[ad_1]

Stuck proper under its 2017 all-time excessive, Bitcoin is shifting sideways with low volatility over the previous few days. The crypto market is making ready to shut one other month-to-month candle within the coming days. This occasion is about to maneuver BTC and different cryptocurrencies, however in what course?

At the time of writing, Bitcoin (BTC) trades at $19,000 with 0.4% revenue and a 2% loss within the final 24 hours and 7-days, respectively. The benchmark cryptocurrency has been one of many worst performing belongings within the high 10 by market cap as XRP (+30%) and Solana (+7%) take the lead.

Bitcoin Option Expiry Will Bring Volatility To The Market

The present establishment out there is perhaps coming to a choice as this month-to-month candle shut will coincide with the expiration of over 100,000 BTC in possibility contracts. This occasion usually brings volatility to the market as huge gamers push to maneuver the worth nearer to their strike worth.

Data from Coinglass signifies that there’s over $5 billion in open curiosity for Bitcoin choices, as huge gamers unwind their positions and shift them, the cryptocurrency is prone to see extra motion. According to the crew behind KingFisher, a platform to view information on crypto derivatives, the extra possible situation is to the upside.

In the quick time period, as month-to-month shut, and choices expiry kick in, the worth of Bitcoin might shortly pattern in the direction of $20,000. Volatility is perhaps fueled by a spike in brief positions opened as BTC trended sideways at its present ranges.

If bulls can push Bitcoin to the upside, taking out these quick positions, the worth motion is perhaps extra violent and gas an extended reduction rally. The crew behind King Fisher commented the next:

Probably some vanna hedging exercise associated to finish of the month

We might see a leap to 19.8k in a matter of hours

TWAP Long ended, both decreasing carry, vol fund, choices desk.

Some quick liquidations have been handed by the engine we might count on extra pretty quickly pic.twitter.com/MQ9xEdSRks

— TheKingfisher (@kingfisher_btc) September 26, 2022

What A Green Monthly Close Could Imply For Bitcoin

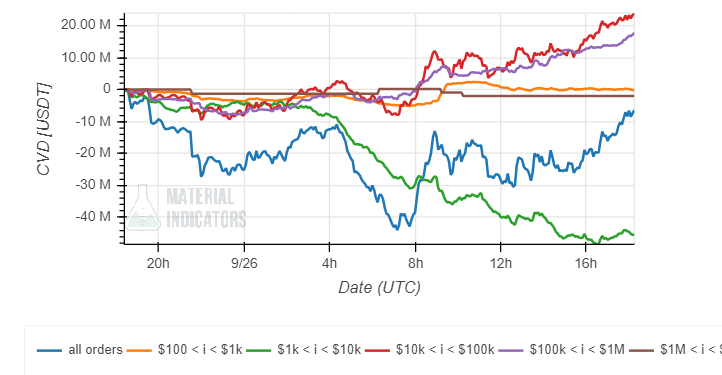

Additional data from the crew behind Material Indicators claims that Bitcoin has two crucial resistance ranges if bulls rating a inexperienced shut above $20,000. These ranges sit at round $20,100 and $39,000.

Although Bitcoin is unlikely to succeed in the latter ranges, as a result of present macroeconomic situations, the cryptocurrency would possibly reclaim the excessive of $20,000. In assist of this thesis, Material Indicators famous a spike in exercise from traders with bid orders of $100,000 and traders with bid orders of $10,000.

The exercise from these traders was capable of “offset the week’s sell pressure with $117 million in market buys”. If this shopping for strain sustains, the crypto market would possibly see some inexperienced after two weeks of trending within the crimson.

However, the mid-term nonetheless factors to extra ache, in response to Material Indicators:

There are quick time period indicators of a possible pump, however the crossing of key shifting averages suggests the broader pattern will proceed down. Resist the urge to overtrade or FOMO in.

[ad_2]

Source link