[ad_1]

On-chain knowledge reveals miners have despatched a considerable amount of Bitcoin to identify exchanges lately, one thing that may be bearish for the worth of the crypto.

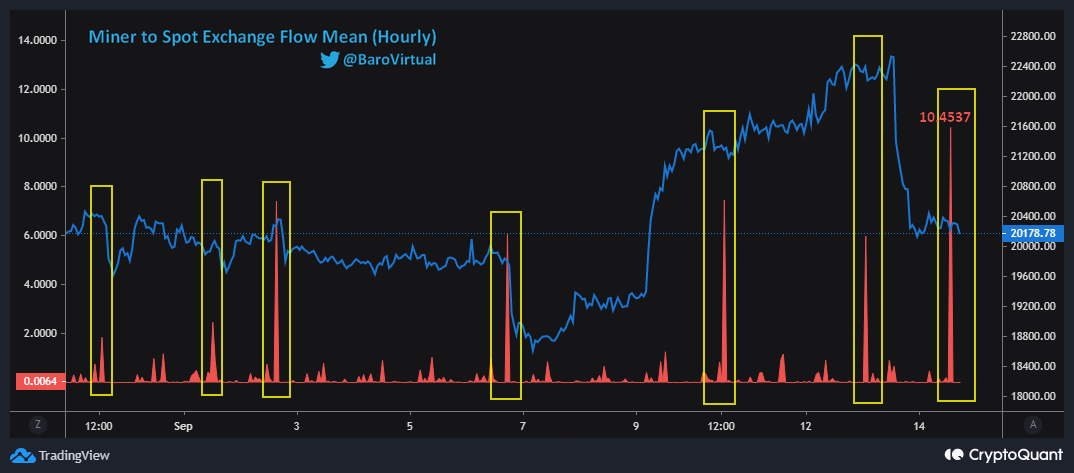

Bitcoin Miners To Spot Exchanges Flow Has Surged Up Over The Past Day

As identified by an analyst in a CryptoQuant post, the newest spike within the miner trade deposits is bigger than some other current peaks.

The related indicator right here is the “miners to spot exchanges flow mean,” which measures the full quantity of Bitcoin being transferred by miners to identify exchanges.

When the worth of this metric shoots up, it means miners have simply despatched a lot of cash to exchanges. Since these chain validators normally deposit to identify markets for promoting functions, this type of pattern can show to be bearish for the worth of BTC.

On the opposite hand, the worth of the indicator being low suggests there aren’t many transactions occurring from miner wallets to centralized trade wallets. Such a pattern could be both impartial or bullish for the worth of the coin because it implies there isn’t a lot promoting strain coming from this cohort proper now.

Now, here’s a chart that reveals the pattern within the Bitcoin miners to identify exchanges stream imply during the last couple of weeks:

The hourly worth of the metric appears to have been fairly excessive in current days | Source: CryptoQuant

As you may see within the above graph, the Bitcoin miners to identify exchanges stream imply has noticed an enormous spike in the course of the previous day.

The final two weeks noticed a number of trade inflows coming from miners, after every of which the worth typically suffered a short-term decline.

This newest improve within the miner spot deposits is considerably bigger than some other seen on this interval, and has come whereas the worth has already plunged down. This is not like the earlier ones, which got here as the worth was round a peak.

If the identical pattern because the earlier miner trade inflows follows this time as properly, then these contemporary deposits are additionally more likely to have a bearish impression on Bitcoin.

BTC Price

At the time of writing, Bitcoin’s price floats round $20.1k, up 4% within the final seven days. Over the previous month, the crypto has misplaced 17% in worth.

Below is a chart that reveals the pattern within the worth of the coin during the last 5 days.

Looks like the worth of the crypto plummeted down a number of days again and has since moved sideways | Source: BTCUSD on TradingView

Featured picture from Brent Jones on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link