[ad_1]

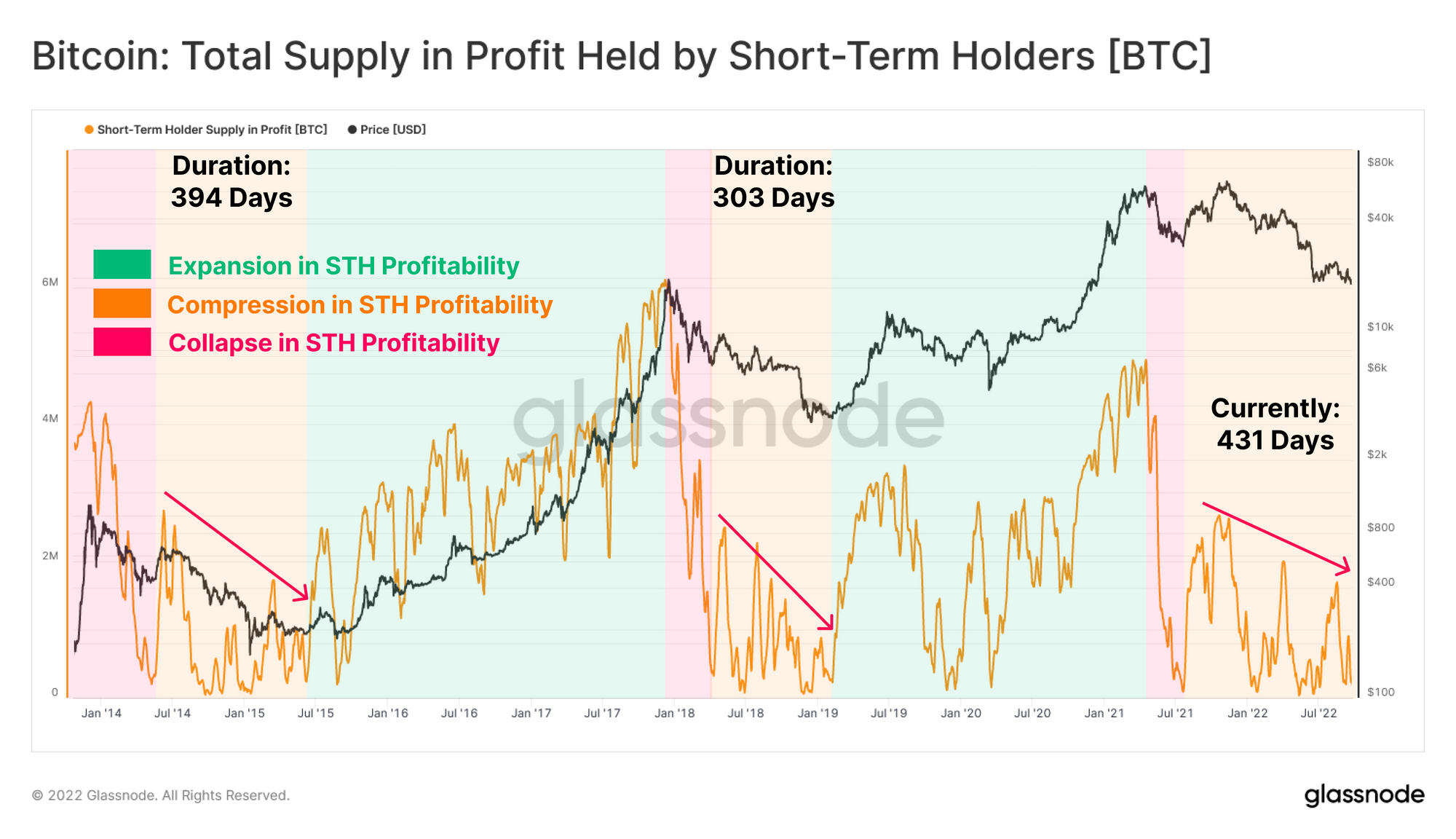

Data from Glassnode exhibits the Bitcoin revenue in provide held by short-term holders has been happening for 431 days now.

Bitcoin Short-Term Holder Supply In Profit Has Been In Compression Phase Recently

According to the most recent weekly report from Glassnode, the STH provide in revenue normally goes by three phases every cycle.

The “supply in profit” is an indicator that measures the overall quantity of Bitcoin at present being held at some revenue on the community.

The metric works by taking a look at every coin on the chain to see what value it was final moved at. If this value for any coin was lower than the BTC worth proper now, then that exact coin is holding some unrealized income at present.

Related Reading: Italian Soccer Champions AC Milan Unveil NFT Partnership With MonkeyLeague

The “short-term holder” (STH) group is a BTC cohort that features all buyers who’ve been holding onto their cash since lower than 155 days in the past.

Now, here’s a chart that exhibits the pattern within the share of the Bitcoin provide in revenue owned by the STHs:

Looks like the worth of the metric has gone down in latest days | Source: Glassnode's The Week Onchain - Week 39, 2022

As you possibly can see within the above graph, the Bitcoin STH provide in revenue has been following the identical three phases throughout the totally different cycles.

The first section takes place proper after the worth of the crypto reaches the cycle tops, the place the decline causes the STHs to enter vital losses.

Further plunges within the BTC worth that observe trigger STH income to shrink even smaller, till the drawdown slows down and these holders’ value foundation catches up with the precise value. This second section is the compression interval.

Finally, because the STH value foundation nears the market value after this section, any vital boosts within the value additionally concurrently trigger giant quantities of STH provide to get into revenue. In this third section, the STH provide in revenue goes by an enlargement together with the coin’s worth.

From the chart, it’s obvious that the Bitcoin market is at present within the second section because the indicator’s worth has been experiencing compression.

The STH provide in revenue has been caught on this section for 431 days now, longer than in any of the earlier cycles.

BTC Price

At the time of writing, Bitcoin’s price floats round $20.1k, up 5% within the final seven days. Over the previous month, the crypto has misplaced 1% in worth.

The worth of the coin appears to have sharply gone up over the past twenty-four hours | Source: BTCUSD on TradingView

Featured picture from Dmitry Demidko on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link