[ad_1]

A large quantity of ETH has made its method to centralized exchanges, growing the Ethereum balances of those exchanges. Given the implications of exchange inflows, it might be a barrier to the cryptocurrency in relation to claiming the $2,000 resistance.

Investors Send 13,000 ETH To Exchanges

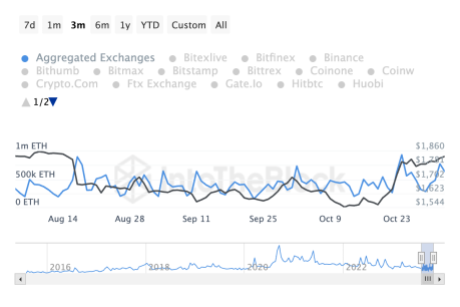

Data from IntoTheBlock exhibits a large quantity of ETH headed towards exchanges as the value rose. The complete influx quantity as of October 31 when the value first cleared the $1,800 resistance was at 480,570. However, by the beginning of November, this quantity had blown up massively.

November 1 noticed the full ETH flowing into exchanges reaching 774,890, and by this time, the bulls had established their dominance above the $1,800 degree. With outflows popping out at simply round 630,000 ETH, the netflows come out to roughly 130,000 ETH flowing into exchanges on November 1. This confirmed a willingness amongst traders to begin taking revenue from their holdings.

Source: IntoTheBlock

As the info tracker exhibits, the vast majority of Ethereum traders had moved again into revenue after crossing $1,800. Even following the retracement, the full share of ETH investors in revenue is sitting at 55.40% and it’s no shock that a few of these traders would need to safe revenue.

By November 2, although, there was a leisure from traders in relation to inflows. Data exhibits that on Thursday, the ETH inflow figures fell to 637,070, though that is nonetheless a lot larger than the earlier week’s figures. The trade web movement is now right down to 31,040 ETH as of Thursday.

ETH value recovers above $1,800 | Source: ETHUSD on Tradingview.com

Ethereum Large Holders Swing Into Action

Ethereum has additionally seen a spike within the variety of giant transactions being carried out on the community in addition to the transaction quantity of those giant holders. The complete variety of giant transactions sat at 1,900 on October 29. But by November 2, the determine ballooned to 4,320, an over 100% enhance in simply 4 days.

The transaction volumes of those whales additionally noticed an increase in an virtually related method in comparison with the variety of giant transactions. Large transaction volumes have been at 741,440 ETH on October 29. But on November 2, the amount reached 2.21 million ETH. In greenback figures, giant transaction volumes went from $1.33 billion to $4.04 billion.

Looking on the bullish and bearish transactions (i.e those that are shopping for versus those that are promoting), there isn’t a big distinction bulls nonetheless proceed to guide within the asset. The 7-day complete for bulls got here out to a complete of 98 bulls in comparison with 87 bears. But the hole is closing additional each day the place IntoTheBlock shows 14 bulls and 12 bears.

[ad_2]

Source link