[ad_1]

Following Do Kwon’s arrest in Montenegro and subsequent authorized points, the value of Terra Classic (LUNC) demonstrated its sturdiness.

Do Kwon’s authorized representatives won’t be able to cease his extradition to the United States. To be extra exact, the attorneys had challenged a ruling from late November that permitted this sort of switch.

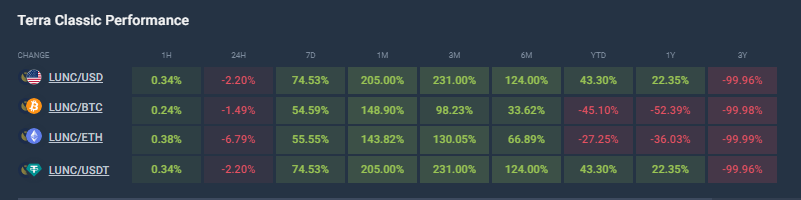

In the aftermath of the arrest, Terra Classic (LUNC) held its floor with a sustained 77% increase in the last seven days, information from Coingecko exhibits.

LUNC Resilience Amid Legal Woes: Kwon Faces Extradition For TerraUSD Manipulation

Despite a shedding 3.4% within the final 24 hours following the information, LUNC was in a position to brush off the negative vibes surrounding Kwon’s authorized nightmares.

A Wall Street Journal report claims {that a} senior Montenegrin judicial official has personally confirmed Kwon’s extradition. The defunct cryptocurrency entrepreneur is accused of manipulating the TerraUSD stablecoin.

LUNC seven-day value climb. Source: Coingecko

His dishonest supervision precipitated a $40 billion market disaster, which has American and South Korean prosecutors itching for a case. For “orchestrating a multibillion-dollar crypto asset securities scheme,” the US Securities and Exchange Commission filed fees in opposition to him in February.

Over the last few weeks, LUNC’s value has been heading north. After the UST/Luna collapse and the creation of a brand new Terra chain, the cryptocurrency—which is the unique Terra LUNA coin that remained—has, not less than, been exhibiting optimistic tendencies for the final three months.

LUNCUSD presently buying and selling at $0.0002023 on the every day chart: TradingView.com

The spectacular weekly rise of the Terra Classic token signifies that it has made important positive factors within the final a number of days, outpacing the general cryptocurrency market. It has gained greater than 200% within the final 30 days, giving buyers important positive factors.

Terra Classic Surges On Ecosystem Boost And Binance Token Burn

The neighborhood’s adoption of a strategic proposal to advertise the ecosystem’s tokens, TerraClassicUSD (USTC) and LUNC, as beforehand reported, elevated curiosity within the token and precipitated a noteworthy surge. Because it burnt extra LUNC tokens, Binance additionally had a component within the enhance.

Source: Coincodex

Due to a comeback surge that has seen the cryptocurrency shed a zero, LUNC is up about 60% for the month. Though LUNC was overbought, the $0.00011495 resistance stage has capped the altcoin’s upside potential, and bulls are presently planning for the following break try.

If there’s extra buying strain above the present ranges, the value of LUNC would possibly prolong and try to interrupt by the beforehand talked about barrier as soon as extra, presumably reaching the equal highs at $0.00011495.

Gains can, in a really optimistic state of affairs, permit the value to problem the psychological barrier of $0.00012000 and, in a really bullish state of affairs, attain the $0.00013000 stage. This would characterize a 30% enhance over the current ranges.

Meanwhile, proponents of LUNC are ready for extra info on the drama surrounding Kwon’s extradition to see if it should damage the token’s worth and trigger it to say no, or if it should assist it enhance its weekly positive factors within the extraordinarily unstable world of cryptocurrencies.

Featured picture from Shutterstock

[ad_2]

Source link