[ad_1]

Decentralized finance (DeFi) tokens have all the time adopted the motion of Ethereum carefully. This is why every time the digital asset has been on the rise, the costs of different DeFi tokens have grown quickly too. This is the case now because the crypto market has entered one other restoration pattern. Bitcoin has as soon as extra settled above $20,000, triggering one other reduction rally for the crypto market.

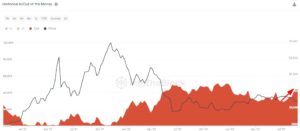

Ethereum Breaks Above $1,500

The worth of Ethereum has gone on one other run that has seen it break above $1,500. The final week has seen the worth of the digital asset decline considerably. Eventually, it had fallen to $1,420, the bottom level to this point in August.

This restoration has put it nicely above the 50-day transferring common, cementing a bullish pattern for the digital asset within the brief time period. Additionally, Ethereum has been one of many solely few cryptocurrencies within the house that has been in a position to flip round its sell-off tendencies as demand grows for it.

The impending ‘Merge’ has additionally been an enormous issue within the restoration of ETH’s worth over the previous couple of months. Although a superb portion of the hype has died down throughout this time, ETH continues to be propped up by the demand that got here with the announcement.

As it stands, ETH has regained help simply above $1,500 and faces actual resistance at round $1,600. If momentum continues, ETH is prone to take a look at this level earlier than the buying and selling day is over.

DeFi Tokens Follow Suit

Ethereum’s restoration has additionally triggered a restoration within the costs of different DeFi tokens. The main good contract platform has rallied nearly 10% within the final 24 hours, dragging the remainder of the DeFi market with it.

Going down the record, BNB has adopted with a 5.75% achieve this time. Interestingly, it’s not the best when it comes to positive factors. That title belongs to Avalanche, which has added 13.19% within the final 24 hours to interrupt above the $20 worth level.

Others embrace Cardano with 4.68% positive factors, Polkadot with 5.39% positive factors, and Solana with 7.55% positive factors. Polygon had gotten to a reasonably good level when it comes to worth, too, in latest weeks and is without doubt one of the solely few digital property exhibiting inexperienced on the 24-hour and 7-day charts.

DeFi TVL has not grown much despite this, though. In the previous day, it’s up $2 billion to be sitting on the $60 billion mark. This accounts for a 3.77% development within the final 24 hours.

Featured picture from Finance Magnates, chart from TradingView.com

Follow Best Owie on Twitter for market insights, updates, and the occasional humorous tweet…

[ad_2]

Source link