[ad_1]

The U.S. Bitcoin ETF market witnessed a big surge in inflows, with BlackRock’s IBIT and Fidelity’s FBTC main the cost, attracting a mixed whole of practically $870 million on March 13, 2024. Notably, amidst this inflow, the broader U.S. Bitcoin ETF noticed a considerable influx of about $700 million, reflecting sturdy curiosity from the institutional gamers.

It’s value noting that a number of market pundits have attributed the current sturdy influx into U.S. Spot Bitcoin ETF to the current rally in Bitcoin value.

BlackRock & Fidelity Bitcoin ETF Dominate Inflows

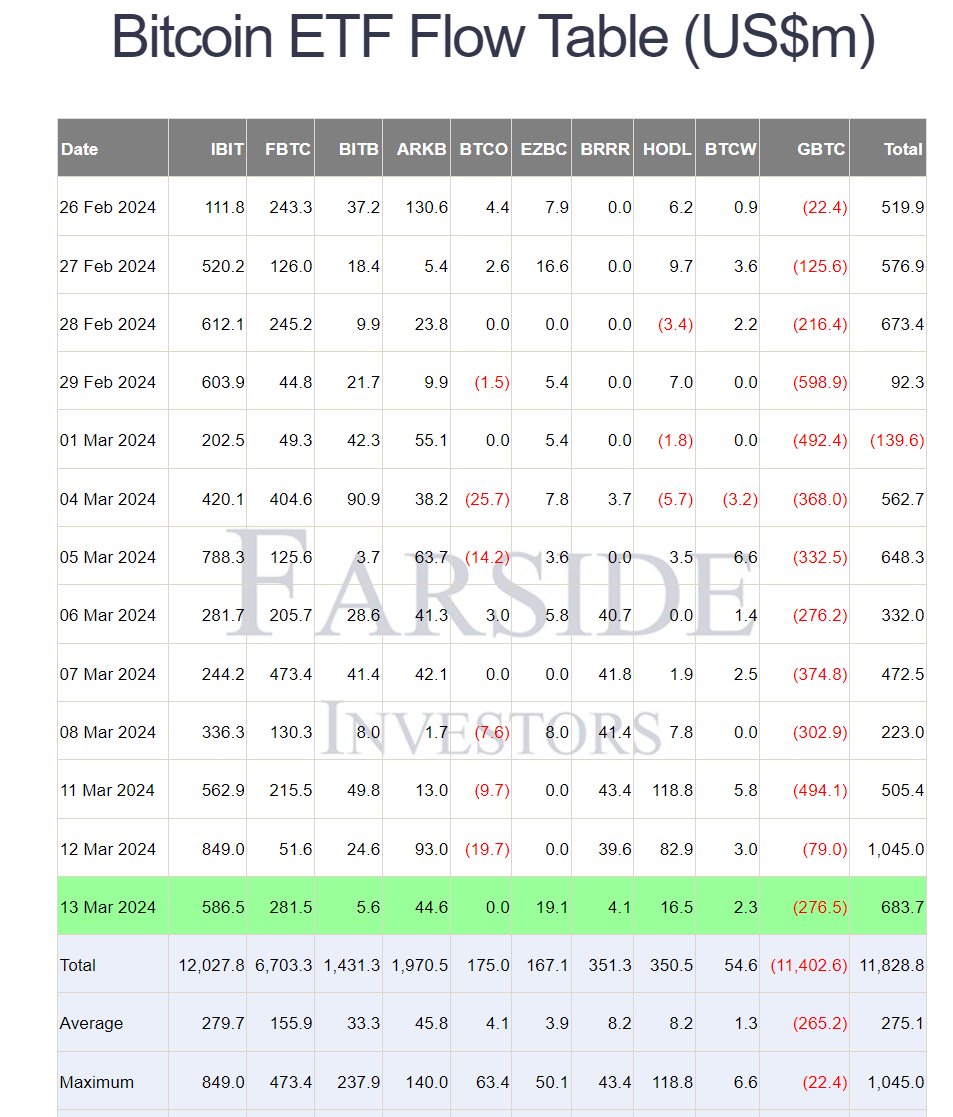

The U.S. Spot Bitcoin ETF recorded an influx of $684.7 million on Wednesday, March 13, in line with Farside Investors’ report. Notably, the persevering with strong influx this week, particularly amid Bitcoin’s unprecedented rally, suggests the sturdy curiosity of the Wall Street gamers towards the flagship crypto.

Meanwhile, BlackRock’s IBIT and Fidelity’s FBTC emerged as frontrunners within the Bitcoin ETF race, with a mixed inflow nearing $870 million. Specifically, BlackRock’s IBIT obtained $586.5 million in inflows on Wednesday, whereas Fidelity’s FBTC recorded a formidable $281.5 million inflow.

However, the inflow into the VanEck Bitcoin ETF (HODL) witnessed a decline, cooling to $16.5 million from $82.9 million within the prior day. However, VanEck had recorded a considerable influx of over $200 million within the first two days of the week, following its determination to waive charges, from 0.20% to 0.0%, for the primary $1.5 billion in property till March 2025.

In distinction, the outflow in Grayscale’s Bitcoin ETF (GBTC) surged as soon as once more, totaling $276.5 million, following a decline to $79 million in the day before today’s outflow.

Also Read: Bitcoin (BTC) Profits Moving to Large Cap Altcoins Like SOL, BNB, AVAX

Bitcoin Price Rallies Amid Market Optimism

The U.S. Spot Bitcoin ETF additionally marked a big milestone, recording its highest single-day internet influx since its launch on March 12. As CoinGape Media reported earlier, the U.S. Spot Bitcoin ETFs witnessed a internet influx of $1.05 billion on March 12, fueled by the second-highest quantity day for the ten Bitcoin ETFs, totaling $8.5 billion.

Meanwhile, these developments coincide with a brand new excessive in Bitcoin’s value, additional underlining the rising curiosity of Wall Street gamers within the cryptocurrency market. Analysts attribute the surge in ETF inflows to the current rally in BTC value, signaling heightened institutional curiosity in digital property.

As of writing, the Bitcoin price was up 1.35% to $73,123.31, with its buying and selling quantity from yesterday falling 20.73% to $48.36 billion. Meanwhile, the crypto has touched a brand new excessive of $73,641.04 at the moment, whereas touching a low of $71,720.18 within the final 24 hours.

Notably, over the past 30 days, the BTC value was up practically 50% throughout writing, together with a weekly acquire of round 11%.

Also Read: Shiba Inu- Shytoshi Kusama Reveals The Shib Magazine’s Latest Edition, Here’s Everything

The introduced content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

[ad_2]

Source link

✓ Share: