[ad_1]

On-chain information exhibits the Bitcoin NUL indicator remains to be beneath a price of 0.5, an indication that extra downtrend may very well be in retailer for the crypto earlier than the underside is in.

Bitcoin Net Unrealized Loss Surges Up, But Still Remains Below 0.5

As identified by an analyst in a CryptoQuant post, the cryptocurrency’s worth should still be nowhere close to a backside.

The related indicator right here is the “net unrealized loss” (or NUL briefly), which tells us concerning the whole variety of cash which can be at present holding an unrealized loss.

The metric works by evaluating the final promoting worth of every coin on the chain to the present worth of Bitcoin. If the earlier earlier of any coin was greater than the present one, then that coin is holding a loss proper now.

On the opposite hand, the present worth being greater than the final promoting worth would suggest that the coin is in revenue in the meanwhile.

Related Reading | Bitcoin Falls Below $30k As 10k BTC Flow Into Gemini

The NUL metric solely takes under consideration the previous kind of cash. Another indicator, the online unrealized revenue (NUP), measures the latter class.

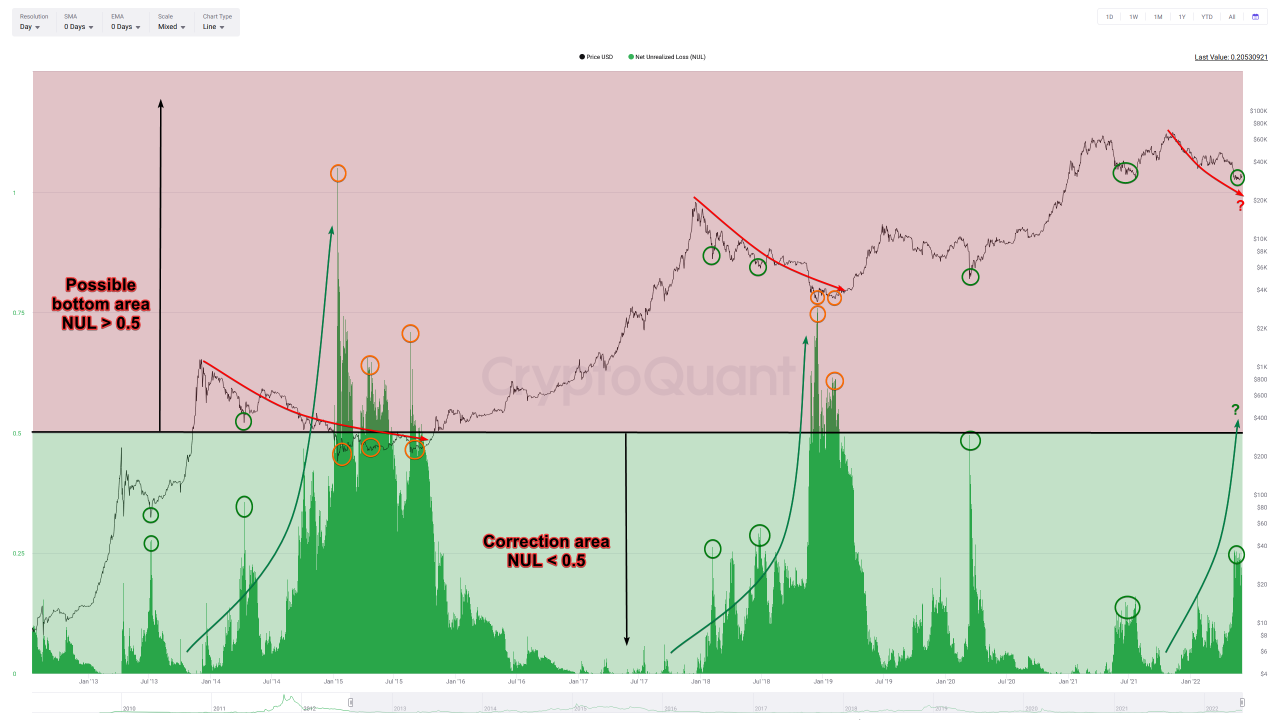

Now, here’s a chart that exhibits the pattern within the Bitcoin NUL over the historical past of the coin:

The worth of the indicator appears to have been rising lately | Source: CryptoQuant

In the above graph, the quant has marked the 2 totally different zones of the Bitcoin NUL, with the metric worth equal to 0.5 line being the divider between them.

It appears to be like like traditionally, the worth of the crypto has tended to look at the most important bottoms when the indicator’s worth has been larger than 0.5

Related Reading | Can FTX Token (FTT) And Parody Coin (PARO) Join Bitcoin (BTC) As The Biggest Cryptocurrency In 2022?

As you may see within the chart, the NUL metric has noticed some uptrend in current months. This is as a result of the worth of Bitcoin has been declining throughout this era, resulting in extra cash going underwater.

However, regardless of this current rise, it looks as if the online unrealized loss’ present worth remains to be effectively beneath the 0.5 degree.

If previous pattern is something to go by, Bitcoin could observe additional downtrend within the coming future earlier than the NUL’s worth exceeds the brink and a bottom is fashioned.

BTC Price

At the time of writing, Bitcoin’s price floats round $29.7k, up 3% within the final seven days. Over the previous month, the crypto has misplaced 23% in worth.

The beneath chart exhibits the pattern within the worth of the coin over the past 5 days.

Looks like the worth of the crypto has gone down over the past couple of days | Source: BTCUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link