[ad_1]

On-chain information suggests Bitcoin long-term holders have began to capitulate not too long ago because the sharp worth drop causes panic available in the market.

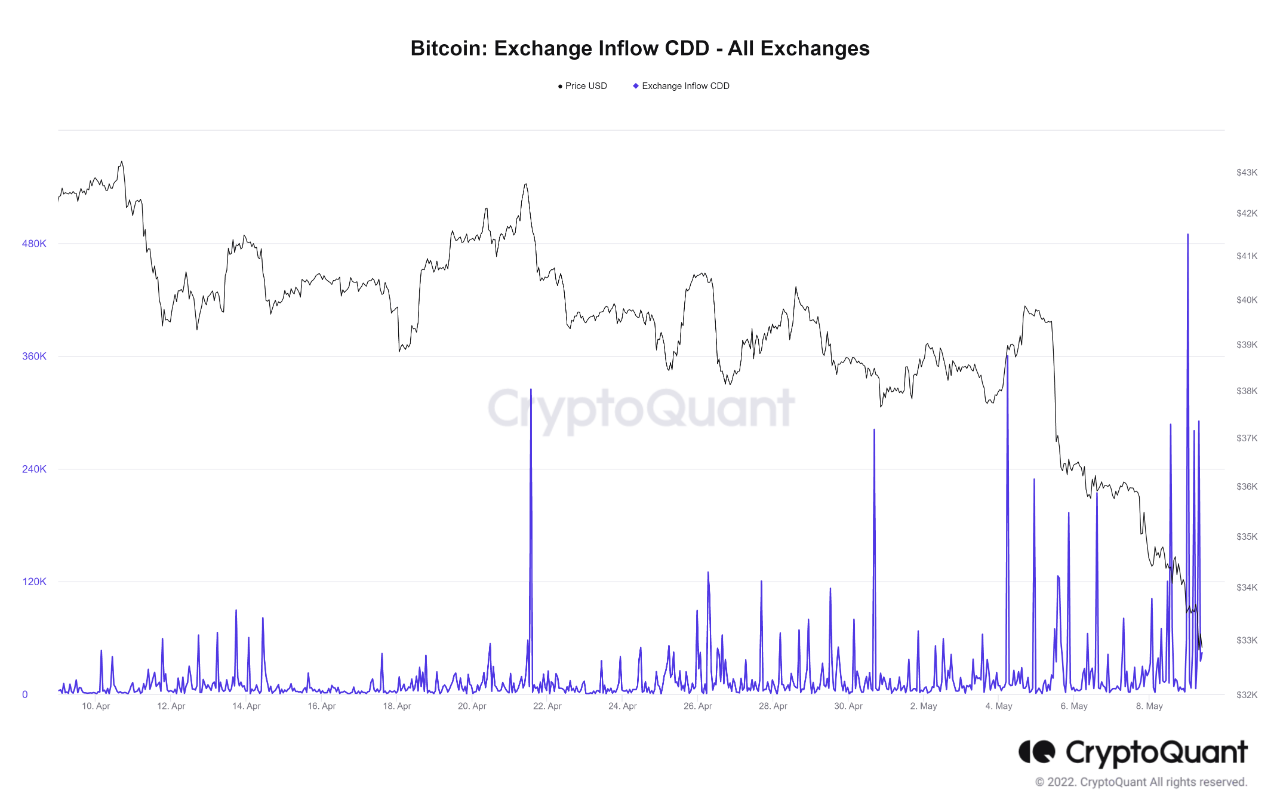

Bitcoin CDD Inflow Indicator Jumps Up, Showing Long-Term Holders Have Been Selling

As identified by a CryptoQuant post, the current worth drop has pushed long-term holders in the direction of promoting their BTC.

“Coin days” are the variety of days a Bitcoin has remained dormant for. An instance: if 1 BTC doesn’t transfer for five days, it accumulates 5 coin days.

When such a coin can be transferred or moved, its coin days can be “destroyed” because the quantity will reset again to zero.

Related Reading | Bitcoin Slips Below $33k As Exchange Inflows Reach Highest Value Since July 2021

The “coin days destroyed” (CDD) metric naturally measures what number of of those coin days are being destroyed in the whole market at any given time.

A modification of this indicator, referred to as the “Bitcoin exchange inflow CDD,” tells us about solely these coin days that have been destroyed by a switch to exchanges.

A excessive worth of the influx CDD usually means that long-term holders (who accumulate a lot of coin days) are transferring their cash to exchanges.

Investors often switch their Bitcoin to exchanges for promoting functions, so LTHs transferring a lot of their cash might be bearish for the worth of the crypto.

Now, here’s a chart that exhibits the pattern within the BTC influx CDD over the previous month:

The worth of the indicator appears to have spiked up not too long ago | Source: CryptoQuant

As you’ll be able to see within the above graph, the Bitcoin change influx CDD has noticed some excessive values over the previous few days.

This exhibits that long-term holders have been promoting amid the current panic available in the market as a result of worth drop from $38k to beneath $30k.

Related Reading | Terra Beats Tesla As Second-Largest Corporate Bitcoin Holder After $1.5B Purchase

The particularly giant spikes within the final two days recommend LTHs could have began to undergo a part of capitulation.

Since LTHs often make up the Bitcoin cohort that’s the least prone to promote, capitulation from them is a destructive signal for the worth of the coin.

BTC Price

At the time of writing, Bitcoin’s price floats round $31.6k, down 18% within the final seven days. Over the previous month, the crypto has misplaced 26% in worth.

The beneath chart exhibits the pattern within the worth of the coin during the last 5 days.

Looks like the worth of BTC has noticed a plunge previously few days | Source: BTCUSD on TradingView

Bitcoin’s drop has continued right now because the crypto briefly touched beneath $30k for the primary time since July of final yr, earlier than rebounding again to the present stage.

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link