[ad_1]

On-chain knowledge reveals promoting from Bitcoin long-term holders might have been behind the latest dip within the crypto’s worth beneath $19k.

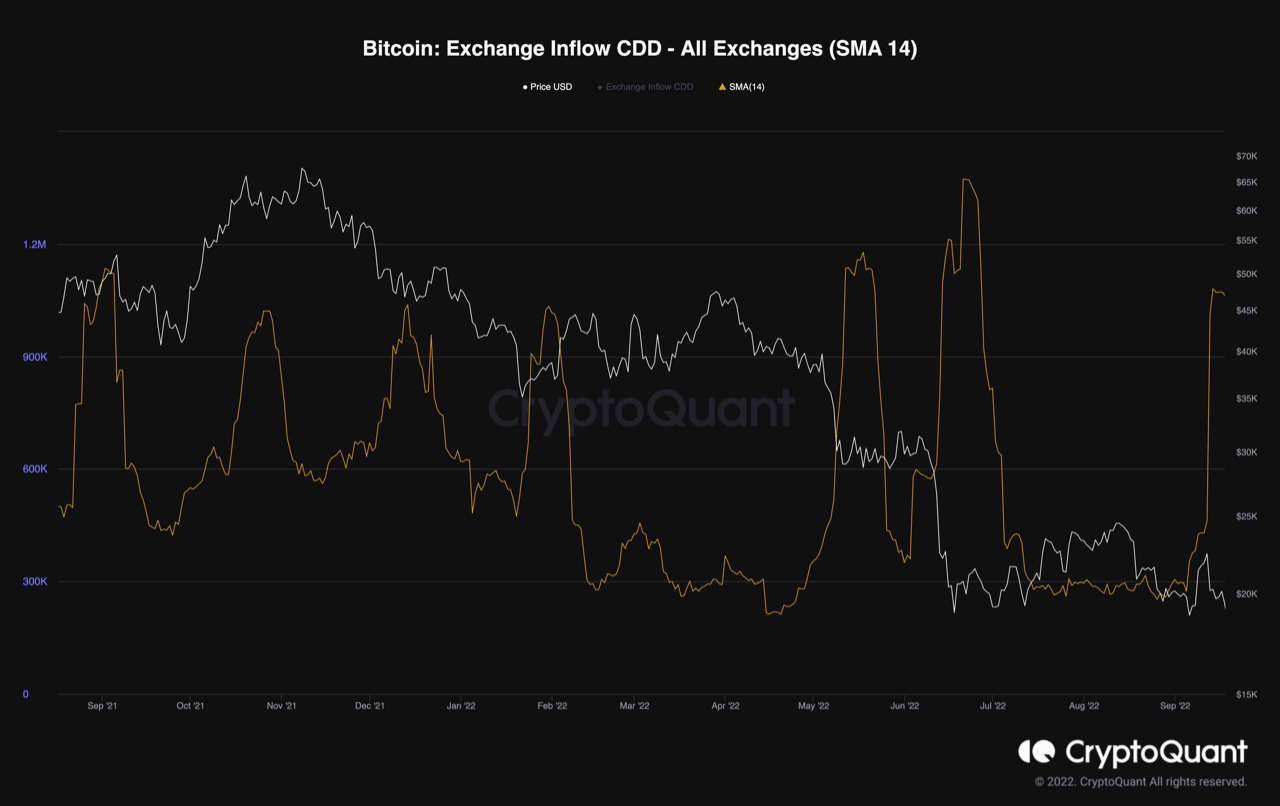

Bitcoin Exchange Inflow CDD Has Recently Observed A Sharp Increase

As identified by an analyst in a CryptoQuant post, there was some attainable promoting stress coming from the long-term holders just lately.

The related indicator right here is the Bitcoin “Coin Days Destroyed” (CDD). A coin day is outlined as the quantity gathered by precisely 1 BTC when sitting idle for 1 full day. The complete variety of coin days available in the market, subsequently, symbolize the sum of time every coin within the provide has been dormant for.

When these cash that had beforehand been sitting nonetheless present some motion, the coin days gained by them are mentioned to be “destroyed” as they reset again to zero. The complete variety of these is exactly what the CDD metric measures.

Now, since long-term holders maintain their cash for lengthy intervals, they naturally accumulate considerably increased coin days than the remainder of the market. As such, spikes within the CDD could be a signal of exercise from this cohort.

Here is a chart that reveals the development within the Bitcoin CDD not for your complete community, however particularly for trade influx transactions:

Looks just like the 14-day shifting common worth of the metric has been fairly excessive in latest days | Source: CryptoQuant

As you may see within the above graph, the Bitcoin trade influx CDD noticed a spike in its 14-day MA worth only in the near past. This means that long-term holders have been making some massive deposits to exchanges over the last week.

In the previous, such spikes within the trade influx CDD have often been bearish for the value of the crypto as these traders often deposit to exchanges for dumping functions.

This time as properly, shortly after the indicator’s values turned raised, BTC noticed a plunge from a neighborhood excessive of round $22.5k.

Following this plummet, nonetheless, the trade influx CDD nonetheless hasn’t gone down a lot and has remained elevated. This may suggest that LTH promoting might have been the trigger behind Bitcoin’s latest transient revisit beneath the $19k degree.

BTC Price

At the time of writing, Bitcoin’s price floats round $19.1k, down 12% within the final week. Over the previous month, the crypto has misplaced 8% in worth.

The beneath chart reveals the development within the worth of the coin over the past 5 days.

The worth of the crypto appears to have already recovered again above $19k | Source: BTCUSD on TradingView

Featured picture from Jason Hillier on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link