[ad_1]

On-chain knowledge exhibits Bitcoin short-term holders appear to have been behind the newest selloff that has taken the value of the crypto under $36k.

Bitcoin Investors Holding Coins Aged Between 1 Day And 6 Months Sold Big Yesterday

As identified by an analyst in a CryptoQuant post, short-term holders appear to have offered the heaviest throughout the latest selloff.

The related indicator right here is the “exchange inflow,” which measures the entire quantity of cash shifting into trade wallets.

A modification of this metric is the “exchange inflow spent output age bands.” it tells us how a lot the totally different Bitcoin holder teams are contributing to the influx.

The varied teams are divided primarily based on what number of days the buyers held their cash earlier than transferring them to the trade.

The 1-day to 6-month coin age group is mostly thought of the “short-term holders” (STH). This cohort is normally the likeliest to promote their cash.

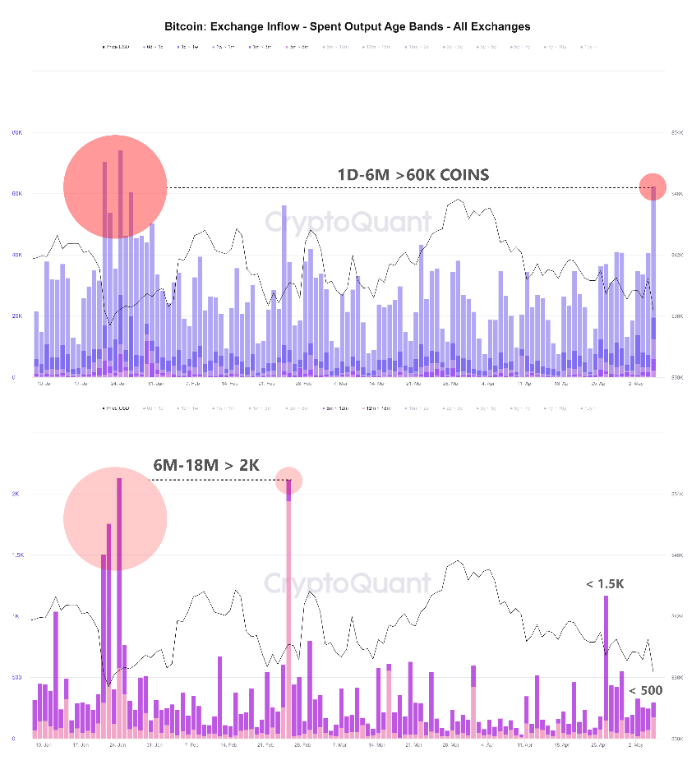

All buyers holding their Bitcoin for longer durations of time are the “long-term holders” (LTH). Now, here’s a chart that exhibits the pattern within the under 6-month and between 6 to 18-month age group inflows over the previous few months:

Looks like STH inflows spiked up lately | Source: CryptoQuant

As you’ll be able to see within the above graph, the 1-day to 6-month coin age group despatched a considerable amount of cash simply yesterday.

The influx spike amounted to greater than 60k cash being transferred by this group. Investors normally ship their Bitcoin to exchanges for promoting functions, therefore these cash took half within the selloff that has now taken the value under $36k.

Related Reading | One Coin, Two Trades: Why Bitcoin Futures And Spot Signals Don’t Match Up

The 6-month to 18-month group, however, doesn’t appear to have moved too many cash over the previous day.

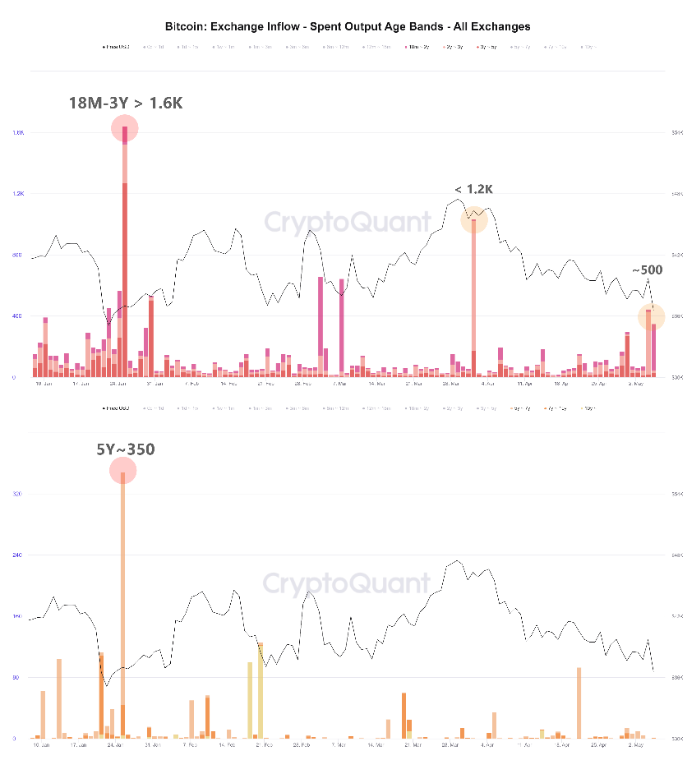

The older Bitcoin LTH teams have additionally not proven a lot exercise lately. The under chart exhibits the pattern of their inflows.

The 1.5-year to 3-year cohort solely seems to have offered round 500 BTC yesterday | Source: CryptoQuant

From these developments, it looks like the one buyers that took half within the promoting yesterday have been the short-term holders, who’re typically the extra fickle ones. The long-term holders nonetheless look to be holding robust.

Related Reading | Bitcoin Long Squeeze Incoming? Funding Rates Surge Up

BTC Price

At the time of writing, Bitcoin’s price floats round $35.8k, down 8% within the final seven days. Over the previous month, the crypto has misplaced 21% in worth.

The under chart exhibits the pattern within the value of the coin over the past 5 days.

The value of Bitcoin appears to have plummeted down over the previous day | Source: BTCUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link