[ad_1]

- I jumped on-chain and observed a key indicator – miner revenue – suggests that Bitcoin could also be prepping for an upward transfer

- But in isolation, this implies nothing. Sample measurement for Bitcoin is too small, with the present environment the one macro bear promote it has seen since launch in 2009

- Until risk-off sentiment in wider market dissipates, on-chain indicators must be taken with pinch of salt

One of essentially the most fascinating issues about Bitcoin for me is the flexibility to bounce on-chain and observe a complete vary of indicators. As the years go by and we construct up extra of a pattern of how Bitcoin performs, these metrics change into all of the extra highly effective.

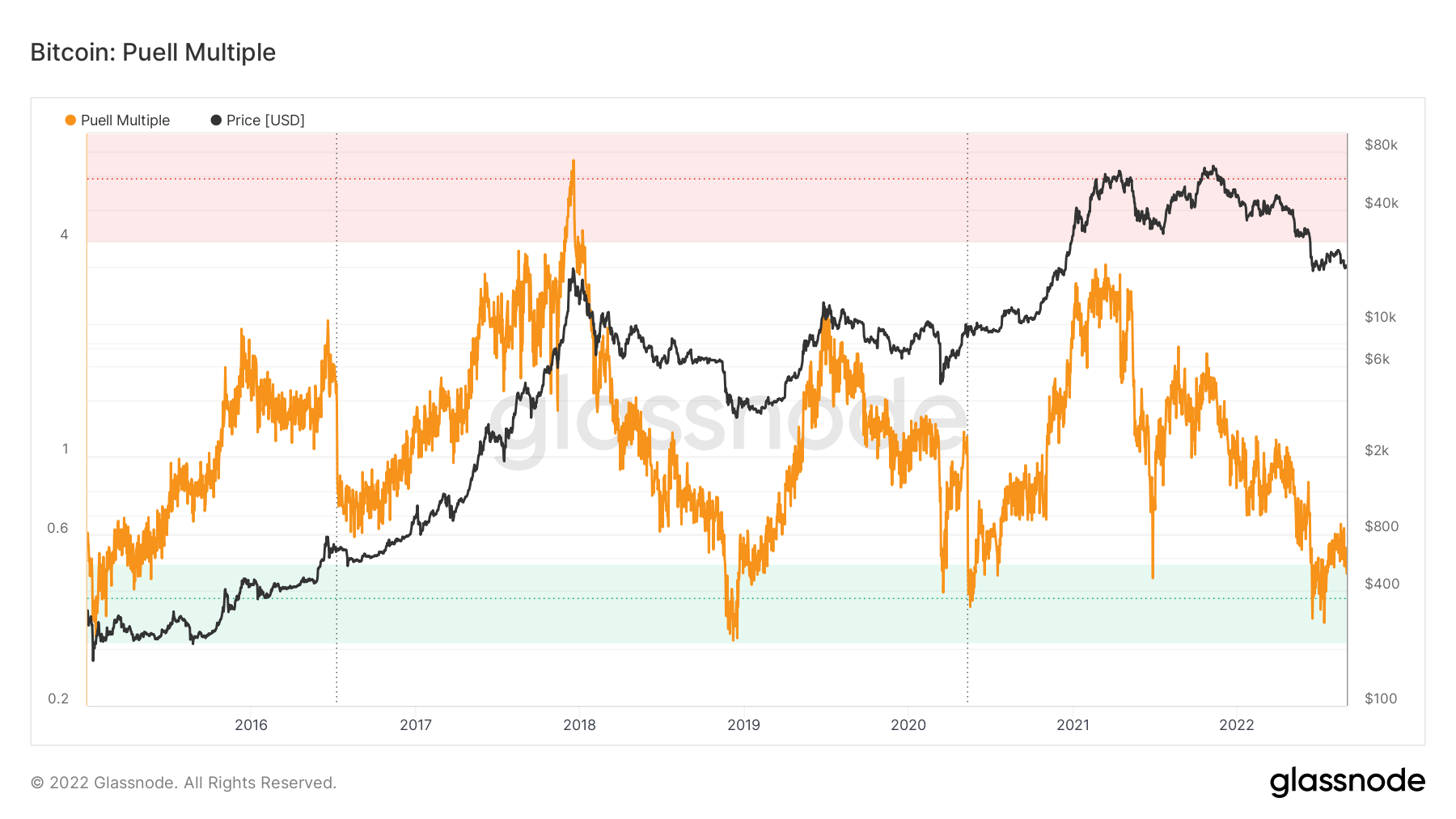

One of my favorite on-chain indicators is the Puell indicator. This takes the full miner revenue and adjusts it by its yearly transferring common. So, the calculation of the indicator takes mining revenue and divides it by the 365-day easy transferring common of mining revenue.

Miner actions usually present distinctive insights into the market. They are sometimes seen as obligatory sellers as a result of their revenue is in Bitcoin, whereas their mounted prices – electrical energy, largely – are in fiat. Obviously, they’ve to cowl these mounted prices and so the issuance of bitcoins from miners will at all times be intrinsically associated to value.

The Puell indicator just about tracks when the quantity of bitcoins getting into the market is too nice or too little relative to historic norms. Looking again at it traditionally, there is fairly a powerful relationship – the value tends to transfer upward when the Puell indicator falls into the inexperienced zone on the chart beneath.

