[ad_1]

On-chain information exhibits the a part of the Bitcoin realized cap held by the long-term holders has elevated and is now at practically 80%.

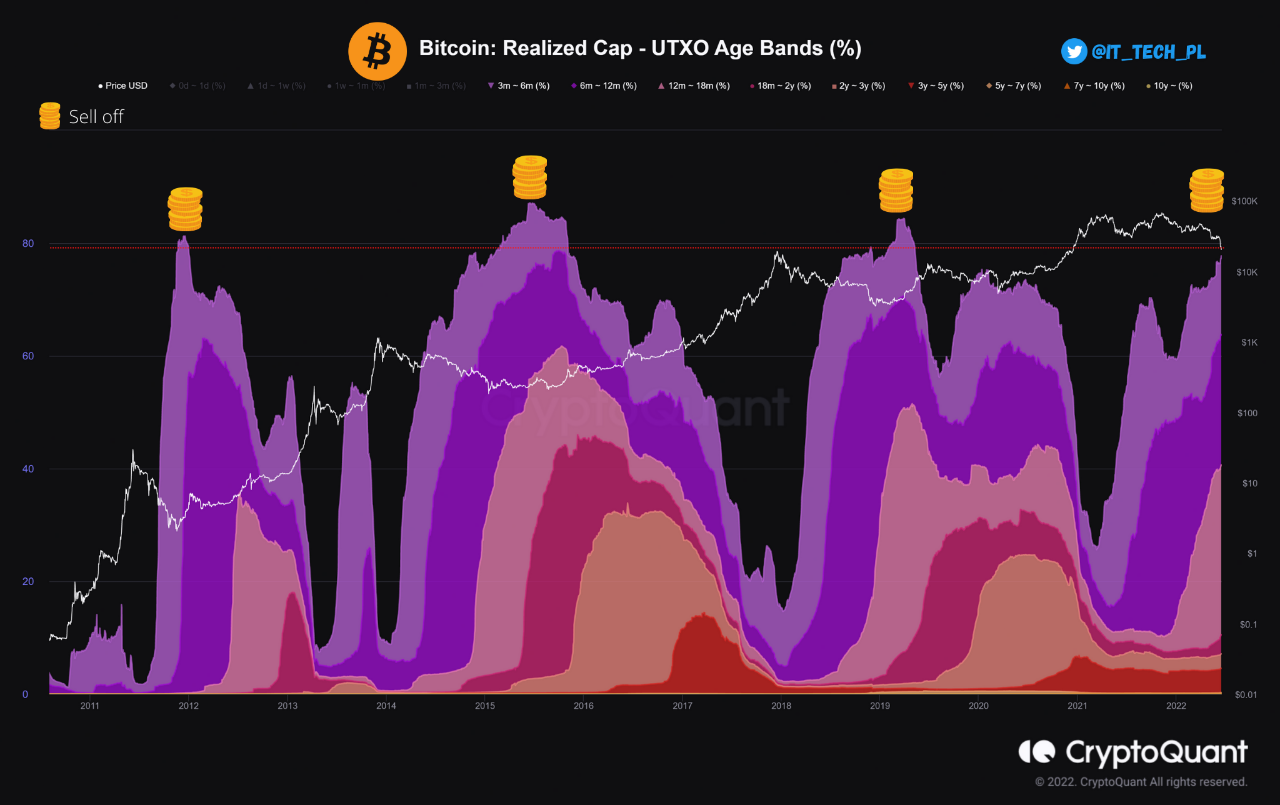

Bitcoin Long-Term Holders Own Almost 80% Of Realized Cap

As defined by an analyst in a CryptoQuant post, the crypto has traditionally tended to type bottoms round when the long-term holder share of realized cap has exceeded 80%.

The “long-term holders” (LTHs) are all these Bitcoin traders who’ve been holding onto their cash with out promoting or shifting since not less than 155 days in the past.

The realized cap is a method of assessing the capitalization of the crypto the place every circulating coin’s worth is taken as the worth it was final moved or offered at, quite than the present BTC value.

Now, the related on-chain indicator right here is the “realized cap – UTXO age bands (%),” which tells us what half are the assorted teams within the Bitcoin market contributing to the overall realized cap of the coin.

Related Reading | Bitcoin Exchange Reserve Spikes Up, Selloff Not Over Yet?

The varied age bands denote the period of time traders belonging to a bunch have been holding their cash for.

As talked about earlier, LTHs embrace all cohorts holding since not less than 155 days in the past. Here is a chart that exhibits how the contribution to the realized cap by these traders have modified over the historical past of Bitcoin:

Looks like the worth of the metric has noticed rise lately | Source: CryptoQuant

In the above graph, the quant has marked all of the related factors of development associated to the Bitcoin realized cap proportion of the LTHs.

It looks as if every time the indicator’s worth has crossed the 80% mark, a backside within the value of the crypto has taken place.

Related Reading | Bitcoin Funding Rates Remain Negative But Open Interest Tells Another Story

Currently, the metric’s worth has been rising up in current weeks, nonetheless, it has nonetheless not gone above the brink simply but.

Nonetheless, the indicator is sort of there. If its worth continues to rise and the historic sample holds this time as properly, then Bitcoin might observe a bottom quickly.

BTC Price

At the time of writing, Bitcoin’s price floats round $21k, down 30% within the final seven days. Over the previous month, the crypto has misplaced 30% in worth.

The beneath chart exhibits the development within the value of the coin over the past 5 days.

The worth of the crypto appears to have been shifting sideways over the previous few days | Source: BTCUSD on TradingView

Since the crash a number of days in the past, Bitcoin has been principally consolidating across the $21k mark. Currently, it’s unclear whether or not the decline is over, or if extra is coming.

If the LTH share of the realized cap is something to go by, then BTC might first seen a bit extra decline earlier than the underside is lastly in.

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link