[ad_1]

In this episode of NewsBTC’s daily technical analysis videos, we examine Bitcoin value motion with Wyckoff accumulation schematics, value cycles and extra.

Take a have a look at the video under:

VIDEO: Bitcoin Price Analysis (BTCUSD): September 8, 2022

This video supplies an in depth have a look at Bitcoin market cycles utilizing Wyckoff theory and different cyclical instruments.

Is The Composite Man Behind Bitcoin Mark Down?

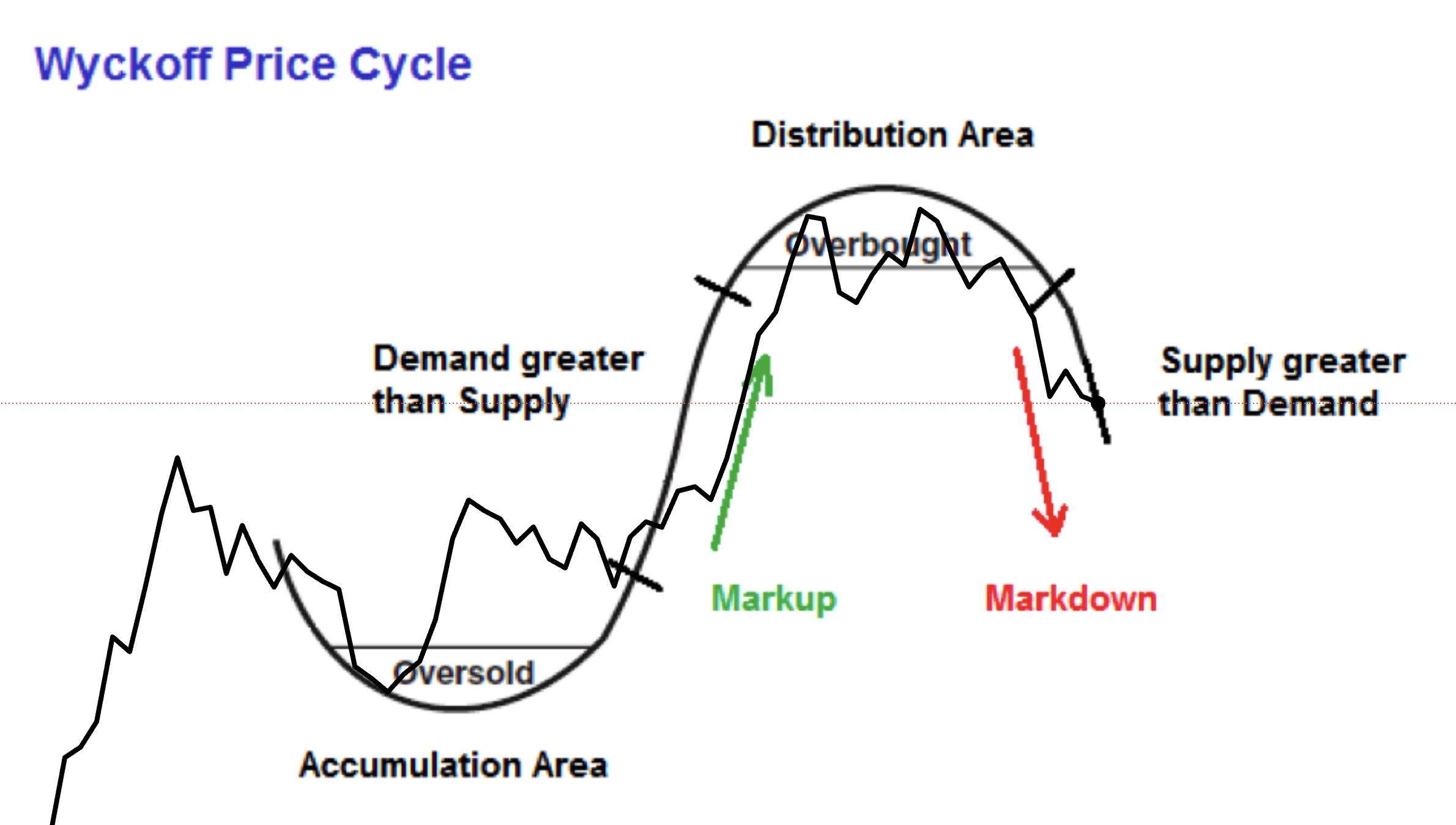

Wyckoff principle is predicated on the concept retail merchants are often outsmarted by massive operators he known as the Composite Man. It can be recognized for its phases of accumulation and distribution, and the mark up and mark down phases that happen in between because the market goes by means of bullish and bearish cycles.

The current value motion continues to comply with what seems to be lots like Wyckoff accumulation. After breaching preliminary help, value reached the promoting climax at $17,500. What we doubtlessly simply noticed this week was a secondary check in part B. that’s the excellent news. The dangerous information is that there could possibly be a very long time till we see excessive costs once more.

A comparability with an Wyckoff accumulation schematic | Source: BTCUSD on TradingView.com

How A Spring Could Put An End To Crypto Winter

That was additionally simply certainly one of Wyckoff’s accumulation schematics. Another schematic instance features a last shakeout referred to as a spring. Based on the schematic, the spring would happen a while round December and a breakout would happen in April.

This is very notable, as a result of that’s precisely when Bitcoin bottomed in 2018 and when the buildup phases led to 2019. Even extra fascinating, is the truth that December has continuously been a timing issue for tops and bottoms in Bitcoin all all through its historical past.

Will we get a spring or not? | Source: BTCUSD on TradingView.com

Related Reading: WATCH: Ethereum Gains Momentum Ahead Of The Merge | ETHUSD September 6, 2022

Wyckoff, Gann, And Other Technical Analysis Greats

Even the 2017 peak was in December, which we’re at the moment retesting for the umpteenth time. The month of December mysteriously was certainly one of WD Gann’s favourite months to search for tops and bottoms, and it was on account of how the Sun conjuncts Mercury while in Sagittarius.

Gann, like Wykoff was one of many all-time greats. Both are often called two of the 5 titans of finance, which embody with Charles Merrill from Merrill Lynch, Charles Dow from Dow Theory and the Dow Jones Industrial Average, and Ralph Nelson Elliott who created Elliott Wave Theory.

Gann’s methodology was probably the most mystical of all of them. Check out how flawlessly certainly one of his instruments, the Gann fan, referred to as the breakout from the bear market and an unimaginable 500% advance within the instance under.

Gann's instruments are primarily based on geometry, angles, and time | Source: BTCUSD on TradingView.com

What To Make Of The Current BTCUSD Market Cycle

Markets are certainly cyclical, as Wyckoff and the opposite greats believed. The cycle begins with accumulation after an asset turns into oversold. Demand begins to outweigh provide and mark up begins. Then the composite man begins to slowly distribute on retail, earlier than mark down begins and provide outweighs demand.

It sounds easy, however that is simply the way it works. Bases on a visible inspection alone and the way historical past has rhymed previously, we might doubtlessly be in or nearing accumulation and mark up will return quickly sufficient.

Is it virtually time for an additional bull run? | Source: BTCUSD on TradingView.com

Learn crypto technical evaluation your self with the NewsBTC Trading Course. Click here to entry the free academic program.

Follow @TonySpilotroBTC on Twitter or be part of the TonyTradesBTC Telegram for unique day by day market insights and technical evaluation training. Please be aware: Content is academic and shouldn’t be thought-about funding recommendation.

Featured picture from iStockPhoto, Charts from TradingView.com

[ad_2]

Source link