[ad_1]

Data exhibits the Bitcoin miner reserves have continued to pattern downwards lately, suggesting that miners have been dumping their cash.

Bitcoin Miners Have Been Withdrawing From Their Wallets In Recent Days

As identified by an analyst in a CryptoQuant post, BTC miner reserves have been observing adverse change lately, one thing that would result in a decline within the worth of the crypto.

The “miner reserves” is an indicator that measures the full quantity of Bitcoin presently current within the wallets of all miners.

When the worth of this metric goes up, it means miners are depositing extra cash into their wallets proper now. Such a pattern, when extended, may be bullish for the worth of BTC as it may be an indication of accumulation from these community validators.

On the opposite hand, a decline within the indicator implies miners are transferring cash out of their reserves in the meanwhile. Since miners often take out their BTC for promoting functions, this type of pattern can show to be bearish for the crypto.

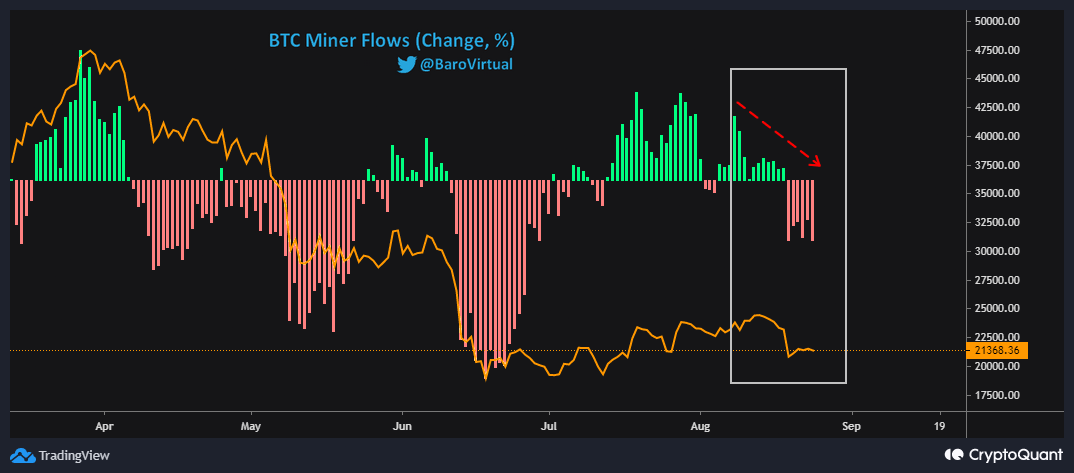

Now, here’s a chart that exhibits the pattern within the Bitcoin miner netflows, a metric that information the proportion adjustments within the complete miner reserves, over the previous couple of months:

Looks just like the indicator has seen adverse adjustments in current days | Source: CryptoQuant

Negative miner netflows counsel the reserves are taking place, whereas constructive values imply they’re registering a rise.

As you’ll be able to see within the above graph, the worth of this BTC indicator had been above zero earlier within the month, however lately it has been underwater.

This might trace that these miners have been dumping in current days. As is clear from the chart, each time the reserve has seen adverse adjustments in the previous couple of months, the BTC worth has taken a success.

This time as effectively the worth of Bitcoin has recorded a decline whereas these newest crimson values of the miner reserve have endured. It’s doable that if miners proceed their pattern of dumping, then the crypto could observe additional drawdown, no less than within the brief time period.

BTC Price

At the time of writing, Bitcoin’s price floats round $21.4k, down 8% within the final seven days. Over the previous month, the crypto has misplaced 4% in worth.

The under chart exhibits the pattern within the worth of the coin during the last 5 days.

The worth of the crypto has been principally shifting sideways in the previous couple of days for the reason that plunge | Source: BTCUSD on TradingView

Featured picture from Joshua J. Cotten on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link