[ad_1]

Celsius Networks, at present present process chapter proceedings, has engaged in vital Ethereum transactions which are inflicting ripples throughout the digital foreign money panorama.

In the previous 10 hours, on-chain analysts at LookonChain detected noteworthy transfers, together with a 13,000 ETH deposit ($30 million) on Coinbase and a further 2,200 ETH ($5 million) on FalconX. These transactions counsel a proactive stance by Celsius in addressing its ongoing monetary challenges.

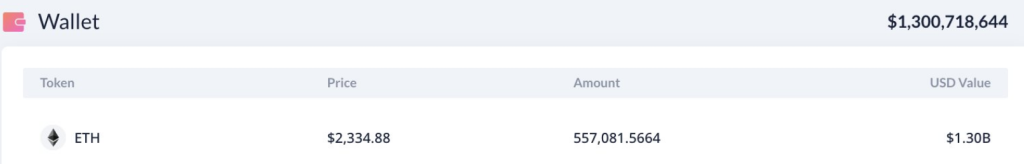

Celsius Sells $125M ETH, Maintains $1.3B Reserve

According to Arkham Intelligence, Celsius offered greater than $125 million price of Ethereum (ETH) cash between January 8 and January 12. The main purpose of this public sale is to repay collectors.

Dune Analytics additionally revealed a extra widespread sample of redemptions, with over $1.6 billion of staked Ethereum being redeemed throughout the identical interval. Since the Shanghai replace final yr, the quantity of redemptions recorded is the very best.

The #Celsius pockets deposited 13K $ETH($30.34M) to #Coinbase and a pair of,200 $ETH($5.13M) to #FalconX once more up to now 10 hours.

Currently, 2 staking wallets of #Celsius nonetheless maintain 557,081 $ETH($1.3B).

Address:https://t.co/3gGOucC9gYhttps://t.co/zodN4gzVHKhttps://t.co/Jjt9fCN2Ej pic.twitter.com/E9DIZ9KDAH

— Lookonchain (@lookonchain) January 23, 2024

Despite dealing with monetary constraints imposed by the court docket, Celsius nonetheless holds a considerable Ethereum reserve. This reserve quantities to over 557,000 cash in two staking wallets, with a complete valuation of roughly $1.3 billion. The dimension of this reserve provides a layer of complexity to Celsius’ present monetary state of affairs and underscores the evolving narrative throughout the crypto area.

Source: LookOnChain

As a part of its obligations to collectors, Celsius has been actively liquidating its Ethereum holdings. These auctions, geared toward paying off excellent money owed, are integral to Celsius’ chapter proceedings.

Source: LookOnChain

The market has responded to those Ethereum transactions, leading to a 4% decline within the worth of ETH. The cryptocurrency slipped under the $2,350 mark, elevating issues amongst analysts, particularly as ETH now wavers under its essential demand zone starting from $2,380 to $2,461.

Analysts predict {that a} failure to keep up this stage might result in a possible retreat in the direction of the $2,000 mark.

Ethereum at present buying and selling at $2,307.2 on the each day chart: TradingView.com

Wealthy Investors Trigger Ethereum Profit-Taking

Santiment’s historic knowledge reveals that vital transactions by rich traders, generally often known as whales, typically set off profit-taking actions amongst common ETH holders. This phenomenon intensifies promoting strain and contributes to cost declines.

Meanwhile, reducing funding charges counsel an underlying optimism available in the market, hinting at a doable cooldown in beforehand overheated perpetual markets. This state of affairs leaves room for ETH to rebound as soon as the promoting strain subsides.

As the chapter drama of Celsius unfolds, the scrutiny on its Ethereum transactions and the ensuing market dynamics will persist. Investors and observers are carefully monitoring the state of affairs, eagerly awaiting additional developments and anticipating the broader implications for each Celsius and the crypto ecosystem.

Featured picture from Shutterstock

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site solely at your individual danger.

[ad_2]

Source link