[ad_1]

This could be Peter Schiff’s weirdest take, and the person’s obtained just a few. While commenting on Kim Kardashian’s current take care of the SEC, the gold bug fired at “the real pumpers”… Michael Saylor? and… CNBC? Did Peter Schiff and his workforce even do primary analysis about Kim Kardashian’s case? Or is he enjoying dumb, attacking his perceived enemies, and muddying the waters? For Peter Schiff’s sake let’s hope it’s the second choice, as a result of what he wrote was downright embarrassing.

The SEC is fining @KimKardashian $1.2 million for pumping #crypto. What about the true pumpers? @Saylor had way more to realize pumping crypto than Kim. Or @CNBC paid thousands and thousands for advertisements by crypto firms, then pumping #Bitcoin continuous whereas offering trade pumpers with airtime?

— Peter Schiff (@PeterSchiff) October 3, 2022

Peter Schiff’s actual phrases have been: “The SEC is fining Kim Kardashian $1.2 million for pumping crypto. What about the real pumpers? Saylor had much more to gain pumping crypto than Kim. Or CNBC paid millions for ads by crypto companies, then pumping Bitcoin non-stop while providing industry pumpers with airtime?” Wow. When newcomers to the area combine bitcoin and crypto, it’s usually an sincere mistake. Peter Schiff, nonetheless, writes about bitcoin on daily basis of his life. Could he be this out of the loop? Or does he have a hidden agenda?

What Is Peter Schiff Even Talking About?

First of all, Kim Kardashian did settle with the SEC for $1.2 million. The accusation was particularly about an alleged rip-off referred to as EthereumMax. Apparently, she didn’t disclose the cost she obtained for the promotion. According to our protection, Kim Okay “agreed to pay $1.26 million in penalties, including her promotional payment for EthereumMax. In addition, the socialite agreed to stop promoting “crypto securities” for the approaching three years and to cooperate with the SEC’s ongoing investigation.”

That’s the case in a nutshell. It has nothing to do with bitcoin or Saylor. And you may ensure that CNBC discloses the entire funds they get for crypto advertisements. So, what’s Peter Schiff even speaking about?

BTC worth chart for 04/10/2022 on FX | Source: BTC/USD on TradingView.com

Michael Saylor Fires Back

The MicroStrategy mastermind replied with a primary lesson: “Bitcoin is a commodity, not a security. Advocating a commodity is similar to promoting steel, aluminum, concrete, glass, or granite. The BTC network is an open protocol, offering utilitarian benefits similar to roads, rails, radio, telephone, television, internet, or english.” This must be frequent data, nevertheless it isn’t. A self-proclaimed professional like Peter Schiff ought to know all about it, although. It’s actually his job.

#Bitcoin is a commodity, not a safety. Advocating a commodity is just like selling metal, aluminum, concrete, glass, or granite. The BTC community is an open protocol, providing utilitarian advantages just like roads, rails, radio, phone, tv, web, or english.

— Michael Saylor⚡️ (@saylor) October 3, 2022

Notice that Saylor didn’t point out gold, Peter Schiff’s bread and butter. When a Twitter person pressed him on the similarities between him shilling gold and Saylor bitcoin, Schiff responded: “My recommending gold is not the same as bitcoin owners looking to sell pumping bitcoin. I don’t sell any gold that I own. I sell retail, then buy wholesale on behalf of customers. Also my advocacy of gold has no effect on its price.” Is he implying that Saylor sells his bitcoin and strikes the market together with his tweets? Because these are two lies.

My recommending #gold isn’t the identical as bitcoin homeowners seeking to promote pumping #bitcoin. I do not promote any gold that I personal. I promote retail, then purchase wholesale on behalf of shoppers. Also my advocacy of gold has no impact on its worth

— Peter Schiff (@PeterSchiff) October 3, 2022

The reality of the matter is that bitcoin is a commodity and never a safety. That’s not an opinion. That’s the SEC’s official stance on the matter.

Plus, Saylor was not paid by a 3rd celebration. Bitcoin is definitely decentralized and doesn’t have a advertising price range, a lot much less an proprietor.

Bitcoin isn’t crypto. And Peter Schiff ought to know that.

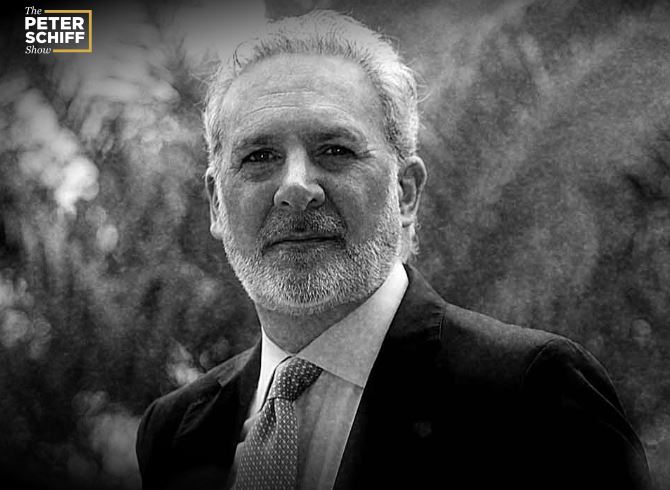

Featured Image: Peter Schiff screenshot from his site | Charts by TradingView

The identify recognition that bitcoin delivered to MicroStrategy can’t be purchased. They “can’t really ignore us,” Saylor stated. Bitcoin has been a “benefit on marketing and sales” and a “net positive” for the corporate. In reality, he qualifies it as “a screaming homerun for the shareholders.”

[ad_2]

Source link