[ad_1]

Data exhibits Bitcoin holders have locked in losses amounting to a complete of $213 billion throughout the previous 12 months.

Bitcoin Investors Have Realized $213 Billion In Loss This Bear Market

As per knowledge from the on-chain knowledge analytics agency Glassnode, the losses realized have meant that 47% of the bull market beneficial properties are actually gone.

When an investor holds any variety of cash and the worth of Bitcoin dips under the worth at which the holder acquired mentioned cash, the cash accumulate some unrealized loss.

If the investor sells or strikes these cash at this lower cost, the loss being carried turns into “realized.”

The “realized loss” is an indicator that measures the full quantity of such losses being locked in by holders all through the BTC community.

Naturally, the alternative metric is named the “realized profit,” and tells us concerning the income being harvested by the buyers.

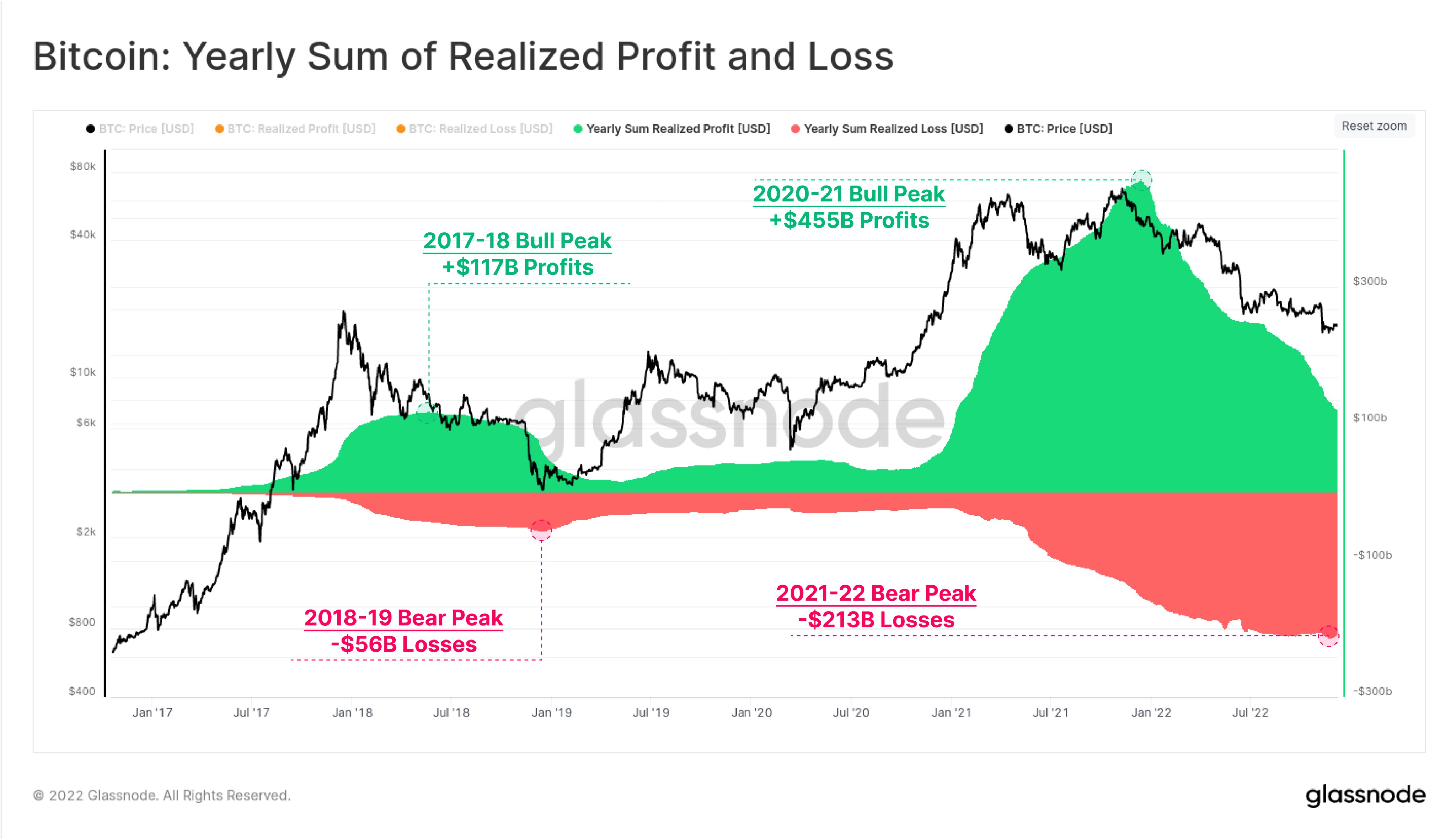

Now, here’s a chart that exhibits how the yearly sums of each these Bitcoin indicators have modified over the previous couple of years:

There appears to have been a considerable amount of losses locked in throughout the previous 12 months | Source: Glassnode on Twitter

As you may see within the above graph, the 2020-21 Bitcoin bull market noticed a peak yearly revenue realization of about $455 billion.

The 2021-22 bear market to this point has seen a realized loss peak of $213 billion, which is the worth of the metric proper now. This signifies that over the past twelve months, BTC holders have locked on this extraordinarily excessive quantity of losses.

Glassnode notes that these losses suggest there was an roughly 47% relative capital lack of the beneficial properties noticed throughout the bull market.

The chart additionally highlights these values for the earlier cycle. It appears like the best yearly sum of realized income seen throughout the 2017-18 bull market amounted to round $117 billion.

And the loss realization peak noticed within the corresponding bear market of 2018-19 measured to about $56 billion. Interestingly, the height income and losses throughout each the present cycle in addition to the earlier one have virtually the very same ratios.

This signifies that the capital loss seen between the bull and the bear within the present cycle is now of the identical stage as when the earlier cycle bottomed out.

BTC Price

At the time of writing, Bitcoin’s price floats round $16.9k, down 1% within the final week. Over the previous month, the crypto has misplaced 18% in worth.

The under chart exhibits the pattern within the BTC worth over the past 5 days.

Looks like the worth of the crypto continues to maneuver sideways round $16.9k | Source: BTCUSD on TradingView

Featured picture from Hans-Jurgen Mager on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link