[ad_1]

-

Binance coin has returned greater than 77% for the reason that June backside worth.

-

The token hit the resistance goal at $326, forcing profit-taking actions.

-

BNB has quickly damaged under key support, though a bearish momentum shouldn’t be but confirmed.

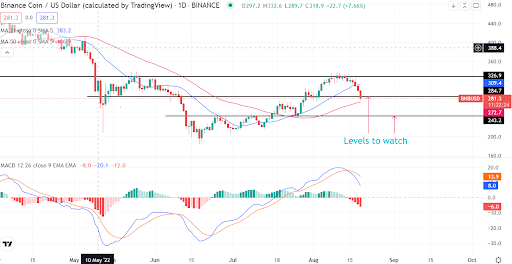

By all means, Binance coin BNB/USD has returned massively for traders who focused $326 resistance. The degree, hit in the course of the first week of August, represents an upsurge of 77% since BNB bottomed at $142. To a technical reader, $326 represents a take-profit zone. That reveals why the token misplaced momentum after hitting the extent. BNB now trades at $280.

BNB slowdown is related to profit-taking actions moderately than weak fundamentals. Whereas the value may climb above $326, traders stay cautious because the recession dangers stay. As of press time, most cryptocurrencies remained within the purple. However, we will’t verify a bear market as of now.

BNB trades at a key degree as worth slides

Source – TradingView

From the each day chart outlook, BNB is below stress. The momentum line has crossed under the shifting common, suggesting a bearish push. The cryptocurrency has additionally damaged above the 21-day MA however stays supported by the 50-day MA.

Two eventualities are possible as BNB trades at key support of $285. In the bull case situation, the each day candle stick may shut above the support, leaving a bearish pin bar. That will enable bulls to take management and push the token again to $326. The situation will see BNB stay supported by the 50-day MA.

In the bear situation, the each day candlestick will shut under the support zone. That could possibly be adopted by a bear affirmation candlestick. The bear situation will see BNB transfer again to $244.

Concluding ideas

Investors ought to watch the shut of the each day candlestick on BNB. That will reveal whether or not BNB will enter a bear market or start a bull reversal.

[ad_2]

Source link