[ad_1]

Ethereum has skilled a gentle setback after breaking the vital barrier at $2,000 and continues to commerce within the inexperienced over at this time’s buying and selling session. The cryptocurrency is main the present crypto market aid and sees poised for additional beneficial properties.

At the time of writing, Ethereum (ETH) trades at $1,980 with a 6% and 15% revenue during the last 24 hours and seven days, respectively. Only Solana (SOL), and Cardano (ADA) come shut to ETH’s worth beneficial properties with double digits earnings over the identical interval.

Trading agency QCP Capital believes the bullish momentum is on observe to lengthen on the again of optimistic macro-economic elements. The crypto aid rally took off final week when the U.S. printed the Consumer Price Index (CPI) July print, a measure of inflation within the greenback.

The metric stood at round 8.5% and, as QCP Capital mentioned, “confirms the peak inflation narrative”. Thus, market members count on a much less aggressive Federal Reserve (Fed) as inflation seems to be trending down. The buying and selling desk said:

This has led to the market pricing a extra dovish Fed, creating bullish momentum that’s possible to proceed till the following FOMC assembly on 22 September.

In the approaching weeks, there are different macro-economic occasions that would negatively impression market members’ perceptions concerning the Fed. However, QCP Capital believes the market will “remain supported regardless”.

For the worth of Ethereum, the bullish narrative is double as there’s a tentative date for the mainnet implementation of “The Merge”, the occasion that can full ETH transition to a Proof-of-Stake (PoS) consensus. The occasion is anticipated to happen between September 15 to 16.

This has led to an “unprecedented” shift within the crypto choices markets, the overall open curiosity (OI) for ETH contracts has overshadowed Bitcoin (BTC) open curiosity. The former stands at $8 billion and the latter at $5 billion.

What Could Become An Obstacle For Ethereum’s Bullish Momentum

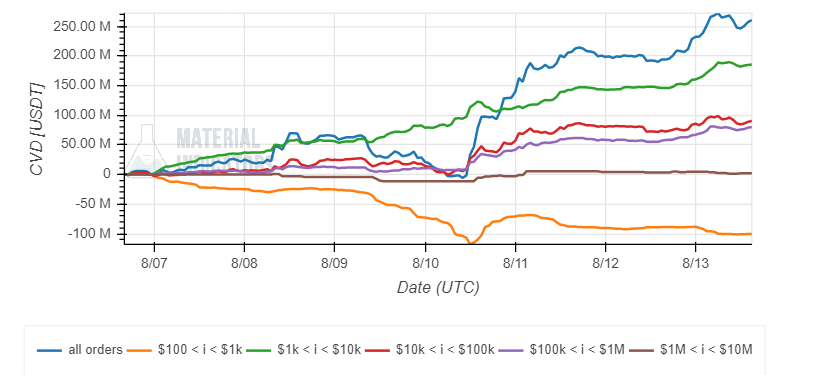

The above may counsel market members are shopping for name (purchase) choices for Ethereum heading into “The Merge”, relying on the occasion to achieve success. In the spot market, knowledge from Material Indicators exhibits that traders with bid orders from $1,000 to $100,000 have been shopping for into ETH’s worth motion during the last week.

If giant traders proceed to assist Ethereum, the bullish momentum might maintain, as QCP Capital expects. However, Bitcoin ought to see extra upward strain to assist any long-term bullish worth motion, as NewsBTC beforehand reported.

Additional knowledge supplied by Material Indicators information skinny resistance for ETH’s worth, on low timeframes, north of $2,050. If bulls can push the worth past these ranges, ETH might reclaim its earlier highs and switch important resistance into assist.

[ad_2]

Source link