[ad_1]

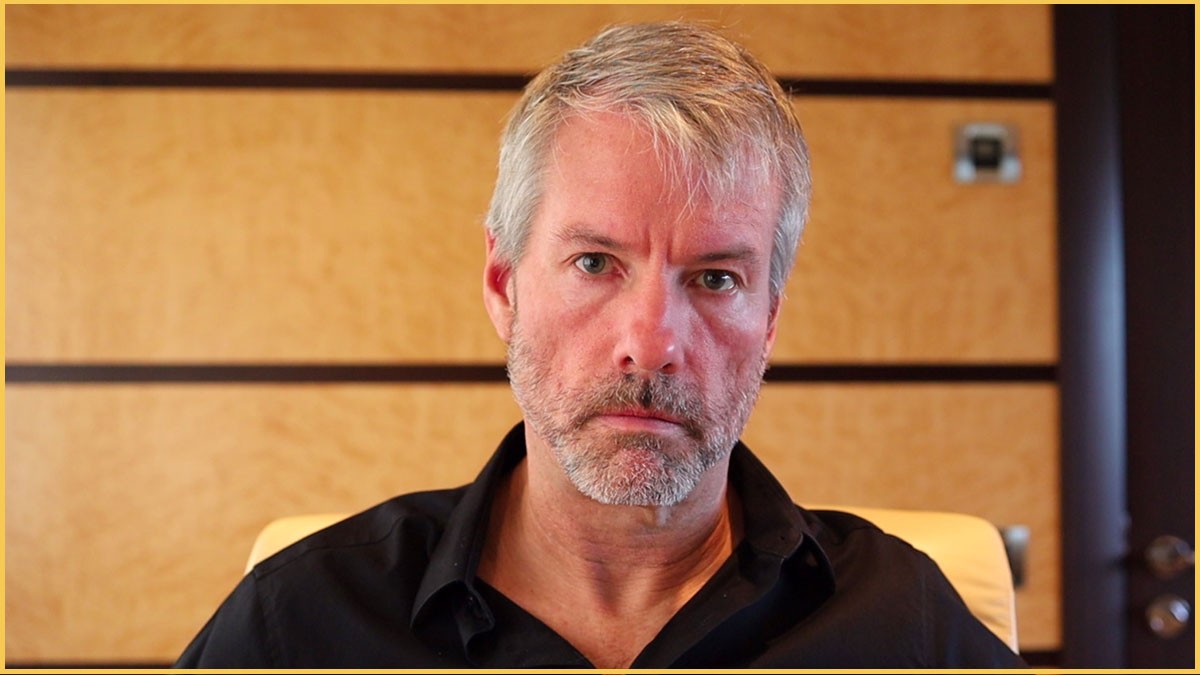

Bitcoin bull Michael Saylor notoriously doesn’t care a lot about altcoins, together with Ripple (XRP) and Ethereum (ETH). In a most up-to-date podcast look, Saylor spoke out in regards to the classification of these cryptocurrencies as securities.

In reference to the legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC), Saylor laid out that he believes Ripple is an unregistered safety.

“It’s pretty obvious,” the MicroStrategy CEO mentioned, persevering with, “It’s a company. The company owns a bunch of it. They sell it to the general public, but they never took the company public. There’s no disclosures.”

This Is Why Ethereum (ETH) And Ripple (XRP) Are Securities

He shared the identical opinion in regards to the second largest cryptocurrency by market cap, Ethereum. According to Saylor, ETH is an unregistered safety as a result of “it’s controlled by a few people – the Ethereum Foundation and ConsenSys … Just like FTT, just like Solana.”

The MicroStrategy CEO went on to elaborate, laying out that just about all altcoins are securities, and needs to be topic to SEC enforcement:

I feel one of the best factor for the world could be if the SEC just about shuts down all of it. It’s all unethical.

While Bitcoin is an moral commodity, all altcoins are simply fairness tokens issued by an organization to keep away from an IPO. “And they are committing securities fraud,” Saylor touted.

“Especially Ethereum.” The Bitcoin bull identified that Ethereum has $20 billion in ETH tokens locked up in a deposit contract in the intervening time, and it’s at the moment unclear when withdrawals will likely be attainable.

As Bitcoinist reported, withdrawals from the ETH 2.0 deposit contract are nonetheless not attainable after the timeline pushed again a number of occasions. Currently, redemptions are scheduled for the Shanghai replace, which would be the subsequent main replace after the merge. The fork is at the moment slated for March 2023.

In reference to this, Saylor criticized the actual fact that there’s a small group of people that resolve if and when redemptions from the deposit contract will likely be allowed.

Now, isn’t that the definition of an funding contract? If a financial institution took $20 billion of your property, froze the window and mentioned ‘You can’t have your a refund, ever, possibly within the yr 2024. We are usually not positive.[…] We might offer you curiosity on it.’ That’s the definition of a safety.

The MicroStrategy CEO generalized that you would be able to’t depend on a number of engineers, an organization, or a CEO if a crypto asset is meant to be a commodity. He concluded:

It’s an funding of cash in a standard enterprise, counting on the efforts of others in an expectation of income. If an individual can decide, it’s not a commodity.

Ripple is making an attempt to dispute the applying of that very definition to XRP in its litigation with the SEC. The truthful discover warning in addition to the frequent enterprise argument are among the many most promising arguments for Ripple to win.

“They’re are committing securities fraud… especially Ethereum.”@saylor offers his ideas on Ethereum and Rippe pic.twitter.com/STsuLX5FQh

— PBD Podcast (@PBDsPodcast) December 6, 2022

CFTC And SEC Hint At Tight Regulation

Remarkably, Saylor only in the near past shared a Fortune report on the Commodity Futures Trading Commission’s evaluation. At an occasion, Chairman Rostin Behnam acknowledged that the one cryptocurrency that needs to be thought of a commodity is Bitcoin.

In doing so, the Behnam-led company utterly backtracked from earlier assessments by which the company referred to ETH as a commodity. Just one month earlier, Behnam gave a speech for the Rutgers Center for Corporate Law and Governance and took the other stance.

Michael Saylor’s opinion can be per current comments by Gary Gensler. The SEC Chairman recommended that Ethereum’s proof of stake may result in the token being thought of a safety.

At press time, the ETH value noticed a drawdown of three.5%, falling to $1,226.

[ad_2]

Source link