[ad_1]

The Bitcoin worth is hanging by a thread because it retraces its positive aspects from yesterday’s buying and selling session. Once once more, macroeconomic forces appear to be taking up the worth motion because the primary cryptocurrency by market capitalization appears into the abyss of a possible recent leg down.

At the time of writing, Bitcoin worth trades at $19,077 with a 5% loss and a 1% revenue within the final 7 days and 24 hours, respectively. BTC is taking a look at two potential assist ranges briefly timeframes to forestall additional draw back.

Bitcoin Price Reacts Bearish To ECB Interest Rates Hikes

Today was poised to be a risky day because the Chairmans of two of the world’s largest central banks, the European Central Bank (ECB) led by Cristine Lagarde and the U.S. Federal Reserve (Fed) led by Jerome Powell, made necessary bulletins.

The ECB announced a 75-basis level rate of interest hike, the most important in its historical past. In the approaching months, the monetary establishment will proceed to hike as they purpose to “dampen demand and guard against the risk of a persistent upward shift in inflation expectations”.

In addition to stopping inflation, the identical goal because the U.S. Fed, the ECB is trying to gradual the Euro from crashing towards the U.S. greenback. In gentle of the present macroeconomic uncertainty and the spike in international vitality, folks have been fleeting to the greenback.

This has led to a crash within the European forex, legacy monetary markets, the Bitcoin worth, and crypto markets. As Lagarde announced their measures, the Euro noticed a small spike which may trace at a optimistic notion from the market.

through Twitter

Sell Liquidity Increases, Can Bitcoin Overcome It?

Both Lagarde and Powell agreed that the quick time period is hinting at extra ache for the monetary world. Initially, the Bitcoin worth reacted to the draw back however remains to be sitting at important assist and may be capable of bounce from $19,000.

This stage and $18,600 are working as key assist and bulls should preserve them to forestall additional draw back. As NewsBTC reported yesterday, it’s important that bulls reclaim higher ranges at $19,000 and north of $20,500.

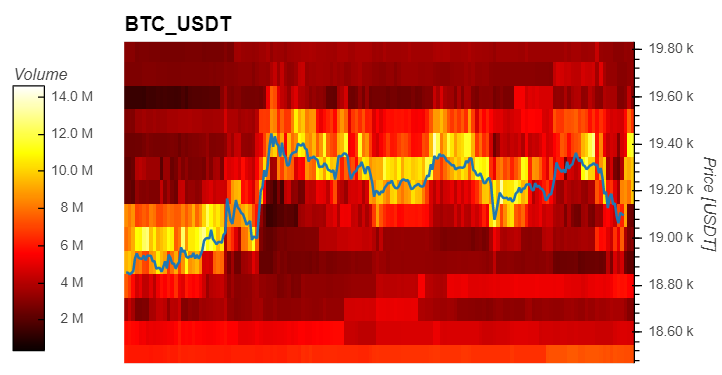

However, information from Material Indicators hints at short-term headwinds because the Bitcoin orderbook is seeing a spike in ask (promote) liquidity. $19,400 looks as if important low timeframe overhead resistance with round $10 million in ask orders.

[ad_2]

Source link