[ad_1]

On-chain information reveals Bitcoin miners have moved round 4.4k BTC to Binance, one thing that will show to be bearish for the worth of the crypto.

Bitcoin Miner To Exchange Flow Has Spiked Up Over The Past Day

As identified by an analyst in a CryptoQuant post, the latest transaction appears to have come from the Poolin mining pool.

The related indicator right here is the “miner to exchange flow,” which measures the overall quantity of cash transferring from wallets of all miners to all exchanges.

When the worth of this metric is excessive, it means miners are sending a lot of cash to centralized exchanges proper now.

Since miners often switch their BTC to exchanges for promoting functions, this sort of pattern is usually a sign of dumping from these chain validators. And thus, it may lead to a bearish consequence for the crypto’s value.

On the opposite hand, low values of the indicator indicate these chain validators aren’t sending that a lot BTC to exchanges for the time being.

Such a pattern can point out miners aren’t placing that a lot promoting strain available on the market proper now, and may due to this fact have an both impartial or bullish affect on the worth of the coin, relying on different circumstances.

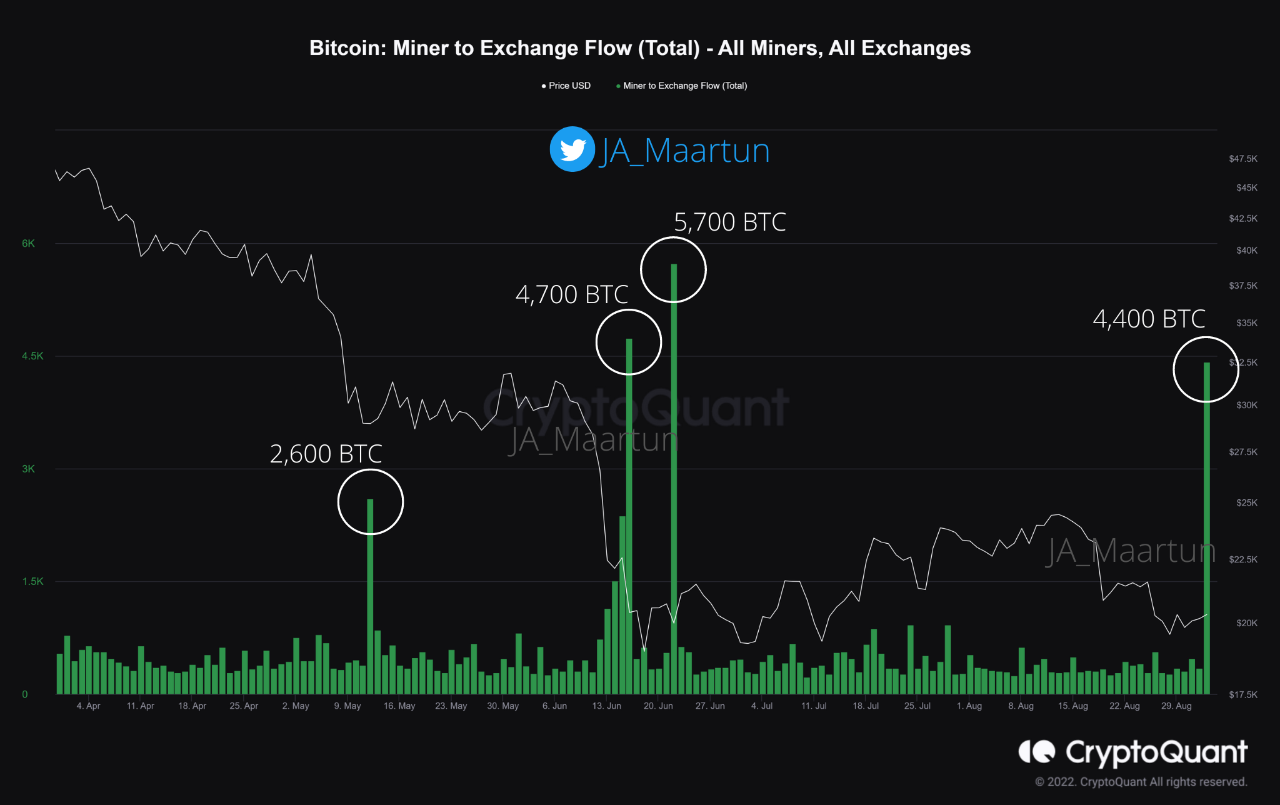

Now, here’s a chart that reveals the pattern within the Bitcoin miner to alternate move over the previous couple of months:

The worth of the metric appears to have been fairly excessive lately | Source: CryptoQuant

As you’ll be able to see within the above graph, the Bitcoin miner to alternate move noticed a big spike through the previous day.

The transaction, which amounted to round 4.4k BTC in complete, got here from miner wallets related to the mining pool Poolin, and was despatched to the crypto alternate Binance.

During the previous couple of months, there have additionally been three different situations of the miners sending cash from their reserve to exchanges. Each of those additionally occurred to come round declines within the crypto’s value.

If the most recent miner to alternate move has certainly occurred with the intention to promote, then this spike may be bearish for the worth of the crypto.

BTC Price

At the time of writing, Bitcoin’s price floats round $20.3k, down 2% within the final seven days. Over the previous month, the crypto has misplaced 13% in worth.

The beneath chart reveals the pattern within the value of the coin during the last 5 days.

Looks like the worth of the crypto has been transferring sideways through the previous few days | Source: BTCUSD on TradingView

Featured picture from Marc-Olivier Jodoin on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link