[ad_1]

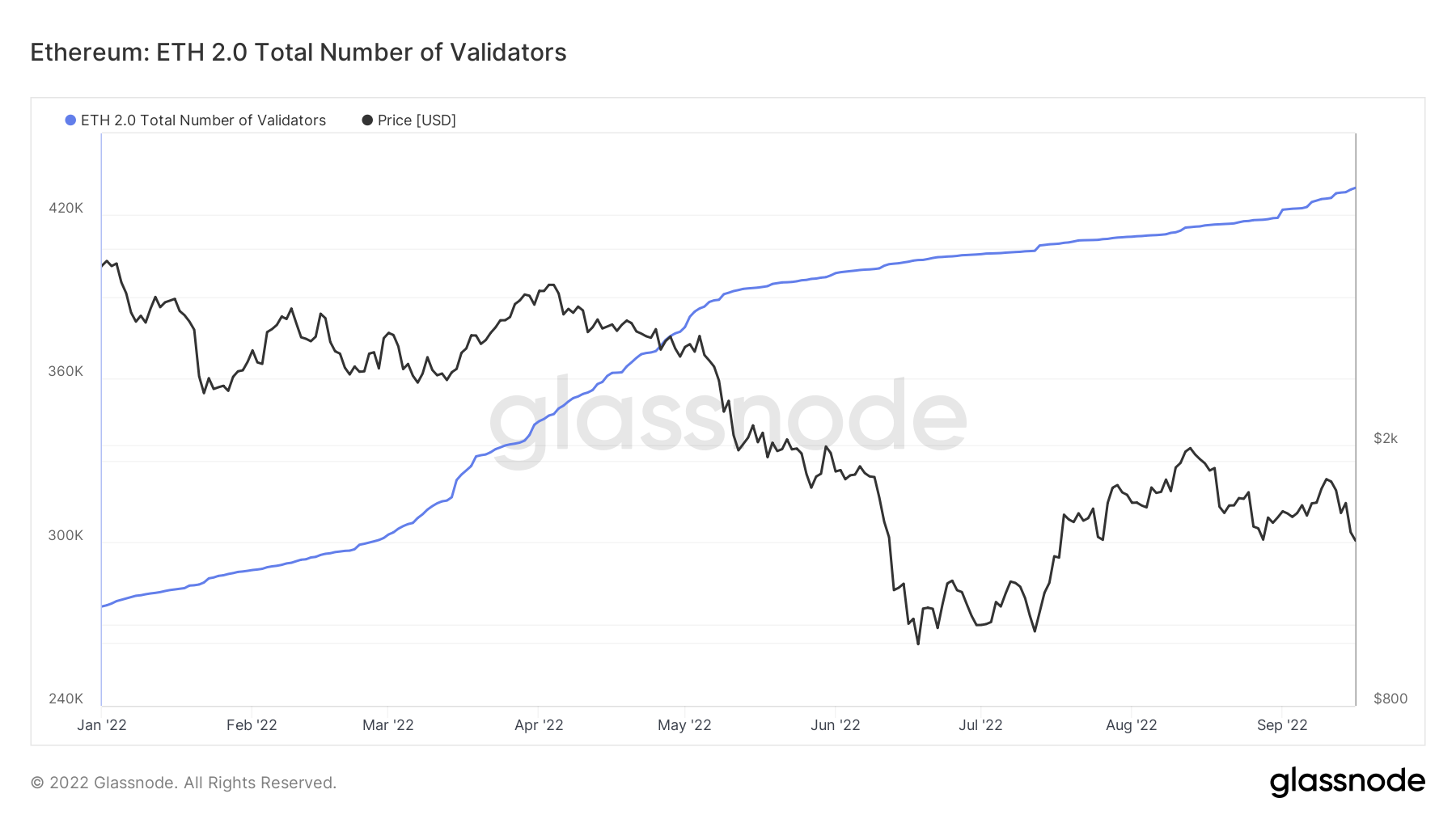

The excellent news for Ethereum buyers is that the Merge got here and went easily, with no hitch. Ethereum is now a Proof-of-Stake blockchain, which means as much as 99.95% decrease vitality consumption.

But it’s not all enjoyable and video games. The drawback of centralisation is one that’s a lot mentioned, however whenever you bounce on-chain and have a look at the statistics, it highlights fairly how a lot of an issue it’s.

