[ad_1]

On-chain knowledge exhibits round 800k ETH has exited wallets of the crypto trade Gemini, an indication that would show to be bullish for Ethereum.

Crypto Exchange Gemini Observes outflows Of 800k ETH

As identified by an analyst in a CryptoQuant post, the Ethereum trade reserve has plunged right down to lows not seen since 2018.

The “all exchanges reserve” is an indicator that measures the whole quantity of Ethereum at the moment saved on wallets of all centralized exchanges.

When the worth of this metric goes down, it means the variety of cash on exchanges are taking place. Such a development, when extended, could be a signal of accumulation from traders, and therefore might be bullish for the value of the crypto.

Related Reading | Bitcoin NUPL Shows Average Holder Back In Profit, But For How Long?

On the opposite hand, a rise within the reserve implies customers are depositing their cash proper now. Since traders normally switch to exchanges for promoting functions, this sort of development can have bearish penalties for ETH.

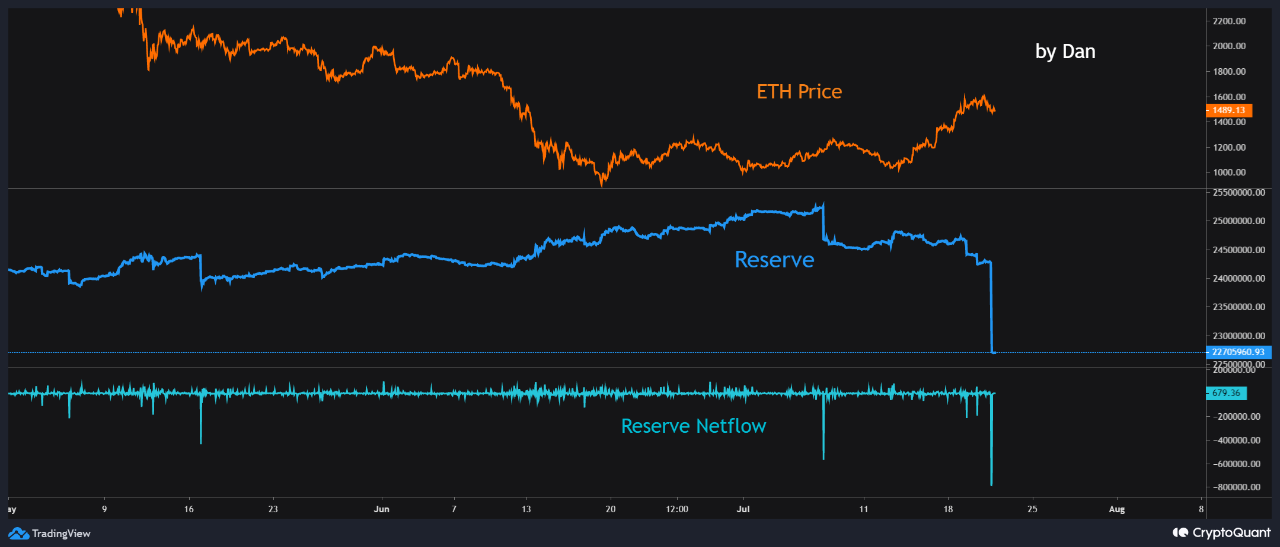

Now, here’s a chart that exhibits the development within the Ethereum all exchanges reserve over the past couple of months:

The worth of the indicator appears to have plummeted down over the previous 24 hours | Source: CryptoQuant

As you’ll be able to see within the above graph, the Ethereum trade reserve has noticed a crash within the final day as a lot of cash have been withdrawn.

The chart additionally consists of knowledge for the “netflow,” which tells us concerning the quantity of ETH coming into or exiting trade wallets (or extra merely, it measures the adjustments within the trade reserve). Its worth is calculated by taking the distinction between the inflows and the outflows.

Related Reading | Short Positions Over $165 Million Get Liquidated Following The Bitcoin And Ethereum Uptrend

This indicator has proven an enormous destructive spike not too long ago, a development which is smart given the trade reserve has plunged down.

The quant notes that these withdrawals passed off on the crypto trade Gemini and amounted to round 800k ETH.

Gemini is popularly identified for use by whales. In the previous, transfers to and from the trade have normally had a noticeable influence in the marketplace.

As such, such a lot of cash exiting from the trade can imply Ethereum’s close to time period outlook is likely to be bullish.

ETH Price

At the time of writing, Ethereum’s price floats round $1.6k, up 13% within the final seven days. Over the previous month, the crypto has gained 45% in worth.

The beneath chart exhibits the development within the worth of the coin over the past 5 days.

Looks like the worth of the crypto has been transferring sideways throughout the previous couple of days | Source: ETHUSD on TradingView

Featured picture from Bastian Riccardi on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link