to pull out and search elsewhere for earnings. This would due to this fact create a reflexive relationship with regard to the yield.

All in all, it stays too early to speculate about the place the Ethereum staking yield is in the end headed, no less than with any diploma of confidence; it will depend on too many elements and the pattern area is just too temporary to date. It does appear doubtless, if not inevitable, that the yield will decline to some extent, however the query of how a lot is a troublesome one to reply. While many are adamant the APY will cascade downwards to uber-thin ranges – and for the avoidance of doubt, it might do – we now have introduced right here no less than some factors of consideration as to why the state of affairs will not be as clear minimize.

[ad_2]

Source link