[ad_1]

On-chain information reveals the Bitcoin taker purchase/promote ratio has lately crossed above ‘1,’ an indication that the crypto may expertise short-term bullish momentum.

Bitcoin Taker Buy/Sell Ratio Surges Up Above A Value Of 1

As defined by an analyst in a CryptoQuant post, the present BTC taker purchase/promote ratio pattern might counsel the crypto would possibly see sideways motion or a bullish reversal within the short-term.

The “taker buy/sell ratio” is an indicator that tells us concerning the ratio between the lengthy and brief volumes within the Bitcoin futures market.

When the worth of this metric is larger than one, it means the lengthy quantity is extra dominant in the meanwhile. Such a pattern means that the final sentiment is bullish proper now.

Related Reading | Bitcoin Long-Term Holder Capitulation Approaching Bottom Zone, But Not Quite There Yet

On the opposite hand, the indicator’s worth being lower than that means that the promoting strain is at present stronger than the shopping for strain within the Bitcoin market.

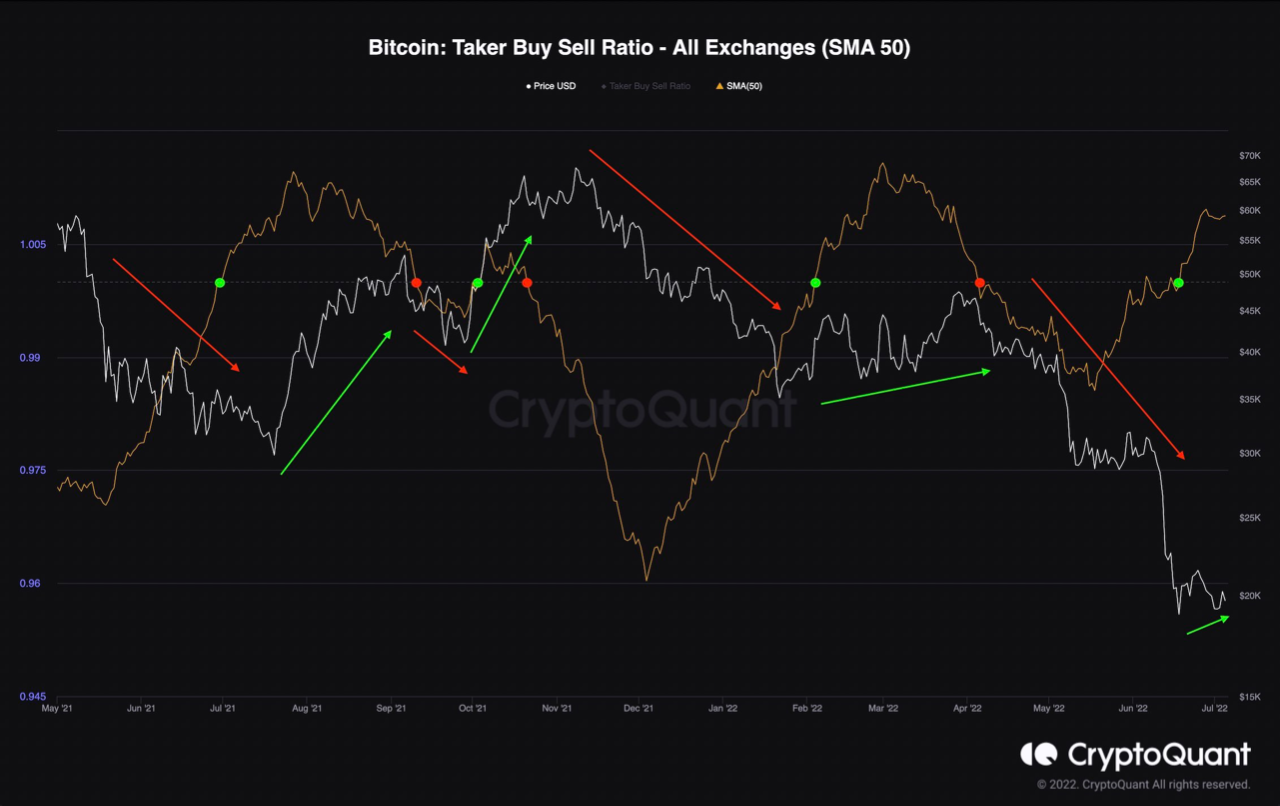

Now, here’s a chart that reveals the pattern within the BTC 50-day shifting common taker purchase/promote ratio during the last yr:

Looks like the worth of the metric has surged up in latest weeks | Source: CryptoQuant

As you may see within the above graph, the quant has marked the related factors of pattern for the Bitcoin taker purchase/promote ratio.

It looks like at any time when the indicator has sunk beneath a worth of 1, the coin’s worth has noticed a bearish pattern quickly after.

Related Reading | Experts Are Calling Out That Bitcoin Is Dead. Projects Like Gnox (GNOX) And Fantom (FTM) Ushering In New Age Of Crypto.

Similarly, the ratio crossing over the one line has often been adopted by a bullish reversal or sideways motion for the crypto.

In latest weeks, the taker purchase/promote ratio’s worth has as soon as once more noticed a surge and has now gone previous the “one” threshold.

If the previous pattern is something to go by, this might imply that Bitcoin might have both a brief bullish reversal or sideways motion in retailer for the close to future.

BTC Price

At the time of writing, Bitcoin’s price floats round $20.5k, up 2% within the final seven days. Over the previous month, the crypto has misplaced 31% in worth.

The beneath chart reveals the pattern within the worth of the coin during the last 5 days.

The worth of the crypto appears to have shot up over the previous day | Source: BTCUSD on TradingView

Over the previous few days, Bitcoin has been principally consolidating sideways. However, previously twenty-four hours or so, the coin’s worth appears to have gained some upwards momentum because it now breaks above the $20k mark once more.

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link