[ad_1]

On-chain knowledge reveals the Bitcoin leverage ratio nonetheless has a really excessive worth, an indication that has often confirmed to be bearish for the crypto in latest months.

Bitcoin Exchange Leverage Ratio Has Been Going Up In Recent Weeks

As identified by an analyst in a CryptoQuant post, the BTC all exchanges leverage ratio remains to be fairly excessive, suggesting that the crypto might nonetheless see additional downtrend.

The “leverage ratio” is an indicator that’s outlined because the ratio between the open curiosity and the all derivatives alternate reserve.

Here, the “open interest” is a measure of the entire quantity of Bitcoin futures positions presently open within the derivatives market.

And the “derivatives exchange reserve” is simply the entire variety of cash presently saved in wallets of all derivatives exchanges.

What the leverage ratio tells us is how a lot leverage customers are taking up common within the BTC futures market proper now.

When the worth of this indicator is excessive, it means customers are taking a considerable amount of threat within the type of leverage for the time being. An extra of leverage often results in greater volatility available in the market.

Related Reading | Bitcoin On-Chain Data: Miners Deposit Big To Derivatives Exchanges

On the opposite hand, decrease values of the ratio can lead to lesser relative volatility within the crypto’s worth since customers aren’t taking a lot threat.

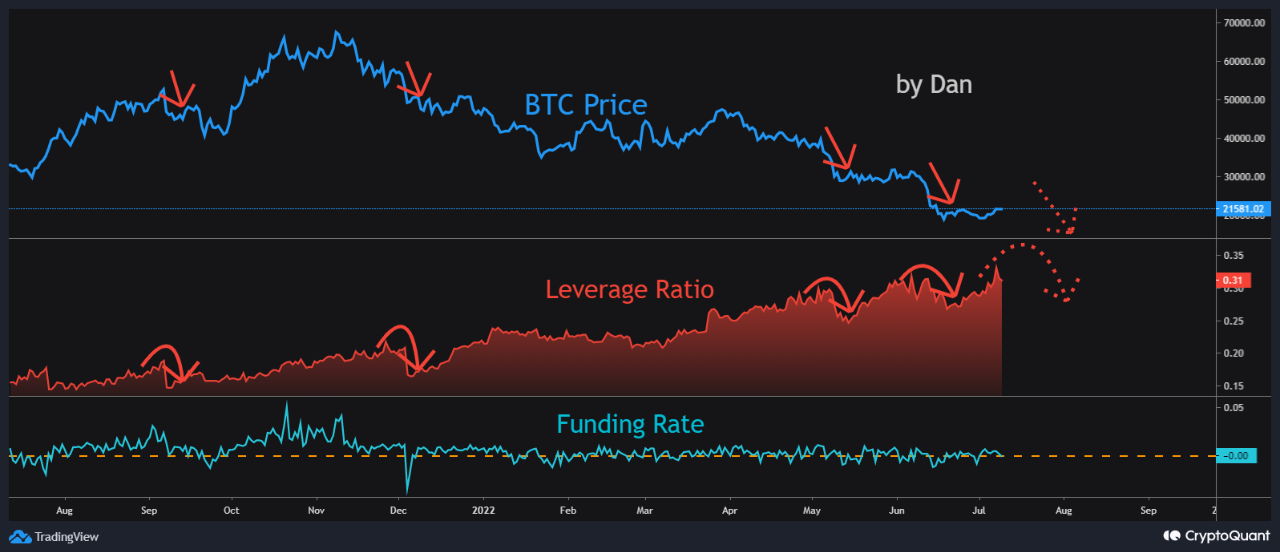

Now, here’s a chart that reveals the pattern within the Bitcoin all exchanges leverage ratio over the past 12 months:

The worth of the metric appears to have been fairly excessive in latest days | Source: CryptoQuant

As you’ll be able to see within the above graph, at any time when the Bitcoin leverage ratio has hit a steep worth over the last a number of months, each the indicator and the coin’s worth has subsequently plunged down.

Mass leverage flushes like these are known as “liquidation squeezes.” During such occasions, liquidations cascade collectively and amplify the value transfer that triggered the squeeze.

Related Reading | Why Bitcoin Is Undervalued According To This Expert’s “Conservative” Model

Since the value moved in the identical course because the squeeze in these cases, they had been all examples of a “long squeeze.”

It seems just like the ratio’s worth is as soon as once more excessive proper now. If the same pattern as in the previous few months follows this time as effectively, then a protracted squeeze could also be coming quickly and taking Bitcoin in for an additional plummet.

BTC Price

At the time of writing, Bitcoin’s price floats round $20.5k, up 4% within the final week. Over the previous month, the crypto has misplaced 30% in worth.

Looks like the worth of the crypto has been taking place over the previous few days | Source: BTCUSD on TradingView

Featured picture from mana5280 on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link