[ad_1]

It is sort of a yr to the day that Facebook CEO and pantomime villain Mark Zuckerberg introduced that his firm can be rebranding as Meta.

It was an enormous assertion about the course of the metaverse, which many had been starting to declare would embody the whole lot from socialising to transacting, working to leisure.

And as I wrote about last week, it’s a wager that has turned bitter for the billionaire.

But throughout the market, are we seeing the identical sample? Is curiosity in the metaverse dwindling?

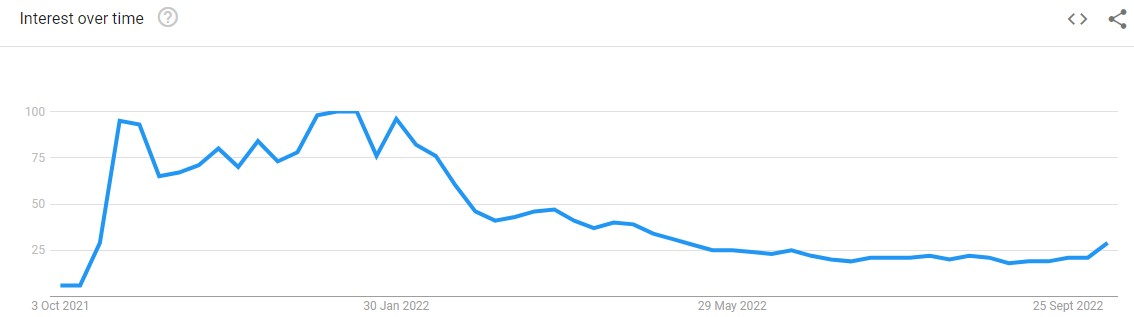

The first port of name I went to was Google, the place search analytics paint an image of a giant spike in curiosity for the time period “metaverse” after Zuck went all-in final October. Not lengthy after, a gradual downtrend.

A damning chart, little question. But how a lot of this may be attributed to the idea of the metaverse itself, and the way a lot is merely a consequence of the wider macro bear surroundings?

It’s laborious to say, however there isn’t any questioning that quite a lot of metaverse initiatives had been considerably overhyped. It is feasible to imagine in the metaverse, but concurrently have the opinion that quite a lot of the tokens in the area are both overvalued, supply minimal utility, or each.

One factor I nonetheless can’t determine is why so many traders are keen to pour money into something remotely metaverse-related, no matter whether or not the funding has a verifiable plan to realize market share in the eventual metaverse, no matter that will appear like.

Sure, this blind punting has fallen off a cliff now that the market is so brutal, however quite a lot of these firms nonetheless have mammoth valuations, even after declines of 80%+.

The dot com bubble

Let us not overlook that the Internet has modified the world immeasurably, going past the expectations of even the greatest bulls. And but nonetheless, consider what number of firms went underneath throughout the dot com bubble burst.

A poignant reference is Priceline.com. You could not recognise that title at the moment, nevertheless it was as soon as in the greatest Internet firms round. Its thesis was attractive: of the half 1,000,000 airplane tickets going unsold day by day, clients might use Priceline to enter the value they’d be keen to pay.

In such a manner, airways offloaded their extra stock, clients picked up low cost seats, and the market equilibrium was discovered. It type of is smart, proper? And all the whereas, Priceline had been taking a minimize of every transaction.

A seemingly smart marketing strategy; a spot in the market; and one thing that may have had individuals at events responding with “oooh, that is so clever”.

It launched in 1998, and inside seven months it had bought 100,000 tickets. Only 13 months after launch, it went public at $16 per share. It spiked on this primary day to $88 and settled at $69. There had been plans to develop additional too – why couldn’t the system work equally properly in areas akin to lodge rooms, prepare tickets, even mortgages?

Its $69 shut after its IPO day gave Priceline a valuation of practically $10 billion. It was the most useful firm in the Internet’s temporary historical past.

And then it fell 94%.

This story is just not distinctive, after all. The Nasdaq shed over a 3rd of its worth simply over a month after peaking in April 2000.

What does the dot com bubble should do with the metaverse?

Which brings me to my level. You might imagine in the Internet with out believing in all the firms that had been claiming to be “Internet companies”. These firms had been infamous loss-makers, with the idea of a revenue remarkable in the dot com days. Priceline, as an illustration, ran up losses of $142.5 million in its first few quarters.

And but, the Internet clearly modified the world.

There are many Pricelines on the market at the moment. Perhaps the dot com period’s “profit” is the metaverse period’s “utility”. Before investing in any of those tokens, ask your self what do they really do? Do they’ve a transparent roadmap in direction of leveraging the metaverse to create one thing of tangible worth? Most importantly, is there any utility right here?

They appear to be primary questions. And that’s type of the level. They actually are primary – however so many cash can’t reply them. Let us not overlook how straightforward it’s to create a cryptocurrency; a easy copy and paste technically creates you one. Combine this with the reality a lot money was flooding into the area – each from traders and thru VC’s – and it’s no shock that so many tokens have utterly collapsed.

For each Amazon, there are ten Pricelines.

And the different factor that must be talked about right here is there’s (clearly) no assure that the metaverse will change into remotely as impactful for society as the Internet was. Even with the Internet hitting each single conceivable goal, there’s nonetheless a raft of Pricelines on the market. Imagine what number of there can be if the Internet flopped?

Final ideas

Just since you imagine in the metaverse, don’t blindly punt something with the title “metaverse” in it.

For the foreseeable, after all, each single crypto – metaverse or different – will proceed to observe the inventory market, such is the macro surroundings proper now. So even the ones which provide utility, and could possibly be properly positioned to in any other case excel, won’t yield returns for traders so long as the wider market continues to lag.

But even when the market recovers, metaverse tokens nonetheless should show they really accomplish one thing – which many can’t do. As all the time in investing, it’s vital to subsequently do due diligence on the coin in query, block out the noise, and ask your self these primary questions as mentioned above.

Don’t let the metaverse seduce you with candy nothings whispered in your ear. A utopian dream gained’t pay the payments at the finish of the day, and we have now the dot com bubble as proof for that.

[ad_2]

Source link