[ad_1]

On-chain information reveals Bitcoin funding charges have sunk into deep destructive values, one thing that might pave manner for a brief squeeze out there.

Bitcoin All Exchanges Funding Rate Has A Red Value Right Now

As identified by an analyst in a CryptoQuant post, BTC may even see a slight uplift within the brief time period due to the present funding charges.

The “funding rate” is an indicator that measures the periodic payment that Bitcoin futures lengthy and brief merchants change between one another.

When the worth of this metric is constructive, it means longs are paying a premium to the shorts proper now to carry onto their positions.

Since there are extra longs out there, such a pattern reveals {that a} bullish sentiment is dominant within the futures market for the time being.

Related Reading | Is Coinbase Losing Its Edge? Nano Bitcoin Futures Sees Low Interest

On the opposite hand, destructive values of the funding price suggest that there are extra shorts out there presently, and that the general sentiment is bearish proper now.

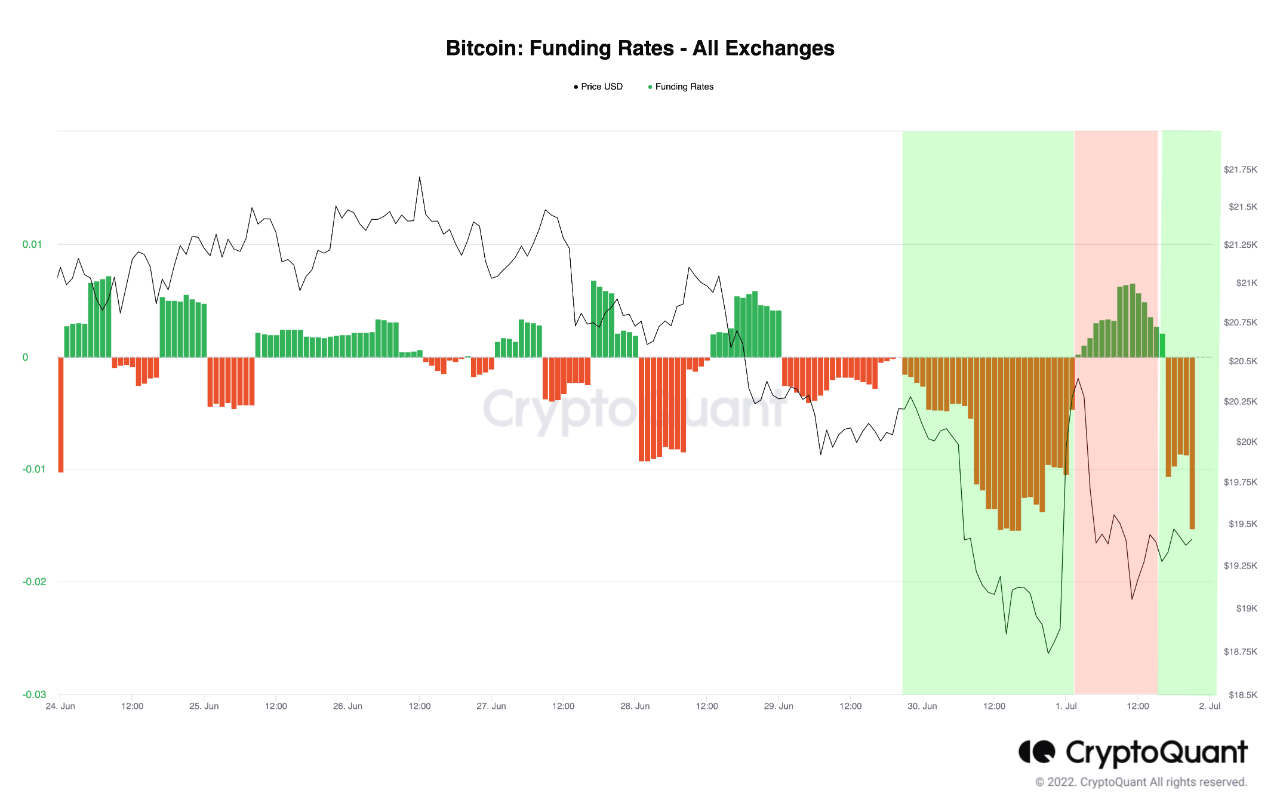

The beneath chart reveals the pattern within the all exchanges Bitcoin funding charges over the past week.

The worth of the indicator appears to be lower than zero for the time being | Source: CryptoQuant

As you possibly can see within the above graph, the Bitcoin funding price has gone down over the previous day and has a comparatively destructive worth proper now.

This implies that futures merchants are piling up shorts out there, An identical pattern additionally occurred simply a few days again because the chart reveals.

Related Reading | Samsung To Make Chips That Can Power Bitcoin Mining – Will This Energize Crypto?

Back then, the worth reversed upwards sharply and brought about a brief squeeze, which additional amplified the worth swing.

A “short squeeze” happens when mass liquidations of brief merchants happen as a result of a sudden sharp swing within the worth.

Large liquidations additional transfer Bitcoin within the route of the reversal, inflicting much more leverage to be flushed. In this fashion, liquidations cascade collectively and the occasion known as a “squeeze.”

Since shorts are accumulating within the BTC futures market proper now, it’s attainable {that a} swing within the worth may trigger such a squeeze, bringing some uplift for the crypto.

However, similar to a few days in the past, it’s doubtless that such liquidations would solely present a rise within the brief time period.

BTC Price

At the time of writing, Bitcoin’s price floats round $19.2k, down 9% up to now week. The beneath chart reveals the pattern within the worth of the crypto over the past 5 days.

Looks like the worth of the coin has sunk down over the previous couple of days | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link