[ad_1]

Once once more, there may be hope for Bitcoin (BTC) as Michael Van De Poppe, a cryptocurrency professional, has spotlighted the potential for the crypto asset’s worth to achieve a brand new all-time excessive earlier than the extremely anticipated Halving occasion commences.

One Final All-Time High For Bitcoin Before Halving

The worth of Bitcoin is presently exhibiting new bearish exercise, which could set off detrimental sentiments out there over the following few days. Despite the notable decline, Michael Van De Poppe is optimistic that BTC will attain a brand new peak previous to Bitcoin Halving anticipated to happen this month’s finish.

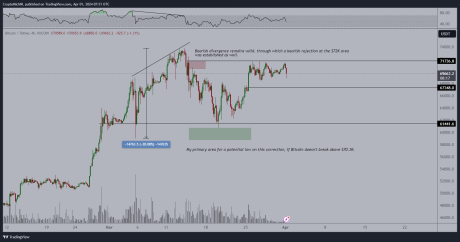

According to the analyst, the digital asset is presently in a consolidation zone. He additional recognized two distinct essential ranges throughout the decrease timeframes such because the $67,000 threshold as a assist stage and the $71,700 mark as a ultimate get away in direction of the height.

It is price noting that Michael Van De Poppe beforehand forecasted that Tuesday might be when the true strikes are anticipated to start as Bitcoin consolidates. Thus, if the coin holds the $67,000 stage, he’ll suggest a one-last peak check forward of the halving.

Poppe appears to be assured about his prediction now as he asserts that if one of many two aforementioned essential ranges develops, it is going to decide the course of Bitcoin. Due to this, he believes BTC will expertise one ultimate pre-halving all-time excessive.

The put up learn:

Bitcoin is calmly consolidating. Crucial ranges (decrease timeframes): $67,000 to carry for assist, $71,700 for a ultimate breakout in direction of the ATH. If both of the 2 occurs, most likely course is chosen. I believe we could have one ultimate ATH check earlier than halving occurs.

Following the current decline, Poppe has issued a warning to the crypto neighborhood on the right way to work together with the worth motion. “You do not want to chase those massive green candles,” he acknowledged.

He advocates getting into the market when BTC‘s worth is down by 15% to 40%. Additionally, he addressed these contemplating investing in altcoins, urging them to speculate when altcoins are down by 25% to 60%.

Possible Triggers For The Correction

As of press time, Bitcoin’s worth is buying and selling at $65,843, demonstrating a decline of over 5% within the each day timeframe. Its buying and selling quantity has seen a major uptick of 66% previously day, whereas its market cap has decreased by 5%.

Since its peak of $73,000, achieved in early March, the worth of Bitcoin has dropped by practically 10%. One issue thought-about to have contributed to the retracement was the inflow of funds into US Spot Bitcoin Exchange-Traded funds (ETFs), which has since began to relax regularly.

Data from Wu Blockchain revealed that the merchandise noticed an general internet outflow of $85.84 million on Monday. BlackRock ETF IBIT recorded a internet influx of $165 million, whereas Grayscale ETF GBTC skilled a single-day internet outflow of $302 million. Presently, the historic cumulative internet influx for the BTC spot ETFs is pegged at $12.04 billion.

Featured picture from iStock, chart from Tradingview.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding choices. Use data supplied on this web site fully at your personal threat.

[ad_2]

Source link