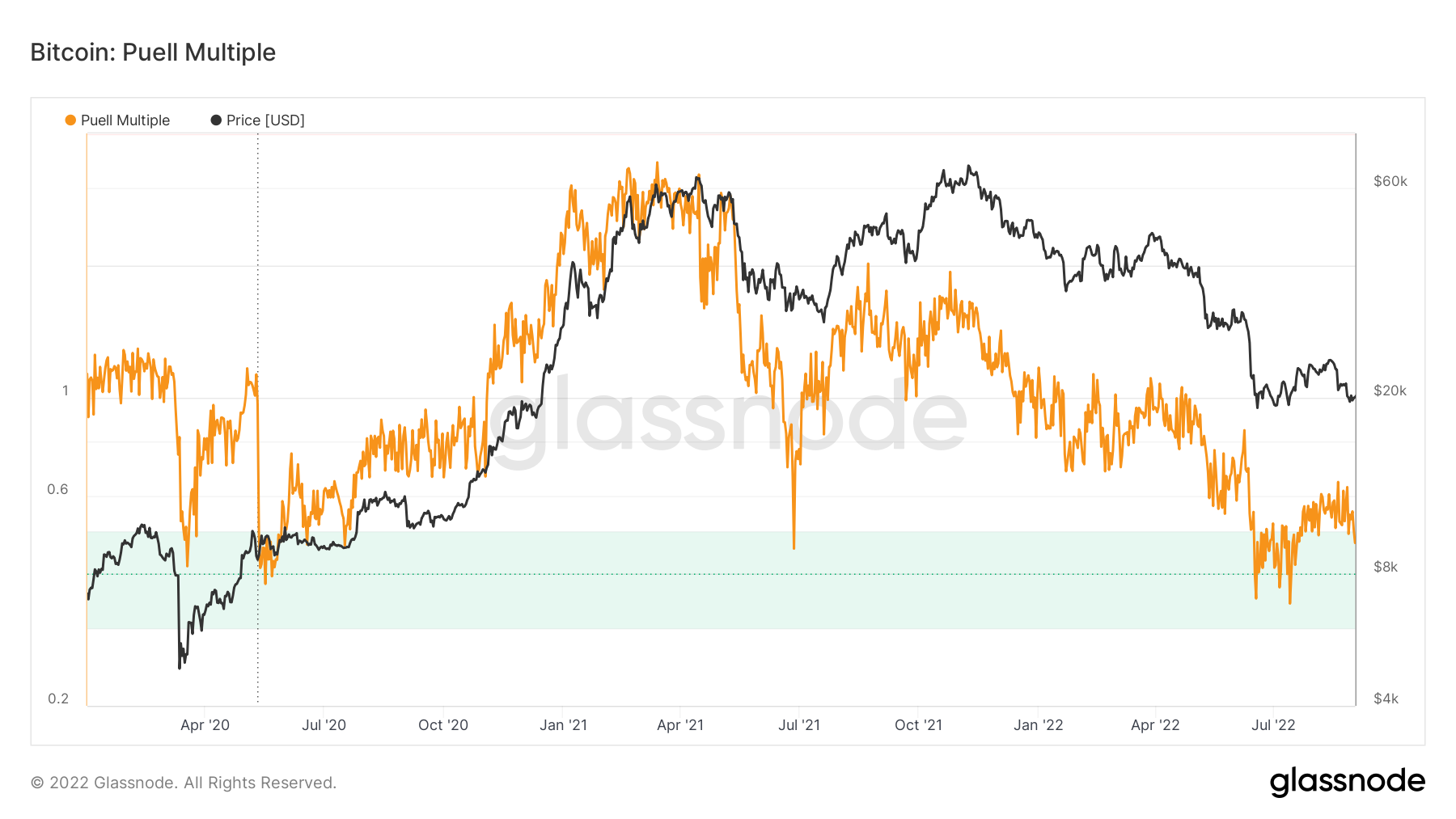

The most up-to-date time the Puell indicator dipped into the “buy” zone was mid-June. Again, we noticed upward motion quickly after, as Bitcoin had its little rally from about $20,000 up above $24,000. Of course within the final week or so now we have dipped again down to beneath $20,000, because the Fed’s feedback on rate of interest plans and inflation sparked a wave of risk-off sentiment throughout all asset lessons.

Interestingly, I observed yesterday that the Puell indicator has dipped again into the “buy” zone. Zooming on the time interval because the begin of 2020 demonstrates this a bit clearer on the chart.

Then once more, I’m at all times hesitant to use on-chain indicators in isolation. This is by no means extra true than within the present local weather, the place now we have an unprecedented mix of a hawkish Fed, rampant inflation and a geopolitical local weather rising extra unstable by the day.

This is the one time in Bitcoin’s quick historical past that now we have seen this macro mix. Indeed, Bitcoin was solely launched in early 2009, which means it has resided throughout a interval of sustained up-only bull market dynamics. The historic pattern measurement of its value motion merely isn’t lengthy sufficient to draw any agency conclusions, subsequently.

The method I’d finally take a look at the Puell indicator is that Bitcoin appears primed to transfer upward IF the macro environment cooperates. But that is a critically large if. It has been the case all 12 months – and it’ll proceed to be the case – that macro developments are driving markets.

Bitcoin is following the inventory market, which is following the information within the inflation, rate of interest and geopolitical sectors. So whereas this is a bullish on-chain indicator for Bitcoin, it means nothing till we get additional cooperation within the wider world.

[ad_2]

Source link