[ad_1]

Following per week of internet outflows, the spot Bitcoin ETF market has rebounded with spectacular internet inflows this week, highlighting a rising investor confidence in Bitcoin and its related monetary merchandise. This week’s market actions have proven a outstanding reversal from the earlier 5-day net outflow streak, with Tuesday witnessing a considerable internet influx of $480 million, adopted by $243.5 million on Wednesday.

Yesterday’s resurgence in investor curiosity was notably boosted by Blackrock’s huge influx of $323.8 million, successfully offsetting Grayscale GBTC’s $299.8 million outflows. Moreover, Ark Invest’s ARKB reported its greatest day but, with $200 million in inflows, regardless of Fidelity experiencing its worst day with a mere $1.5 million in outflows. Nevertheless, Fidelity managed to bounce again with important inflows of $261 million and $279 million on Monday and Tuesday, respectively.

Yesterday’s ETF flows had been optimistic for $243.5 million.

Blackrock lastly awakened once more for $323.8 million utterly cancelling out $GBTC‘s $299.8 million outflows.

Ark had their greatest day but with $200 million. Fidelity had its worst day with $1.5 million.

Price dumped on… pic.twitter.com/LLChkITN7q

— WhalePanda (@WhalePanda) March 28, 2024

1% Down, 99% To Go For Bitcoin ETFs

However, based on Bitwise Chief Investment Officer (CIO) Matt Hougan, that is simply the mere starting of what’s to return within the upcoming months. Hougan’s commentary, a part of his weekly memo to funding professionals, sheds mild on the present market dynamics and the colossal potential that lies forward. “1% Down; 99% to Go,” Hougan wrote, highlighting the nascent but promising journey of Bitcoin ETFs.

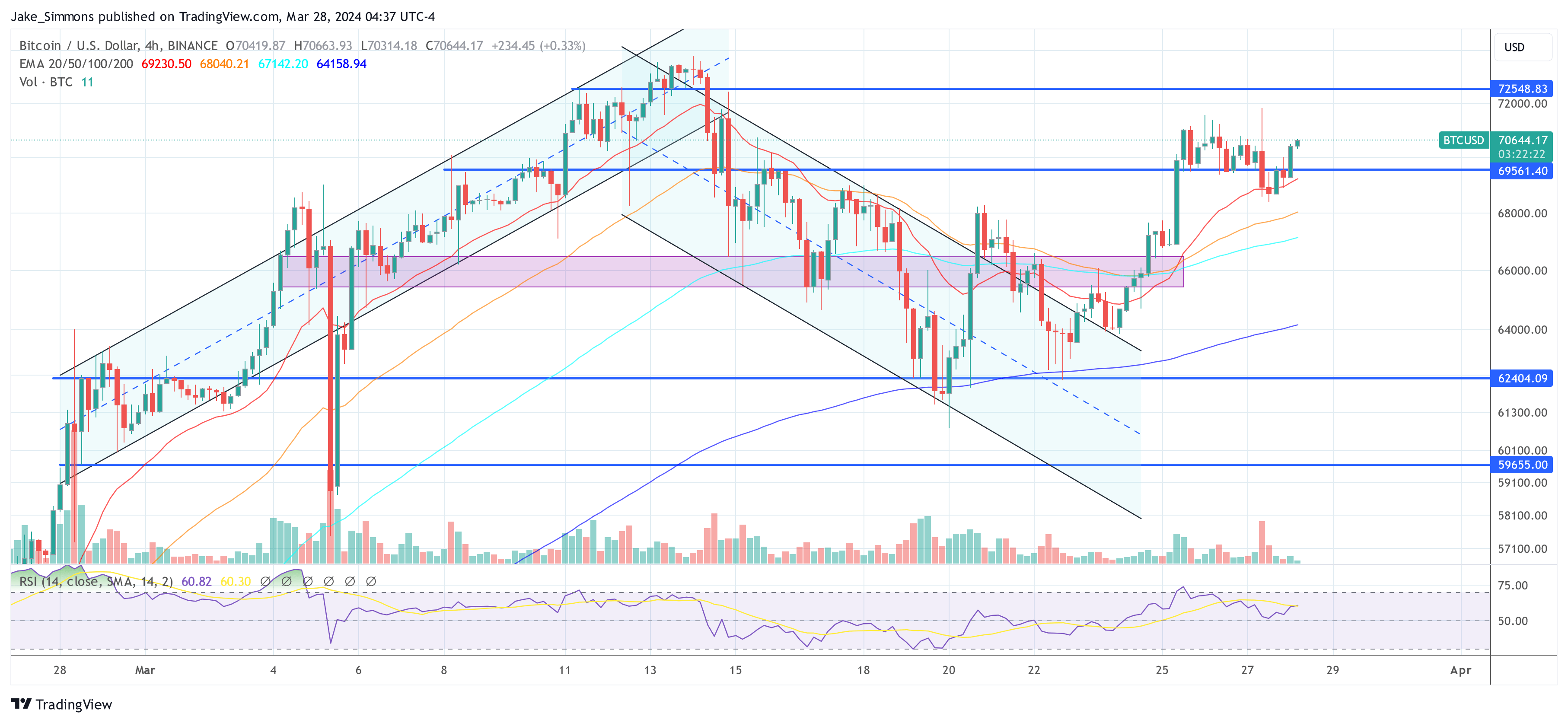

Lately, the market has been characterised by its volatility, with Bitcoin’s value oscillating between $60,000 and $70,000. Hougan advises a relaxed and long-term perspective amidst this fluctuation, particularly because the sector anticipates the upcoming Bitcoin halving round April 20, the approval of Bitcoin ETFs on nationwide account platforms, and the soon-to-come completion of due diligence by varied funding committees.

Despite the present sideways motion of Bitcoin’s value, Hougan stays bullish about its long-term trajectory. “Bitcoin is in a raging bull market,” he asserts, noting an almost 300% improve over the previous 15 months. The launch of spot Bitcoin ETFs in January has marked a big milestone, opening up the Bitcoin market to funding professionals on an unprecedented scale.

Hougan’s evaluation factors to a profound shift as world wealth managers, who collectively management over $100 trillion, start to discover investments within the “digital gold.” He means that even a conservative allocation of 1% of their portfolios to Bitcoin may end in roughly $1 trillion of inflows into the house.

This perspective is backed by historic knowledge displaying that even a 2.5% allocation to Bitcoin has enhanced the risk-adjusted returns of conventional 60/40 portfolios in each three-year interval of Bitcoin’s historical past.

The latest inflows into Bitcoin ETFs, although spectacular, are seen by Hougan as merely the start of a a lot bigger motion. “We are all excited about the $12 billion that has flowed into ETFs since January. And it is exciting: Collectively, the most successful ETF launch of all time..But imagine global wealth managers allocate just 1% of their portfolios to bitcoin on average,” Hougan elaborates, emphasizing the dimensions of potential progress awaiting the cryptocurrency market. He concludes:

Think concerning the implications. […] A 1% allocation throughout the board would imply ~$1 trillion of inflows into the house. Against this, $12 billion is barely a down fee. 1% down, 99% to go.

At press time, BTC traded at $70,644.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site fully at your individual threat.

[ad_2]

Source link