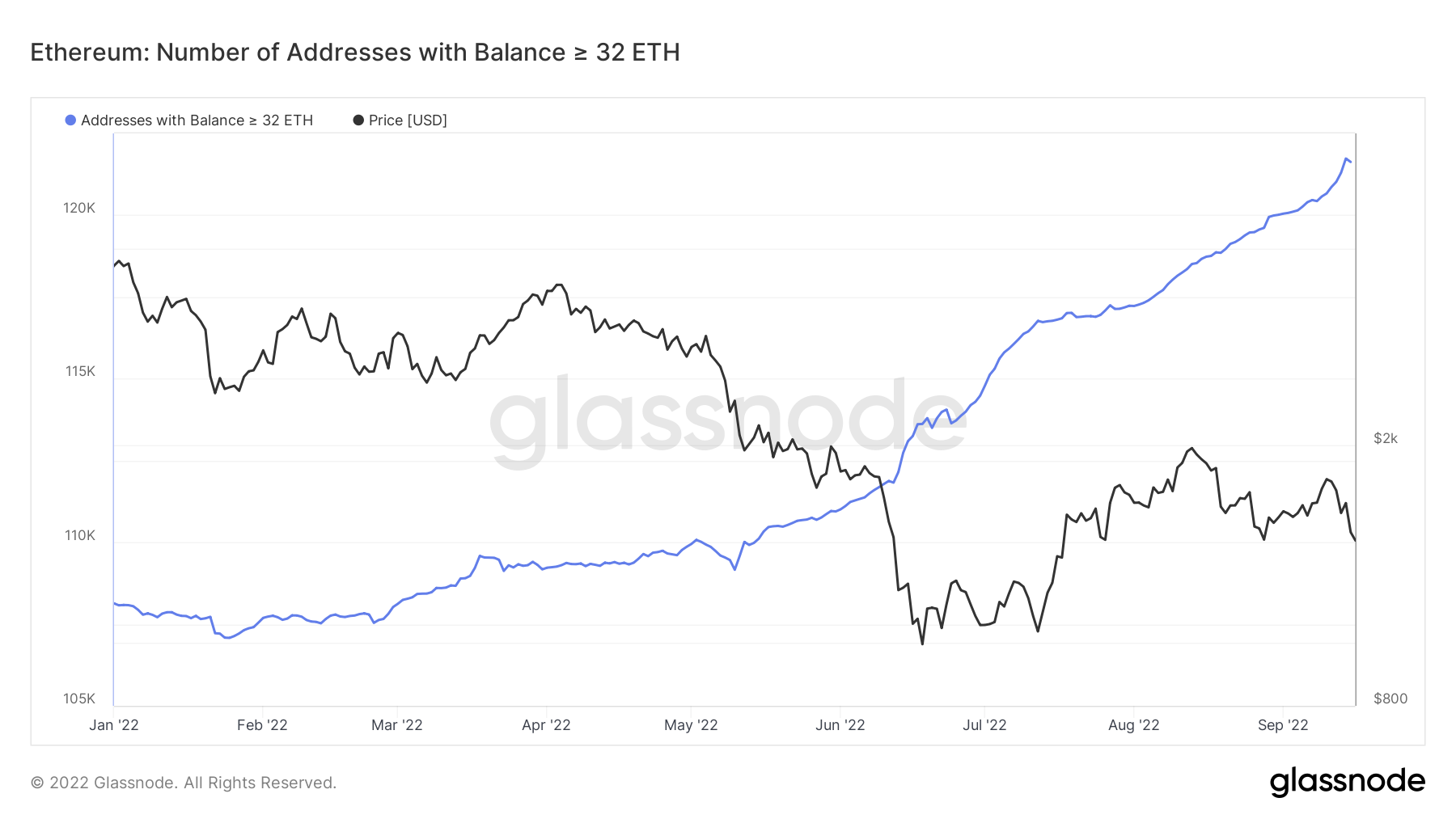

To clarify the problem in primary phrases, to be able to change into a validator on the Ethereum community, now that mining has change into out of date after the Merge moved the blockchain to Proof-of-Stake, an investor wants to carry at the very least 32 ETH.

This is clearly a heavy chunk of change – value $42,000 at time of writing – and therefore not doable for almost all of buyers. In truth, on-chain knowledge beneath exhibits there are solely 122,000 wallets holding better than 32 ETH. That’s out of 86 million non-zero wallets.

So, enter staking swimming pools.

So, enter staking swimming pools.

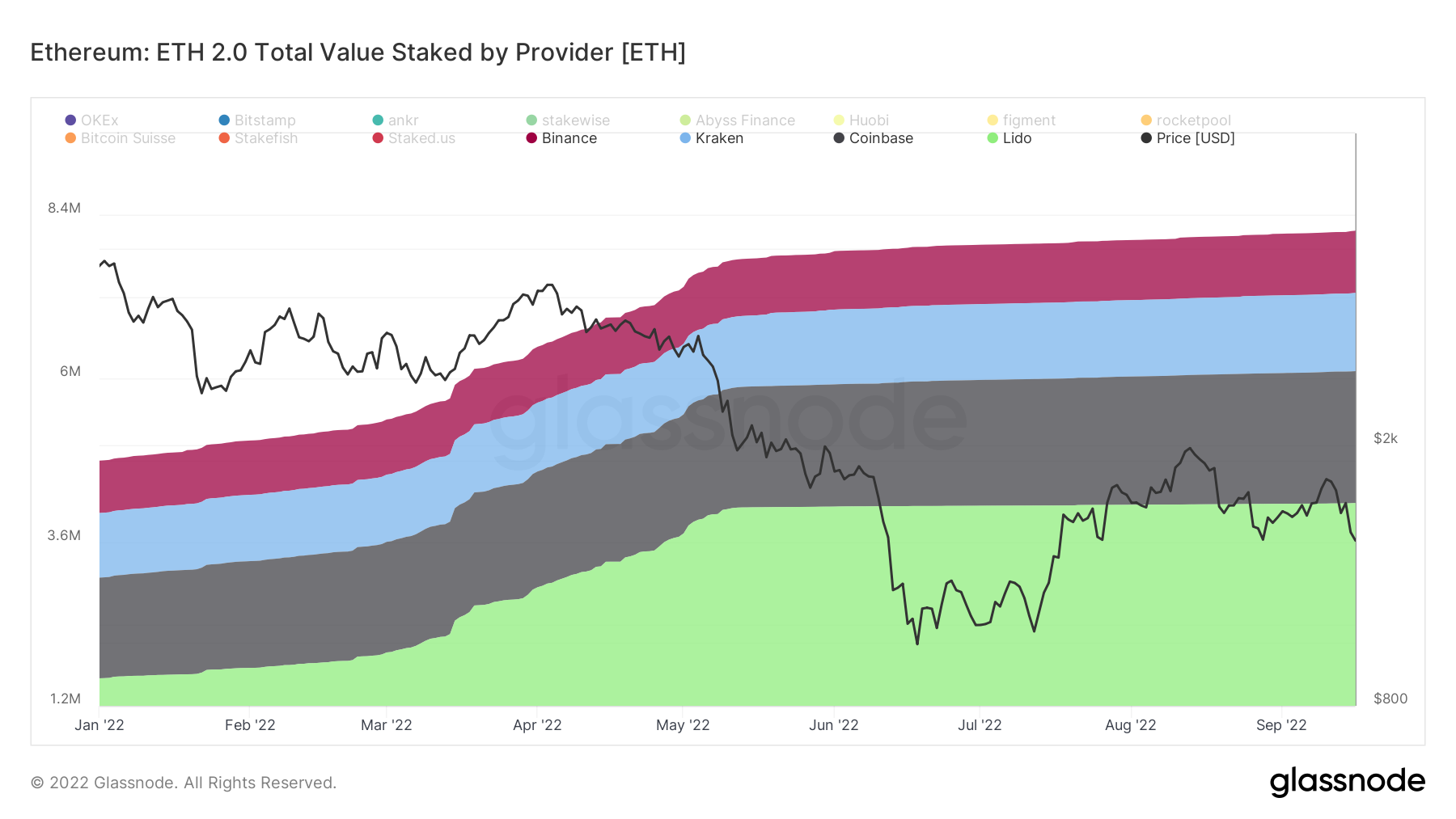

In locking up their funds with a 3rd occasion, buyers can be a part of swimming pools with as little ETH as they like, with the third occasion gathering the funds to behave as a validator. Think of it like shopping for fairness in an organization – you don’t personal the entire firm, however you get a proportion of the income.

Only drawback is, these third events then management big quantities of the community.

In truth, narrowing in on the four largest staking swimming pools exhibits the issue. Out of 13.7 million complete ETH at present staked, 4.2 million is through Lido, 1.9 million through Coinbase, 1.1 million through Kraken and 0.9 million through Binance. That’s 59% of the full worth staked via these four providers alone.

The knowledge explains merely why some are involved that the Merge to Proof-of-Stake has led to better centralisation of the Ethereum community. Because in fact, it has – and it’s exhausting to argue with the above numbers.

It’s sobering to consider what might occur if one of the above providers immediately stopped performing their staking duties, for no matter purpose. Perhaps some sort of scandal on the firm, or a regulatory purpose (bear in mind Tornado Cash) or every other unpredictable occurring.

With a lot staked ETH funnelled via these providers, it’s an immense quantity of worth – and a key, central supply of danger for all the Ethereum blockchain.

[ad_2]

Source link