[ad_1]

BTC worth has settled in for consolidation across the pivotal $26,000 degree. Bulls have because the large drop from the earlier vary interval with assist at $29,000, set camp at $25,000 in a bid to dampen the expectations of an prolonged decline to $20,000 forward of the following bull run.

BTC Price Consolidates As the Next Breakout Brews

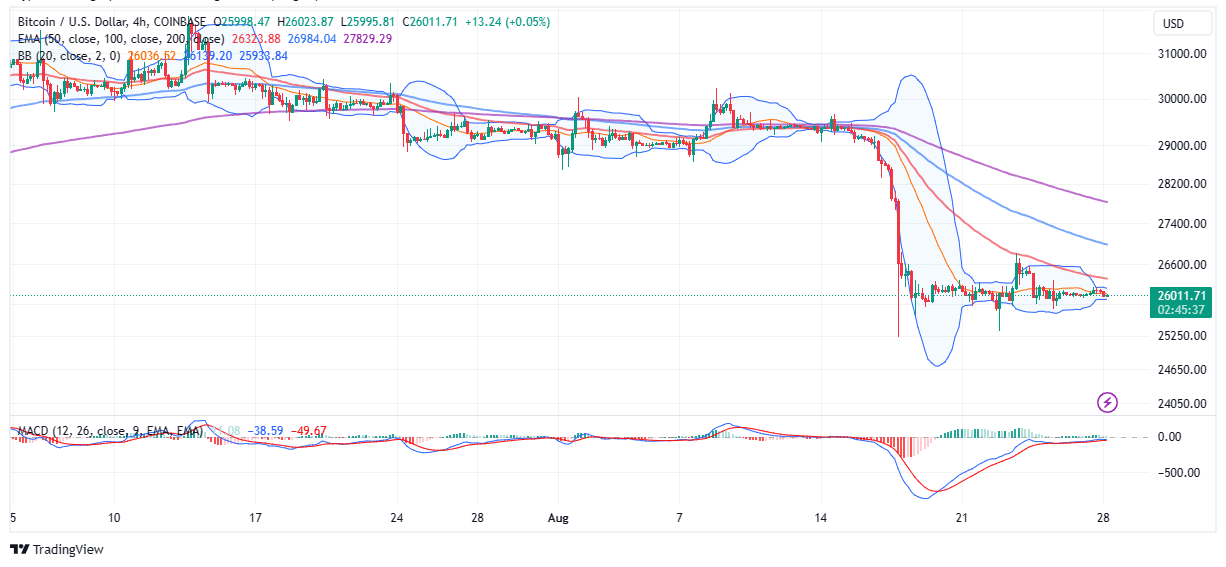

Bitcoin is on the cusp of a short-term breakout primarily based on the Bollinger bands indicator on the four-hour chart.

Bollinger bands measure the volatility of the Bitcoin market. They comprise a transferring common and two commonplace deviations above and under it.

When the bands constrict as is the case with the present BTC worth outlook, it implies that the market is in a low volatility section and a breakout is more likely to happen quickly.

Traders faucet this indicator to anticipate the route and magnitude of the breakout and place their bets accordingly. A breakout happens when the value strikes past one of many bands and indicators a change within the pattern.

Another key side of the Bollinger bands is that the value tends to return to the transferring common.

In different phrases, if short-term assist at $26,000 holds, merchants can anticipate a rebound at the least to $26,600 and if sidelined buyers stream into the market to guide recent positions in BTC, the positive aspects may prolong to $28,200 and $30,000.

The Moving Average Convergence Divergence (MACD) reinforces the continued sideways pattern, implying that Bitcoin lacks the momentum to set off a breakout. Several obstacles line the restoration path with BTC worth more likely to stall on the 50-day Exponential Moving Average (EMA) (crimson) holding at $26,323, the 100-day EMA (blue) at $26,983 and the 200-day EMA (purple) at $27,829.

It is price mentioning that declines under $26,000 would put stress on the assist/resistance at $25,000. There’s the potential for a large sell-off occurring with BTC falling to $20,000.

Bitcoin Supply On Centralized Exchanges Dims

The BTC worth consolidation might be sending the unsuitable indicators that buyers will not be stacking up on the main crypto. On the opposite, information by CryptoQuant reveals that “reserves of US-based exchanges, such as Coinbase, Gemini, and Kraken, have declined by at least 30% and up to 50% or more.”

Investors within the crypto market, particularly long-term consumers desire to retailer their digital property away from centralized exchanges. In so doing, the availability held on the platforms dwindles, decreasing the potential promoting stress. When this provide begins to extend once more, it’s typically adopted by a sell-off with buyers closing positions to guide earnings.

Institutional exercise has additionally been on the rise and is anticipated to be a significant participant within the subsequent Bitcoin bull run. CryptoQuant’s information, which thought-about “the amount withdrawn and the deposit and withdrawal records of the wallets, institutions are continuously buying Bitcoin.”

3/ Institutions’ accumulation

Considering the quantity withdrawn and the deposit and withdrawal information of the wallets, establishments are constantly shopping for #Bitcoin.

For instance, In August alone, greater than 20K $BTC, accounting for roughly 25%, had been withdrawn from Gemini. pic.twitter.com/dWmlwWjoTN

— CryptoQuant.com (@cryptoquant_com) August 28, 2023

While BTC worth nurses wounds from the promoting stress this month, buyers hope to disregard the ups and downs and deal with the following halving round April 2024. The four-year cycles that BTC goes by way of according to the halving foreshadow a bull run round 2024/2025, which may propel the value to a brand new all-time excessive.

Related Articles

The introduced content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link