[ad_1]

Bitcoin value is barely holding within the inexperienced, growing by 0.6% over the past 24 hours to commerce at $27,227 on Friday. This week’s correction from highs above $28,000 has sparked discussions concerning the underside degree forward of the bull run.

Some analysts like Rekt Capital say that if $31,000 was the height in 2023, it will take Bitcoin price months earlier than seeing this degree once more.

However, he encourages buyers to maintain reserving their positions previous to the halving in 2024, noting that this may be the one time to purchase BTC inside the $20,000 vary as a result of the worth might be a lot increased after miner rewards have been halved.

If ~$31000 was the Top for 2023…

Then the subsequent time we see these costs might be months from now, simply after the Halving (purple field)

Only distinction between from time to time?

In this Pre-Halving interval, $BTC may nonetheless retrace from right here

But after the Halving, BTC would… pic.twitter.com/eZdWwuWtug

— Rekt Capital (@rektcapital) October 5, 2023

Can Bitcoin Price Breakout To $30,000?

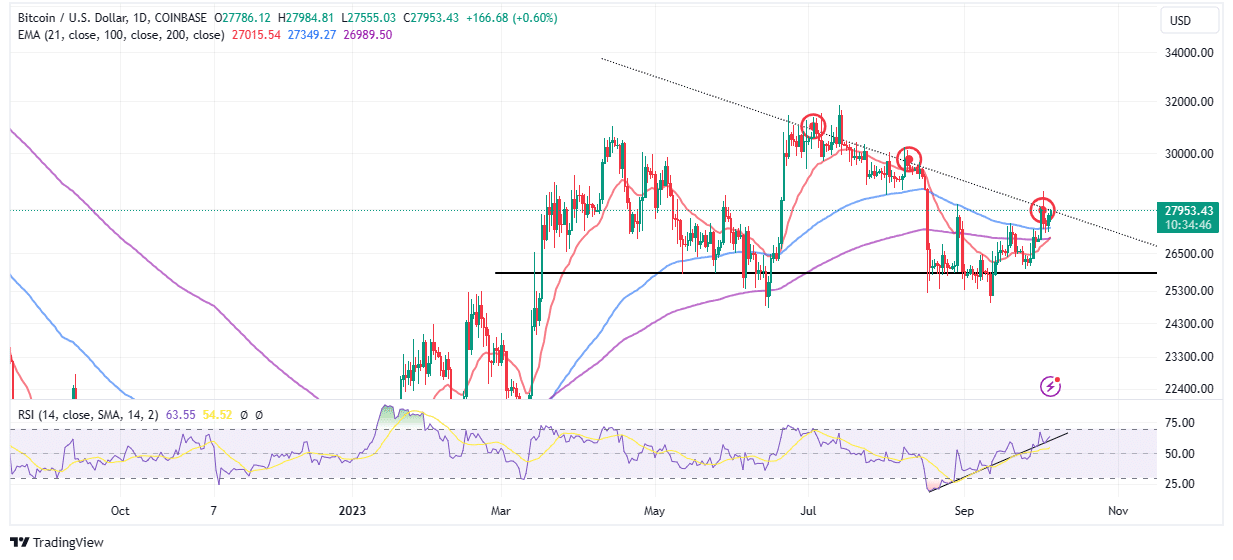

Bitcoin bulls are doing all they can to forestall declines from extending under $27,000. As lengthy as this help is secured, buyers could be inspired to maintain their positions open with out worrying about potential dips to $26,500 and $25,000 help areas.

The 100-day Exponential Moving Average (EMA) reveals that consumers have the higher hand, serving because the speedy help at $27,346. On the upside, bulls are dealing with bears in a heated tug-of-war to interrupt resistance at $28,000, coinciding with a falling trendline.

Bitcoin has been rejected from this pattern a number of occasions since July, implying that till it’s damaged, the possibilities of returning to $30,000 could be minimal.

The Relative Strength Index (RSI) dons a bullish outlook because it ascends inside the impartial 0.000 space towards the overbought area. A bullish divergence relative to BTC value reinforces the presence of bulls available on the market.

Another incoming purchase sign is the golden cross. This sample happens when a short-term shifting common crosses above a long-term shifting common. In Bitcoin’s case, the 50-day EMA is on the verge of flipping above the 200-day EMA to affirm the uptrend.

14,924 BTC Flow Into Kraken Exchange

A file 14,924 BTC have been deposited into Kraken exchange, in keeping with the on-chain analytics platform, CryptoQuant. An analyst on the agency stated that this inflow of Bitcoin “deserves special attention as it is the largest recorded on Kraken since 2018.”

Investors ship crypto to exchanges desiring to promote on the earliest comfort or when in revenue. Hence, such an enormous influx implies that promoting strain may very well be imminent.

Historic Inflow of 14,924 $BTC into Kraken: A Signal for Investors?

“The influx of 14,924 #Bitcoin deserves special attention as it is the largest recorded on Kraken since 2018.”

by @joao_wedsonLink👇https://t.co/2uPXsa2lUl pic.twitter.com/SqLsXHCR2S

— CryptoQuant.com (@cryptoquant_com) October 4, 2023

For now, buyers could need to test a couple of containers as they endure the bear market. For instance, reclaiming help above $28,000 may propel Bitcoin value nearer to $30,000. On the draw back, shedding help at $27,000 may hamper the uptrend and set off a sell-off to $25,000.

Related Articles

The introduced content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.

[ad_2]

Source link

✓ Share: