[ad_1]

After Bitcoin didn’t sustainably overcome the essential resistance at $16,600 inside the final 5 days, the value noticed a renewed pullback a couple of hours in the past.

A week in the past, on November 21, the BTC worth fell to a brand new bear market low of $15,480, after which the value noticed a spike, which, nonetheless, got here to an abrupt finish, questioning the energy of the bulls.

At press time, BTC was buying and selling at $16.195 and initially discovered assist at $16.050. If the closest resistance at $16.310 doesn’t flip again into assist, a retest of the present bear market low could possibly be on the playing cards.

Bitcoin Bottom Still Not In?

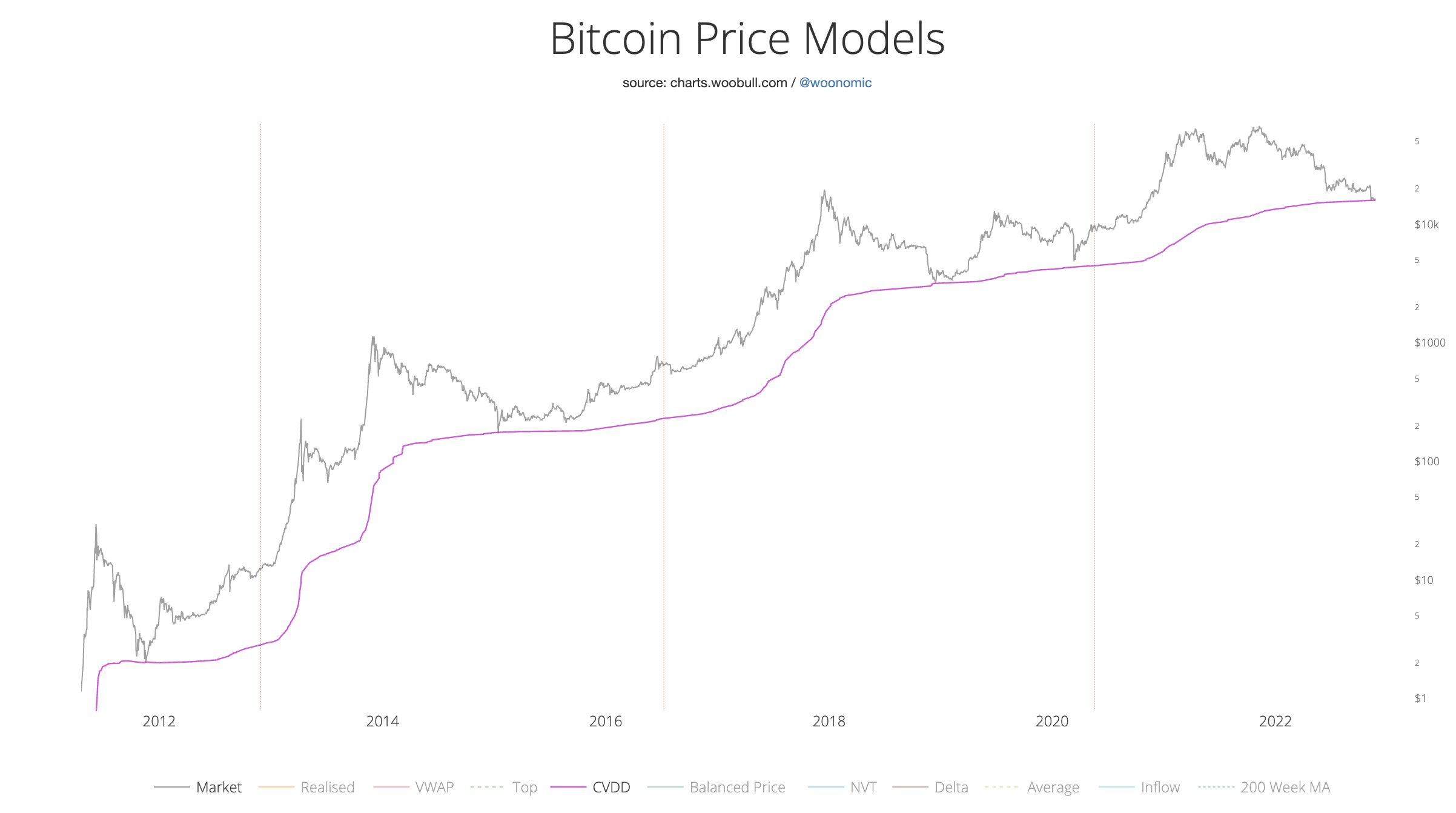

Meanwhile, well-known on-chain analyst Willy Woo has informed his 1 million followers {that a} Bitcoin backside could possibly be close to. The analyst is utilizing three on-chain information fashions to return to this conclusion.

As Woo writes, the CVDD ground worth is at the moment being examined. The mannequin examines alternate options to the market worth. Dashed traces imply the mannequin is only technical, that means it makes use of solely the market worth as an enter. Solid traces embody metrics that come from the blockchain, that means they embody investor, community, and consumer habits fundamentals.

Ultimately, the mannequin created by Woo in April 2019 makes use of the age and worth of Bitcoin shifting to new buyers to create a ground. Woo’s principle: “When significantly old coins (say bought at $100) pass to new investors (say at $16k), the market perceives a higher floor.”

Currently, the mannequin with a confirmed monitor document is exhibiting a second retest.

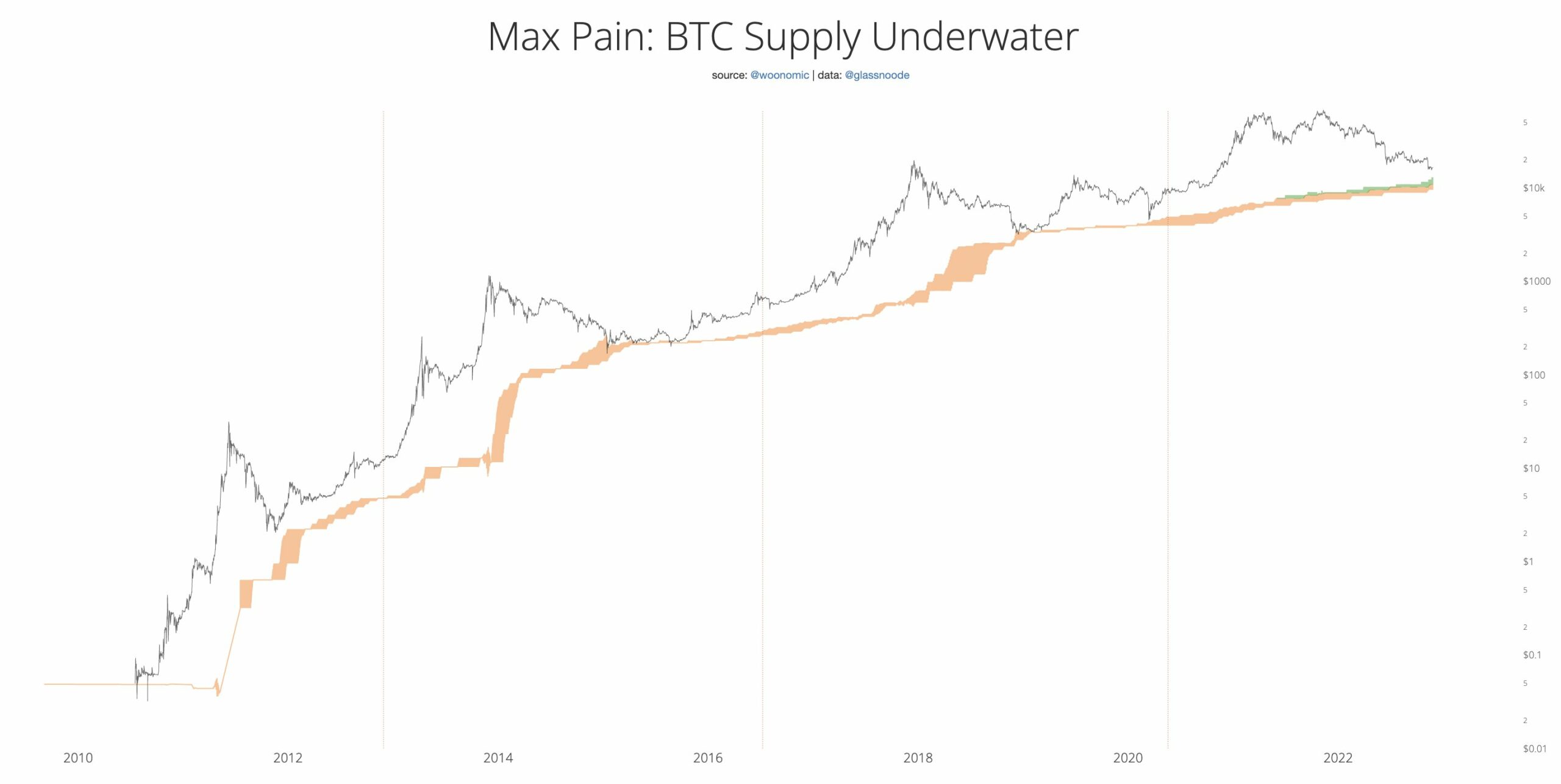

The max ache mannequin additionally alerts that the Bitcoin bottom is coming closer. Historically, the Bitcoin worth reaches its backside of a macro cycle when 58%-61% of the cash are within the loss zone. Whenever the value has fallen into the inexperienced zone, it marked a ground.

“The upper limit of the shaded area is at 13k and rising rapidly,” Woo mentioned. Thus, one other worth drop could possibly be doable, though the analyst additionally confused that not all lows have been reached, with “those that weren’t were close.”

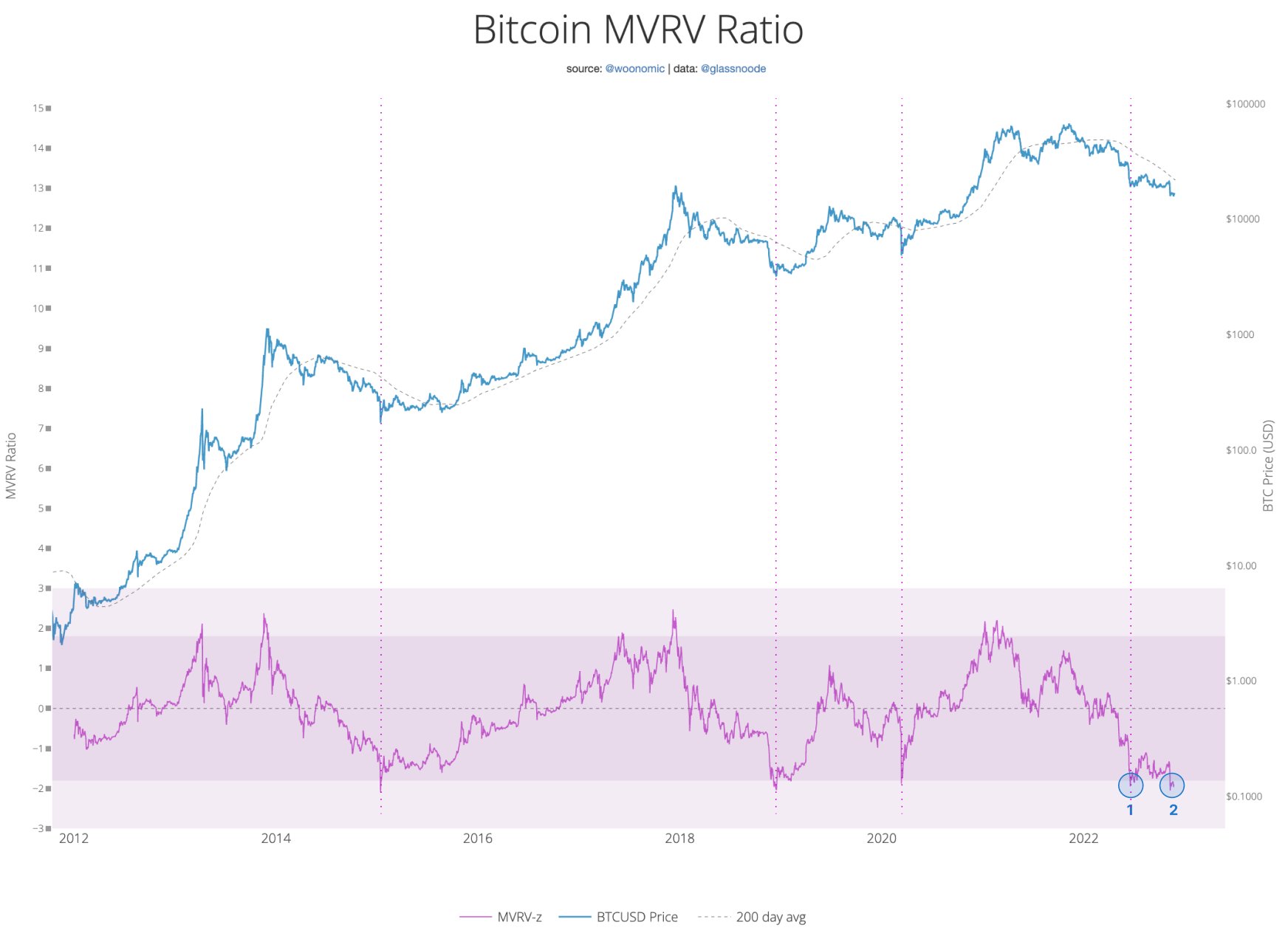

Third, Woo seemed on the MVRV ratio. This represents the ratio between the market cap and realized cap. Its function is to indicate when the exchange-traded worth is under “fair value” and to determine the highs and lows of the market. Analyzing the MVRV ratio, Woo states:

MVRV ratio is deep inside the worth zone. Under this sign we have been in already bottoming (1) till the newest FTX white swan debacle introduced us again right into a purchase zone (2).

Overall, Woo sees the likelihood that the underside may imply somewhat extra ache for Bitcoin buyers. He additionally factors out that the market is in an “unprecedented deleveraging scenario,” placing all fashions to the check.

Bitcoin Miner Capitulation Causing Max Pain?

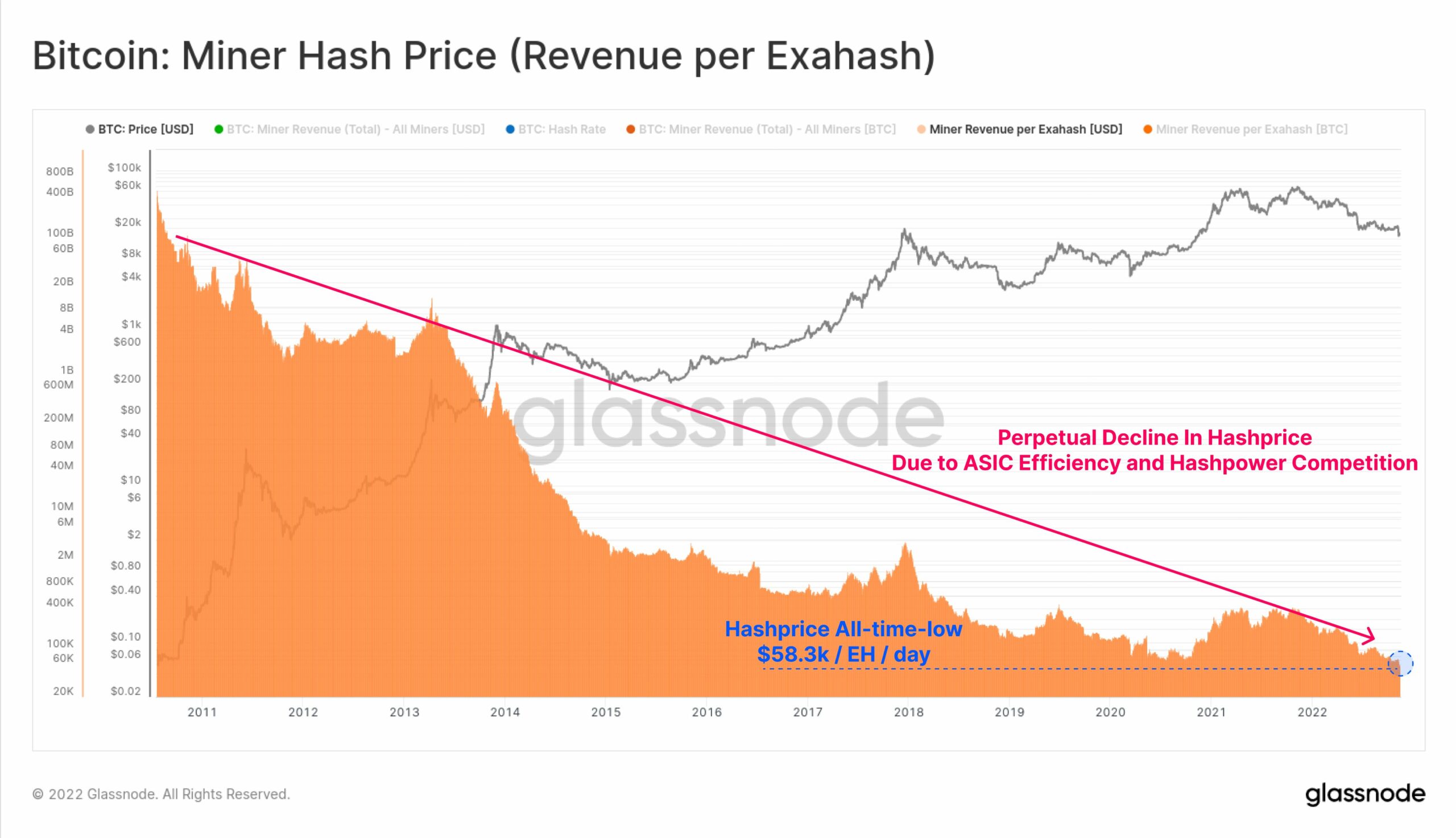

As Glassnode’s senior on-chain analyst Checkmate famous through Twitter, Bitcoin miners could possibly be a cause for extra ache as they’ve run into critical bother in latest months.

The hash worth has fallen to an all-time low. The mining trade is shortly changing into one other drawback space available in the market and thus, the chance of “miner capitulation in round 2” can also be rising.

[ad_2]

Source link