[ad_1]

On-chain information exhibits Bitcoin alternate inflows from whales holding between 1k to 10k BTC have spiked up just lately, an indication that may be bearish for the worth of the crypto.

Bitcoin Exchange Inflows Spike Up Following Rally Above $24k

As identified by a CryptoQuant post, the BTC whales with between 1k to 10k BTC appear to have despatched a big stack to exchanges just lately.

The “exchange inflow” is an indicator that measures the whole quantity of Bitcoin being transferred to wallets of all centralized exchanges (each spot and derivatives).

When the worth of this metric spikes up, it means numerous cash are being deposited to exchanges proper now. Depending on what number of of those are being moved to identify exchanges, such a pattern will be bearish for the worth of BTC as buyers often ship to those exchanges for promoting functions.

On the opposite hand, low values of the indicator counsel there’s little promoting occurring available in the market in the meanwhile. Therefore, this sort of pattern will be impartial or bullish for the worth of the coin.

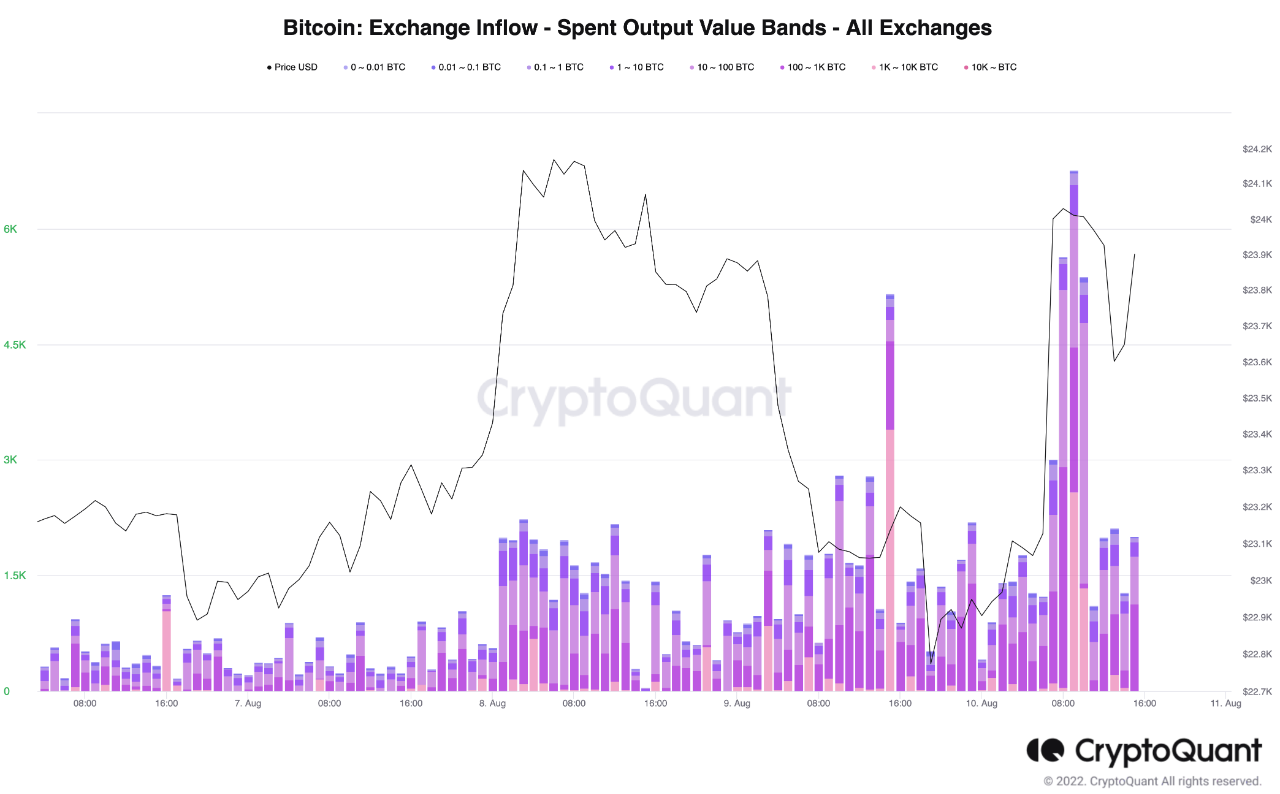

Now, here’s a chart that exhibits the pattern within the Bitcoin all exchanges inflows over the previous couple of days:

The worth of the metric appears to have spiked up just lately | Source: CryptoQuant

As you may see within the above graph, the Bitcoin all exchanges inflows have registered massive values over the last couple of days. The newest spike has come shortly after the BTC value surged above $24k.

The chart truly exhibits a modified model of the indicator, referred to as the “exchange inflow – spent output value bands,” which tells us what contribution to the whole inflows is coming from every of the totally different sized holders available in the market.

It appears just like the buyers holding 1k to 10k BTC had an particularly massive motion to exchanges within the final two days. Holders belonging to this group are the whales, so the present pattern can counsel whales could also be planning to dump proper now.

However, as talked about earlier, the indicator takes under consideration inflows for each spot and derivatives exchanges. A big a part of the most recent inflows went to the derivatives exchanges, which suggests whales might have been hedging in opposition to their spot positions.

Nonetheless, a sizeable a part of the whole inflows did go to identify exchanges, so some promoting should be occurring available in the market from these whales.

BTC Price

At the time of writing, Bitcoin’s price floats round $23.8k, up 2% up to now week.

Looks like the worth of the crypto has come down throughout the previous day | Source: BTCUSD on TradingView

Featured picture from Thomas Bonometti on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link