[ad_1]

On-chain information exhibits the Bitcoin trade whale ratio has sharply declined just lately, an indication which will show to be bullish for the value of the crypto.

Bitcoin 7-Day MA Exchange Whale Ratio Has Rapidly Gone Down Recently

As identified by an analyst in a CryptoQuant post, the metric additionally noticed the same decline through the finish of 2018.

The “exchange whale ratio” is an indicator that measures the ratio between the sum of the highest ten transactions going to exchanges, and the entire trade inflows.

The ten largest transfers to exchanges are assumed to be coming from the whales. So, this ratio tells us what a part of the entire trade inflows is being contributed by these humongous holders proper now.

When the worth of this metric is excessive, it means the vast majority of the inflows are made up by whales presently. Since one of many essential causes traders deposit to exchanges is for promoting functions, such values may very well be an indication that whales are dumping massive quantities, and would possibly therefore be bearish for the value of the crypto.

On the opposite hand, the indicator having low values suggests whales are making a more healthy contribution to the inflows, and will thus be both impartial or bullish for the worth of BTC.

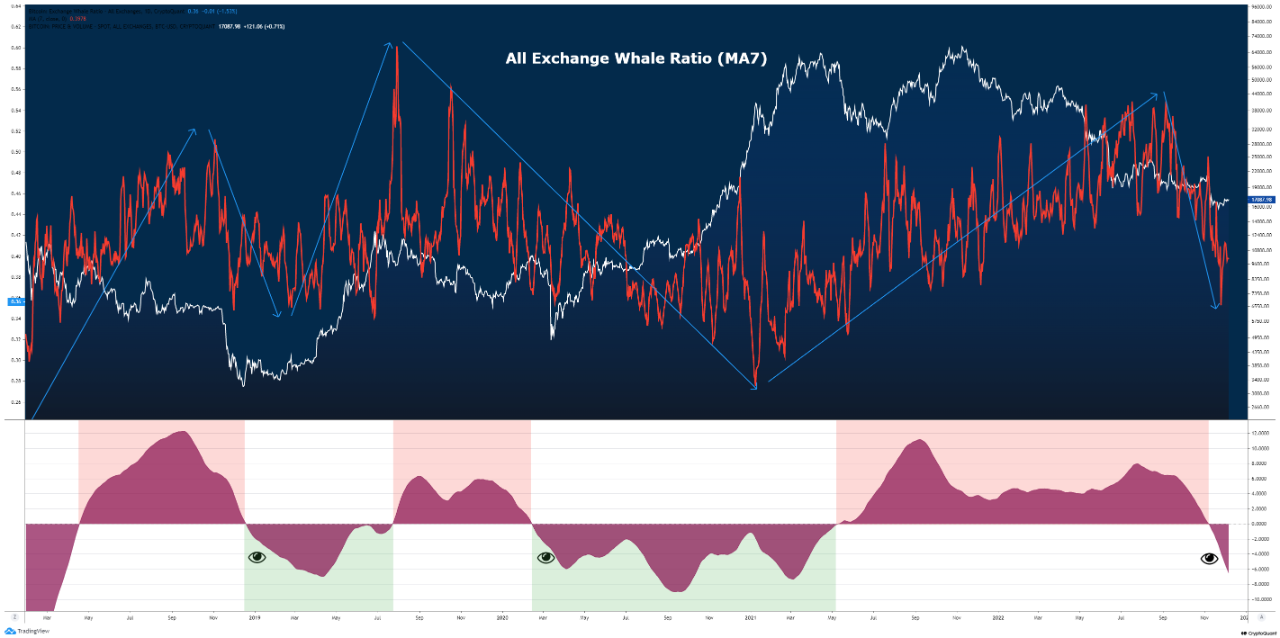

Now, here’s a chart that exhibits the development within the 7-day shifting common Bitcoin trade whale ratio over the previous couple of years:

Looks just like the 70-day MA worth of the metric has been sharply falling off in latest weeks | Source: CryptoQuant

As you may see within the above graph, the Bitcoin trade whale ratio had a fairly excessive worth only a few months again.

However, since then, the indicator has been observing some speedy downtrend, and the ratio has now attained fairly tame values.

This signifies that whales have been decreasing their influx volumes just lately, suggesting that promoting strain from them could also be getting exhausted.

The quant has additionally highlighted the development within the trade whale ratio through the earlier Bitcoin cycle within the chart. It looks as if the same downtrend as now was additionally seen again in late 2018, when the underside of that bear market shaped.

The analyst notes that whereas it’s unattainable to say if the present sharp decline within the whale ratio means the underside is in for this cycle as nicely, it’s doubtless that not less than the volatility will now start to chill down.

BTC Price

At the time of writing, Bitcoin’s price floats round $16.8k, down 1% within the final week.

BTC has declined through the previous day | Source: BTCUSD on TradingView

Featured picture from Thomas Lipke on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link