[ad_1]

Bitcoin has been shifting sideways round its present ranges with no clear route on decrease timeframes. The cryptocurrency has skilled its worst-selling strain in years however has held firmly round its 2017 all-time excessive.

Related Reading | Crypto Trading Volumes In India Sink Due To Heavy Taxation, What’s Ahead?

At the time of writing, Bitcoin trades at $20,140 with a 4% revenue within the final 24 hours. The common sentiment available in the market has been turning extra constructive, as NewsBTC reported yesterday, because the Crypto Fear and Greed Index climbs again from Extreme Fear ranges.

According to Senior Commodity Strategist Mike McGlone, Bitcoin and the crypto market are close to their 2018 drawdown ranges. At that point, the nascent asset class skilled an analogous bearish pattern which pushed BTC’s worth to a 75% loss from its ATH.

At that point, the $3,000 worth level turned a significant backside which noticed a interval of accumulation extending for a number of years. In 2020, when international markets had been in turmoil as a result of COVID-19 pandemic, BTC marked the underside as soon as extra when close to $3,000.

After that, the cryptocurrency started a brand new ascend into worth discovery. This time macro-economic circumstances are totally different, and Bitcoin may retest its yearly low of round $17,000, however McGlone suggests it has reached a degree the place long-term holders may revenue within the second half of 2022:

(…) the Bloomberg Galaxy Crypto Index nearing an analogous drawdown because the 2018 backside and Bitcoin’s low cost to its 50- and 100-week shifting averages much like previous foundations, we see danger vs. reward tilting towards responsive buyers in 2H.

Since its inception, BTC’s worth has traditionally discovered a backside round earlier all-time highs. McGlone claims there are circumstances for $20,000 to function as this pivot assist stage in 2022 on the again of a decline in “risk measures” in opposition to the standard market.

Bitcoin at $20,000 could also be appeared again upon like $2 in 2011, $200 in 2015 and $3,000 in 2018. Bitcoin and Ether danger measures are falling vs. equities and the potential for US regulation (Lummis-Gillibrand crypto plan) reveals mainstream maturation.

Bitcoin Short Term Outlook Show Improvement?

On decrease timeframes, Bitcoin has been capable of keep above $20,000 regardless of the decline in conventional markets and the power of the U.S. greenback. The U.S. foreign money is approaching a 20-year-old excessive as buyers proceed to de-risk amid present macroeconomic circumstances.

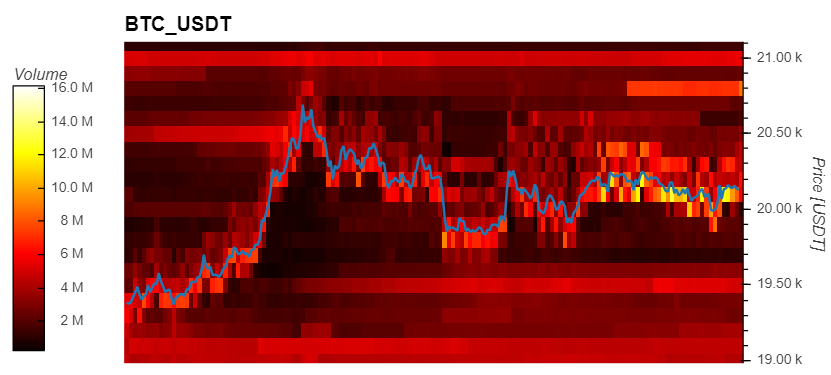

Data from Material Indicators (MI) data round $20 million in bid orders for BTC’s worth from $20,000 to $19,000. These ranges ought to function as assist in case of additional draw back as BTC whales proceed to build up.

Related Reading | TA: Bitcoin Faces Another Rejection, Can Bulls Save The Day

Larger BTC buyers have been shopping for into the cryptocurrency’s worth motion over the previous week. Addresses with 100 to 100,000 BTC added 30,000 BTC over this era.

In the previous week, addresses with 100 to 10,000 $BTC added roughly 30,000 #BTC to their holdings whereas 40,000 #Bitcoin had been withdrawn from identified #cryptocurrency change wallets. pic.twitter.com/vRC7cJYvbZ

— Ali Martinez (@ali_charts) July 4, 2022

[ad_2]

Source link