[ad_1]

On-chain knowledge exhibits the Bitcoin taker purchase/promote ratio began displaying a inexperienced sign shortly earlier than the surge above $22k.

Bitcoin Taker Buy/Sell Ratio Is Now Showing a “Buy” Signal

As identified by an analyst in a CryptoQuant post, the BTC taker purchase/promote ratio instructed a bounce not too lengthy earlier than the rally right this moment.

The “taker buy/sell ratio” is an indicator that measures the ratio between the Bitcoin lengthy and quick volumes within the futures market.

When the worth of this metric is bigger than one, it means the taker purchase quantity is at the moment greater than the taker promote quantity. Such a development exhibits a bullish sentiment is dominant out there proper now.

Related Reading | On-Chain Data Shows Bitcoin Miners May Be Preparing To Dump

On the opposite hand, values of the ratio lower than one suggest the quick quantity is at the moment overwhelming the lengthy quantity, and thus the bulk sentiment is bearish in the intervening time.

The related indicators right here are literally the 15-day and 40-day moving averages (MAs) of the taker purchase/promote ratio, and never the metric’s each day values.

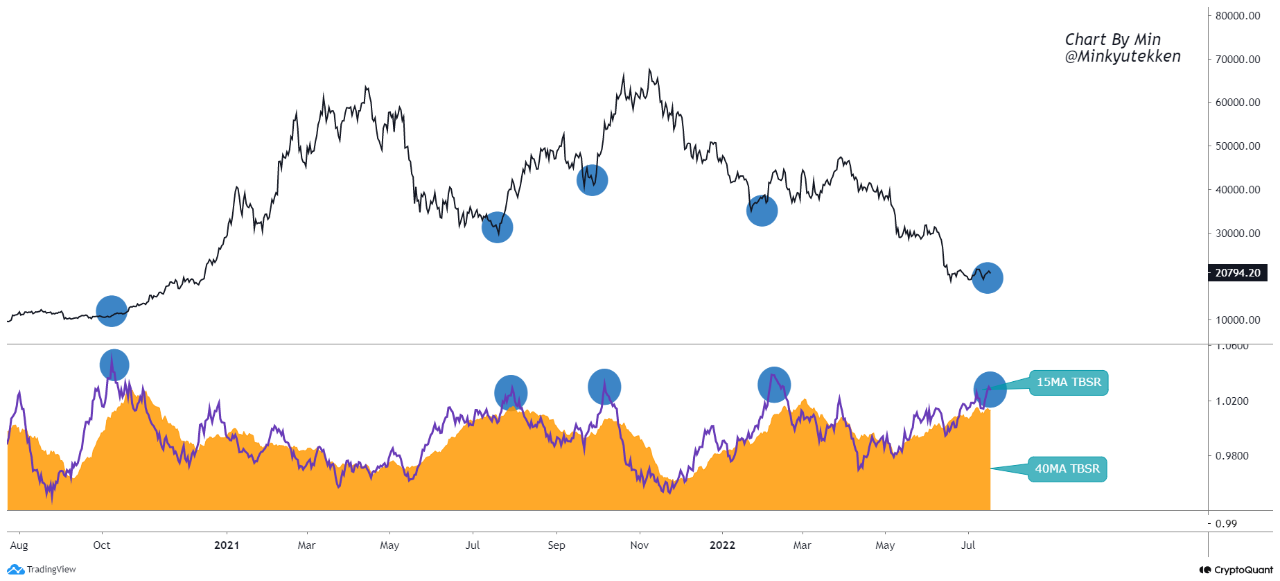

The under chart exhibits the development in these taker purchase/promote ratio MAs for Bitcoin over the previous couple of years.

The worth of the 15-day MA appears to have surged up in current days | Source: CryptoQuant

In the above graph, the quant has marked the areas of the related development for these Bitcoin taker purchase/promote ratio MAs.

It appears like at any time when the the 15-day MA has hit a excessive above the one mark whereas additionally staying at a better worth than the 40-day MA, the value of the crypto has noticed a bounce shortly after.

Related Reading | Uniglo (GLO) Brings Forth Fractionalized Asset Ownership, Overshadowing Bitcoin (BTC), Ethereum (ETH), and Cardano (ADA)

Recently, each the 15-day and 40-day MAs have proven some development, with the previous seeing a steeper increase. This implies that the sample from the previous has once more fashioned now.

If the development from these earlier cases repeats this time as effectively, then Bitcoin may probably observe some bullish momentum.

In reality, for the reason that time the analyst posted the chart, BTC has already seen some sharp uptrend as the worth of the coin has now damaged above the $22k stage.

BTC Price

At the time of writing, Bitcoin’s price floats round $22k, up 9% within the final seven days. Over the previous month, the crypto has amassed 7% in good points.

The under chart exhibits the development within the worth of the coin over the past 5 days.

Looks like the worth of the crypto has sharply shot up over the past twenty-four hours | Source: BTCUSD on TradingView

Featured picture from André François McKenzie on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link