[ad_1]

On-chain information exhibits Bitcoin is now buying and selling 24% beneath the realized worth, right here’s how a lot deeper the crypto went throughout historic cycles.

Bitcoin Has So Far Declined 24% Under The Realized Price

As identified by an analyst in a CryptoQuant post, drawdowns beneath the realized worth have been shrinking with every cycle.

A preferred capitalization mannequin for Bitcoin is the “realized cap,” which measures the cap by weighting every coin within the circulating provide in opposition to the value at which it was final moved.

This is totally different from the standard market cap, the place each coin in circulation is solely multiplied with the newest BTC worth.

Now, from this realized cap, a “realized price” could be derived by dividing the metric with the whole variety of cash in circulation.

The usefulness of this worth is that it signifies the associated fee foundation of the typical holder within the Bitcoin market. This implies that each time the traditional worth dips underneath this indicator, the typical investor enters right into a state of loss.

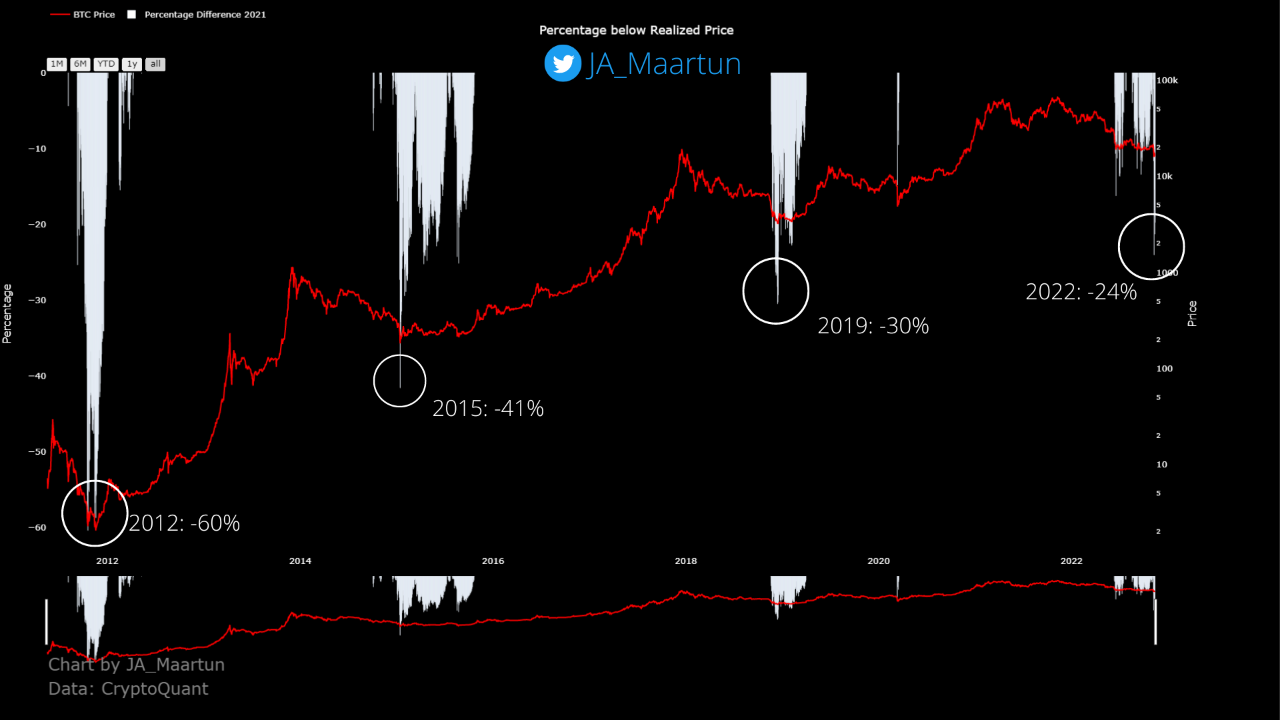

Here is a chart that exhibits the odds beneath the realized worth BTC has gone throughout every cycle:

Looks like the worth of the metric has plunged in current days | Source: CryptoQuant

As you’ll be able to see within the above graph, the newest crash within the worth of Bitcoin has taken the crypto 24% beneath the realized worth, the deepest worth noticed within the present cycle up to now.

It’s obvious from the chart that the earlier bear market of 2018/19 noticed an excellent bigger drawdown, as the value had declined about 30% beneath the metric on the backside.

Comparing the 2 cycles in isolation would recommend the present bear market nonetheless must see a notable quantity of decline earlier than the identical backside values are hit.

However, issues change when the 2015 and 2012 bottoms are additionally taken into consideration. In 2012, Bitcoin went as little as 60% beneath the realized worth, whereas in 2015 the decline was round 41%.

There appears to be a sample right here, and it’s that the proportion of fall beneath the indicator has been shrinking with every cycle.

If this development continues to carry this time as nicely, then Bitcoin might in reality already be close to a backside for this cycle.

BTC Price

At the time of writing, Bitcoin’s price floats round $16.5k, down 1% within the final week. Over the previous month, the crypto has misplaced 14% in worth.

The beneath chart exhibits the development within the worth of the coin during the last 5 days.

The crypto continues to point out stale worth motion | Source: BTCUSD on TradingView

Featured picture from Traxer on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link