[ad_1]

Data reveals Ethereum staking has handed one other milestone as greater than 10% of the whole ETH provide is now locked throughout the contract.

Around 12 Million ETH Is Now In The Ethereum 2.0 Deposit Contract

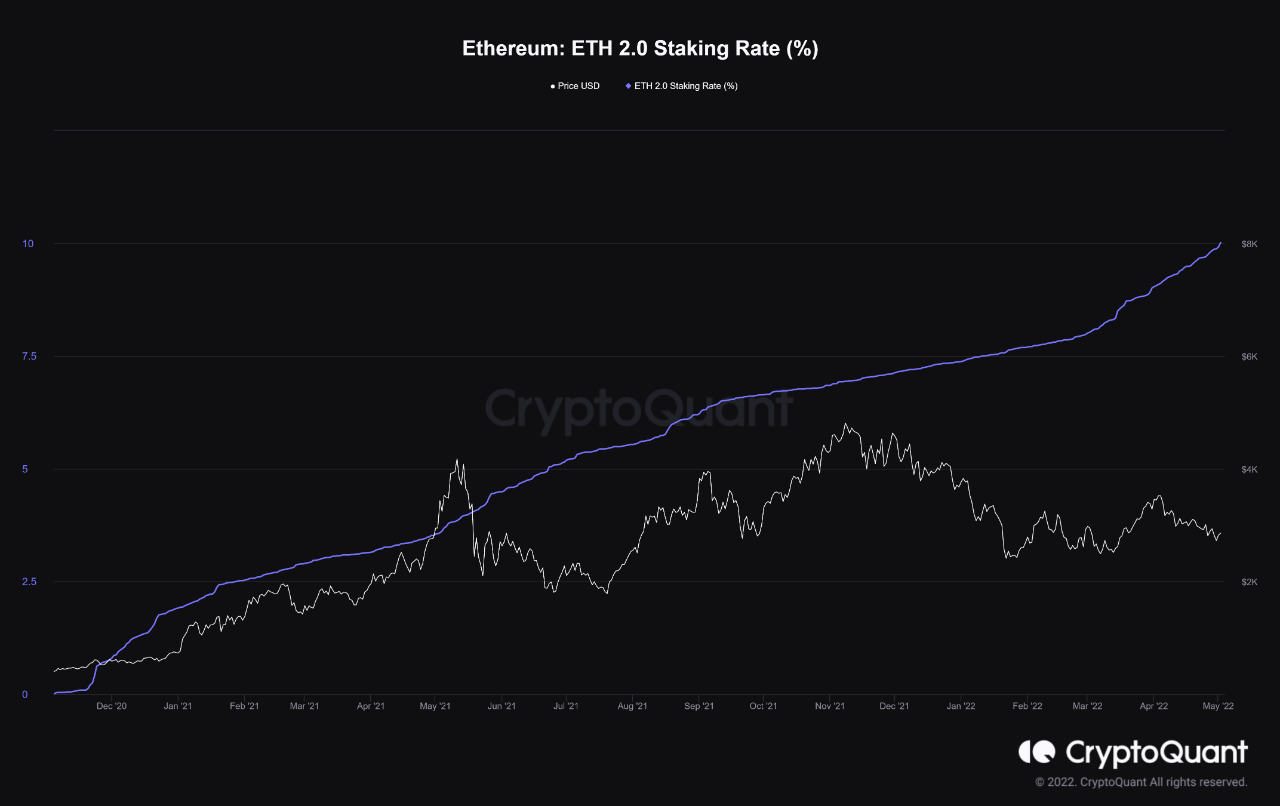

As identified by an analyst in a CryptoQuant post, the ETH staking fee has noticed additional surge just lately, taking the metric’s worth to 10% of the whole provide.

In case anybody’s not conscious of what “staking” is, it’s greatest to check out the “proof of stake” (PoS) consensus system first.

In cryptocurrencies utilizing the PoS framework, community validators (referred to as the stakers) have to lock in a minimal quantity of the crypto right into a contract (32 ETH in case of Ethereum) to take part within the consensus system.

The community then randomly chooses one of many stakers to signal the following transaction (stakers with the upper staked quantity have a greater probability of being chosen).

Related Reading | Bitcoin, Ethereum, Other Coins Now Supported By Argentina’s Biggest Private Bank

This is in contrast to proof of labor (PoW), the place miners require a excessive quantity of computing energy to compete with one another to signal the transactions.

Since mining machines can have a adverse impression on the setting, PoW cryptos have more and more come underneath scrutiny just lately.

However, as PoS networks don’t require validators to have any excessive energy {hardware}, they’re by design extra environmentally pleasant.

The Ethereum “staking rate” is a measure of the share of the whole ETH provide at present locked into its staking contract.

The under chart reveals the pattern within the indicator over the previous couple of years:

Looks just like the metric has noticed sharper uptrend in current months | Source: CryptoQuant

As you’ll be able to see within the above graph, greater than 10% of the whole Ethereum provide is now locked into the staking contract.

Related Reading | EPA Vs. Bitcoin: Dorsey, Saylor, Others Oppose Lawmakers’ Call For Action Vs. Crypto Mining

More cash being locked into the contract can show to be a bullish signal for the crypto as buyers staking are often in it for the lengthy haul, and are thus unlikely to promote.

Ethereum Price

At the time of writing, ETH’s price floats round $2.8k, down 5% within the final seven days. Over the previous month, the crypto has misplaced 17% in worth.

The under chart reveals the pattern within the worth of the crypto during the last 5 days.

The worth of the crypto appears to have principally moved sideways over the previous couple of days | Source: ETHUSD on TradingView

Ethereum has been struggling for fairly some time now, as has been the remainder of the crypto and monetary market. At the second, it’s unclear when the coin may even see any important restoration.

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link