[ad_1]

Bitcoin worth has surged 25% because the spot Bitcoin ETF launch within the United States and vital Bitcoin accumulation by massive whales in 2024. Given the low BTC provide coupled with rising mining difficulty state of affairs, a rise in block dimension might doubtlessly add stress on miners to promote their holdings.

Crypto Fear & Greed Index hits “Extreme Greed” with a worth of 76, indicating a possible crypto market selloff within the subsequent few days.

Bitcoin Miners Under Selloff Pressure

Bitcoin block dimension has elevated by about 40-50% amid an increase in Bitcoin community exercise on account of BTC’s latest rally, as per a CryptoQuant-verified analyst. Typically, Ordinals enhance block dimension that usually results in a rise in charges. However, there is no such thing as a vital enhance in charges, which suggests the rise in block dimension is because of excessive quantity of BTC shopping for or promoting.

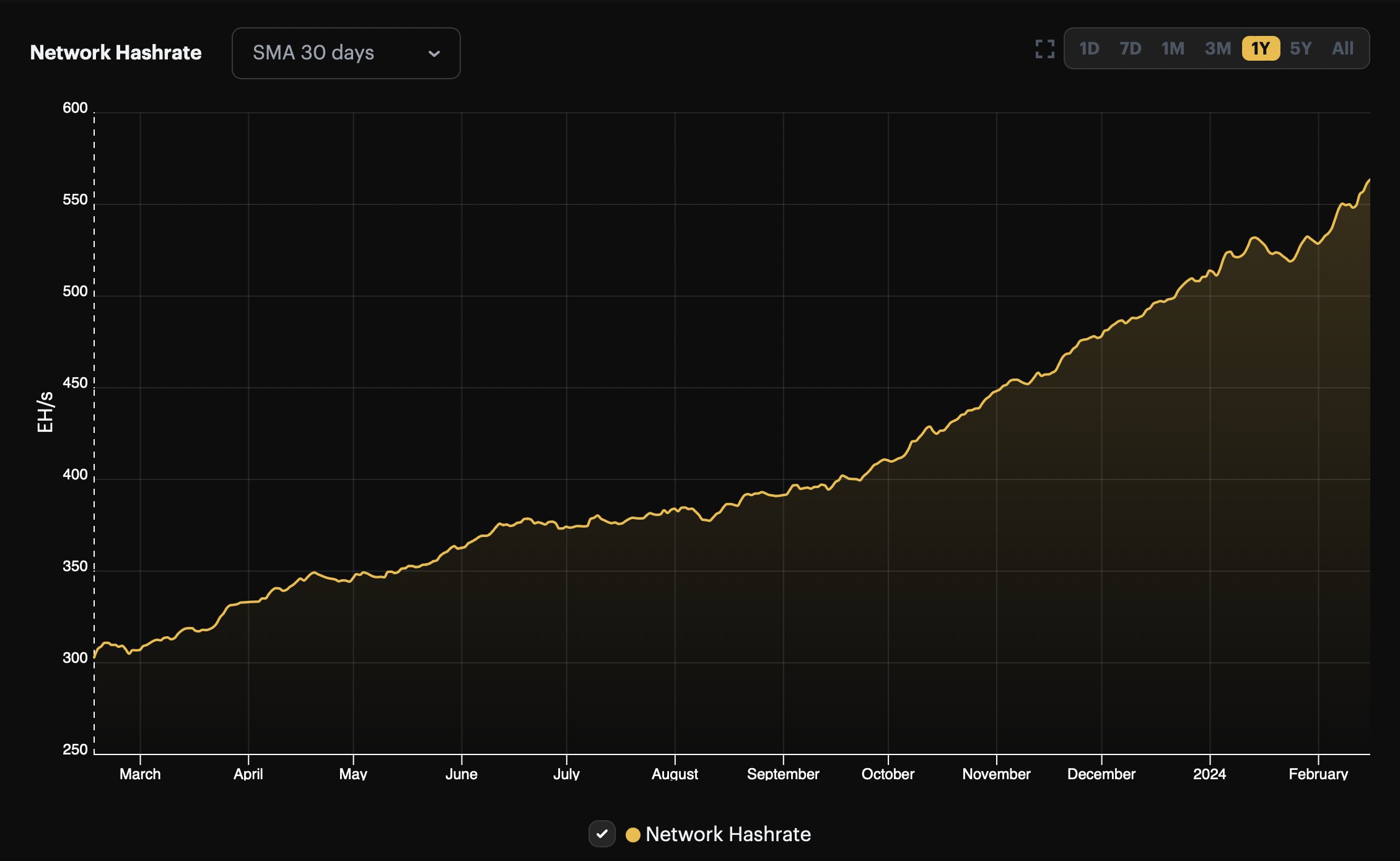

While mining issue and block dimension are totally different ideas, a rise in block dimension not directly impacts mining competitors as miners spend extra time transmitting over the community. Bitcoin mining issue hits 81.73T, with community hashrate almost doubled within the final 12 months going from 303 EH/s to a median of 577 EH/s, as per BTC.com data.

The enhance in block dimension amid rising mining issue and BTC worth can add stress on miners to promote their BTC holdings. Notably, the Bitcoin Miners’ Position Index (MPI) can be indicating elevated promoting stress from miners, elevating issues amongst analysts and buyers. Historically, BTC worth witnessed correction when MPI was excessive and miners reserve additionally fell.

Currently, the miner reserve has declined to 3-year low amid huge demand from spot Bitcoin ETFs and the market. The alternate reserves are additionally getting ready to dropping under 2 million BTC, a key degree maintained till November-end.

Spot Bitcoin ETFs have recorded a internet influx of $323.90 million on Friday, with influx since launch reaching nearly $5 billion.

BTC price fell barely in the previous couple of hours, with the value at present buying and selling at $51,640. The 24-hour high and low are $51,641 and $52,537, respectively. Furthermore, the buying and selling quantity has decreased additional by 30% within the final 24 hours, indicating a decline in curiosity amongst merchants. Analysts akin to Ali Martinez predicted a downslide within the subsequent few days.

Also Read:

The offered content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.

[ad_2]

Source link

✓ Share: